In recent months, a breathtaking resurgence in technology stocks has caught many investors by surprise, and at the center of this whirlwind are Nvidia and Microsoft. Both companies are not just rebounding; they are racing towards an exclusive market capitalization milestone—the $4 trillion club. This ascension is not a mere reflection of market hype but a testament to the foundational role these companies play in the AI-driven economic transformation unfolding right now. The enthusiasm for artificial intelligence (AI) isn’t fleeting excitement—it’s a profound shift in technology infrastructure and corporate strategy, one that is accelerating investment and innovation across the entire sector.

This momentum is especially notable considering the earlier pessimism tied to geopolitical uncertainties—especially fears around China’s export controls and tariff tensions—which seemed to threaten the tech landscape earlier this year. These concerns have cooled, allowing investor focus to sharpen on the massive potential AI offers. Nvidia’s stellar rise, boasting a quarter-to-date gain exceeding 44%, alongside Microsoft’s steady climb of over 30%, reflects concrete confidence in their continued relevance and growth. Such gains signal more than short-term speculation; they underscore a paradigm shift, shepherded by AI, that is reshaping industry norms and economic expectations alike.

Nvidia: The Undisputed AI Chip Revolution Leader

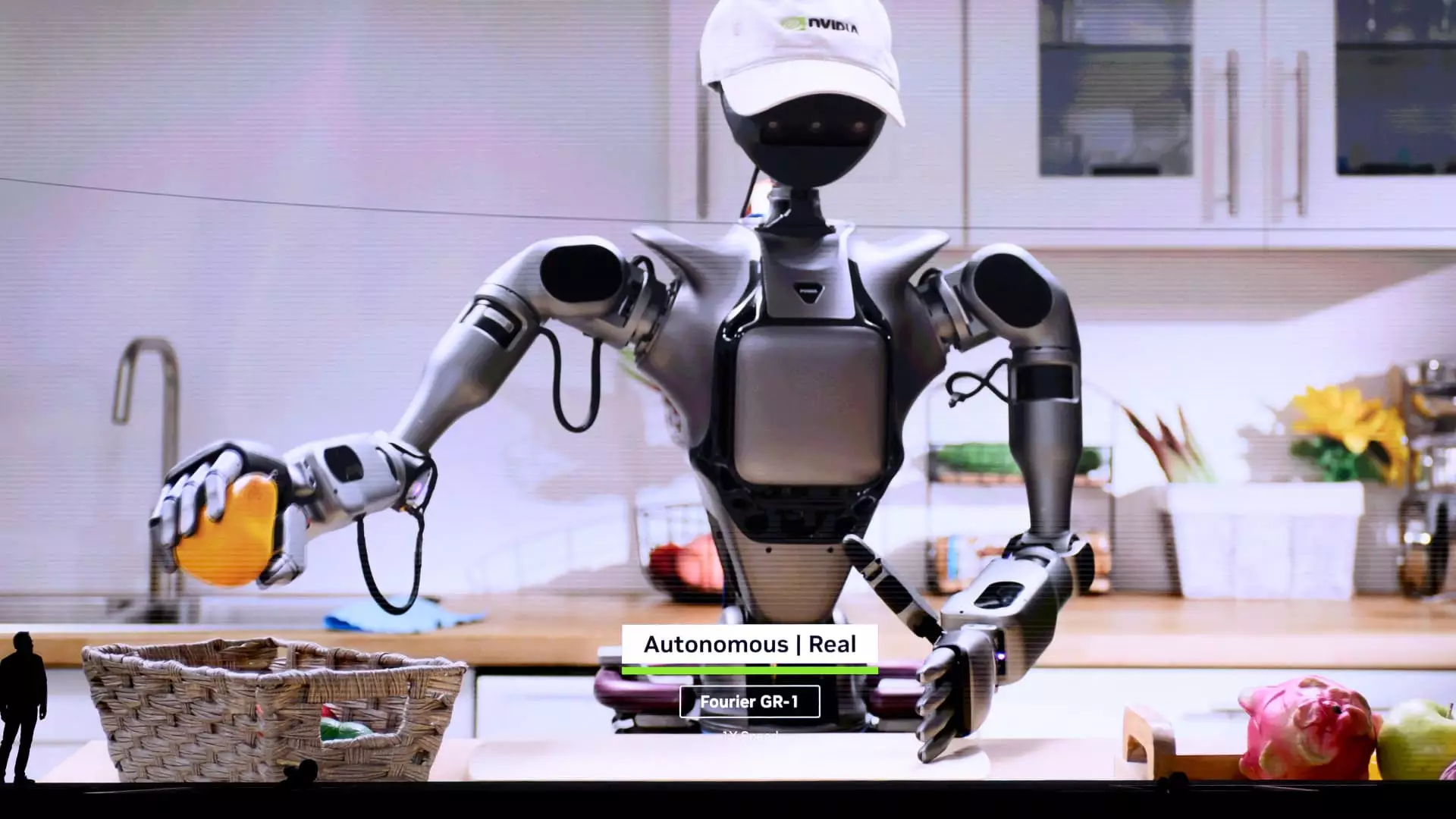

Nvidia occupies a unique and near-monopolistic position in the AI revolution. Its cutting-edge semiconductors have become indispensable to the AI ecosystem—from powering cloud data centers to enabling autonomous robotics. Industry experts like Dan Ives of Wedbush Securities laud Nvidia as the “foundation for the AI Revolution,” attributing to it an extraordinary influence where each dollar invested generates eight to ten dollars of broader economic value. This multiplier effect speaks volumes about Nvidia’s central role in the AI supply chain and its ripple effects throughout technology industries such as cybersecurity, software, and autonomous systems.

Few companies can claim this level of critical importance. Nvidia isn’t merely participating in AI development; it’s setting the standards and fueling the industry’s most important advances. CEO Jensen Huang, often dubbed the “Godfather of AI,” presides over a company whose strategic breadth extends beyond chip manufacturing into enterprise AI demand, acting as a catalyst for innovation globally. The implied future trajectory is clear: Nvidia is not just riding an AI wave but curating the very tools that sustain it, thereby ensuring its market dominance well into the future.

Microsoft’s Pivotal Role in Cloud and AI Services

