As we step into the final quarter of 2024, the bond market is exhibiting an exhilarating momentum, setting the stage for what is poised to be a record-breaking year. The recent data reveals that September alone saw a staggering 44.5% increase in bond issuance compared to the same period last year, a substantial rise fueled by state and local governments eager to access new capital. This surge in activity is reflective of a broader trend in the capital markets, as issuers re-enter the arena amid the winding down of pandemic relief funds and the uncertainty surrounding upcoming elections.

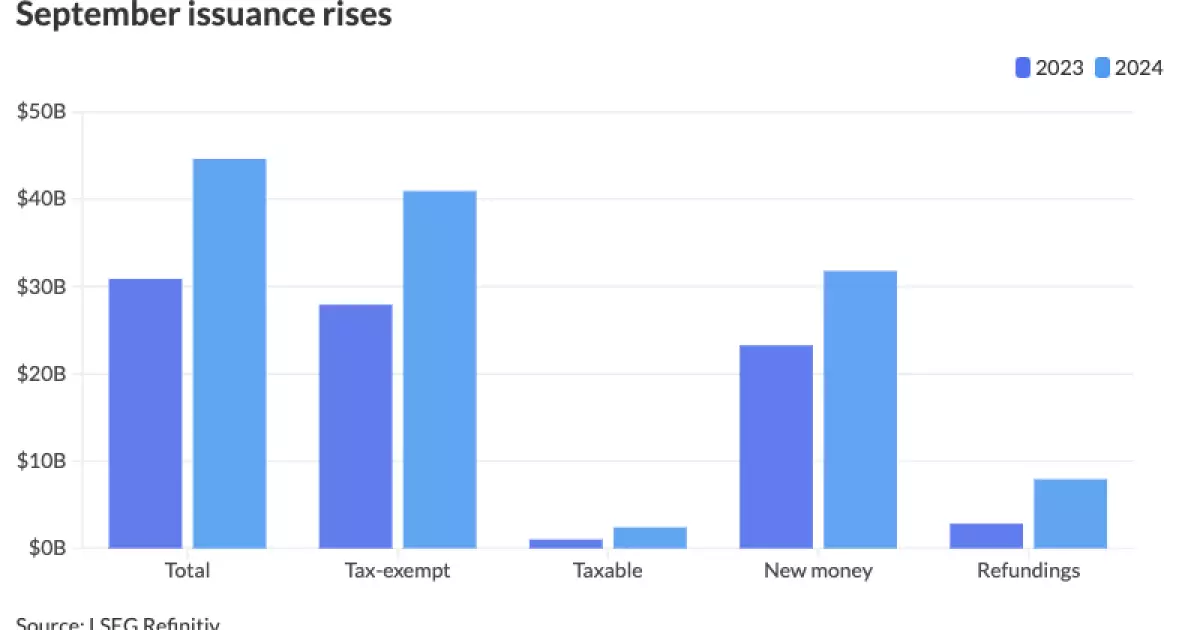

According to LSEG data, September’s bond volume reached an impressive $44.628 billion across 752 separate issues, surpassing September 2023’s $30.88 billion across 619 issues. The figures are not merely outliers; they represent a robust shift in investor confidence as issuers leverage favorable financing rates. September marks the ninth consecutive month of year-over-year issuance increases and the sixth month that has exceeded the $40 billion threshold, contrasting with the struggles of 2023 when no month crossed this mark due to significant market volatility.

Several interrelated factors are driving this prolific issuance. Analysts highlight the diminishing fiscal support from pandemic-related aid as a primary catalyst prompting issuers to seek fresh capital. As states and local governments adjust to this new fiscal reality, they are prompted to seek funding for various infrastructural and development projects, rekindling their relationships with investors in the municipal bond market.

The rising trend of “mega deals” is indicative of a shifting investor landscape. The past few months have seen substantial growth in high-value issuances, with recent examples including Washington D.C.’s $1.6 billion general obligation bonds and Texas’s $1.6 billion water revenue bonds. This trend signals a broader acceptance and appetite for larger bond offerings in the marketplace, as issuers feel increasingly confident in the demand for such substantial financial instruments.

Another noteworthy influence on the accelerated issuance is the upcoming electoral cycle. Historical patterns indicate that presidential election years tend to alter market dynamics significantly, often leading to spikes in bond issuance. Past experiences, particularly in 2016 when market volatility surged following President Trump’s election, have led issuers to adopt preemptive strategies to avoid potential disruptions.

During election years, issuers typically ramp up their bond offerings in the months leading to the election to secure financing before the potential for political-related market fluctuations emerges. The last two election cycles in 2016 and 2020 saw issuance exceeding $100 billion between October and December. With $10.14 billion already on the calendar for the first half of October, it appears that this trend is set to continue.

The latest data also delineates a marked increase in sector performance metrics. Tax-exempt bond issuance in September surged by 46.6%, underscoring investor preference for tax-advantaged securities amid the current market climate. Taxable bonds also saw a significant uptick, registering a 135.6% increase in issuance.

The emergence of record levels of issuance highlights not only an eagerness to capitalize on current market conditions but also a genuine need for funding across various sectors. Revenue bonds, which are backed by specific revenue streams, rose by 41.6%, reflecting diversified revenue strategies employed by municipalities and states.

These developments invite scrutiny of how sustained levels of issuance could impact the broader financial landscape. While increased supply may initially bolster market liquidity and stimulate investment in infrastructure and public services, there could be potential downsides. Analysts caution that if this surge in issuance outpaces demand too significantly, it could lead to elevated yields and a subsequent recalibration of the market landscape.

As we reflect on the burgeoning bond market landscape of 2024, several critical challenges and opportunities lie ahead. The potential dip in issuance expected as the elections approach, compounded by uncertainty surrounding economic conditions, opens the door for volatilities reminiscent of past election cycles. Nevertheless, submarkets and sectors demonstrating resilience—especially in infrastructure and public service financing—present compelling investment opportunities.

The bond market’s remarkable trajectory in 2024 is illustrative of a complex interplay of financial imperatives, strategic foresight among issuers, and evolving market dynamics. Stakeholders will need to monitor these trends closely, as the confluence of historical patterns and global economic conditions will determine whether this surge leads to sustainable growth or subsequent challenges in the months ahead. The stakes have never been higher as we enter uncharted territory that could set the tone for the bond market for years to come.