While Nvidia’s hardware prowess is undeniable, Microsoft capitalizes on the demand for AI through a different yet equally compelling avenue: cloud and software integration. As artificial intelligence permeates various industries, Microsoft’s Azure cloud platform stands as a crucial enabler, offering AI-enhanced services that are reshaping business operations across sectors. The company’s strategic investments in AI applications allow enterprises to unlock new levels of efficiency, insight, and innovation, contributing greatly to its rapid market appreciation.

Microsoft’s gains are far from incidental. Amazon’s AWS and Google’s GCP also aggressively pursue AI service integration; however, Microsoft has consistently maintained momentum, building on its hybrid cloud strength and extensive enterprise client base. The ubiquity of AI use cases across industries—from healthcare to finance to retail—is driving Microsoft’s value, which reflects not just projected growth but tangible adoption and deployment of AI-powered solutions.

Beyond the Giants: The Broader AI Ecosystem

The AI wave doesn’t stop with Nvidia and Microsoft. Other players, such as Advanced Micro Devices (AMD), Google, and Amazon, contribute significantly to the burgeoning AI economy. The real transformation will proliferate outward from cloud infrastructure giants and chip makers to consumer internet, cybersecurity, and autonomous technologies. The competitive and collaborative dynamics between these companies mean that the AI-driven tech bull market is far from over; it is, in fact, entering its early innings.

However, the tech sector must maintain a careful balance. Overreliance on a few dominant players can stifle innovation and increase systemic risks. Investors and policymakers alike should encourage diversity in AI development to foster healthy competition, prevent monopolistic complacency, and ensure that AI’s benefits reach a broad spectrum of industries and communities.

An AI Revolution Steered by Market Realism and Strategic Vision

The narrative around Nvidia and Microsoft, as leaders of this new tech era, represents a center-right viewpoint valuing both market-driven innovation and strategic investment. These companies exemplify how entrepreneurial vision combined with calculated capital expenditure can ignite industry transformation without excessive state intervention or bureaucratic overreach. The AI revolution is not a moment for heavy-handed regulation but rather for embracing the potential unleashed by companies willing to invest heavily in cutting-edge technology and infrastructure.

Their trajectory into the $4 trillion valuation range embodies more than market cap metrics—it signals the triumph of persistent innovation and strategic foresight against a backdrop of global uncertainty and geopolitical headwinds. This is a story of market optimism grounded in technological reality, and it challenges investors and policymakers alike to adapt swiftly and pragmatically to a rapidly evolving corporate landscape.