Municipal bonds, which once radiated stability in an unpredictable financial world, are currently experiencing unprecedented turmoil. The recent trading sessions have unveiled a reality where rising yields and investor hesitance create an atmosphere of anxiety. On the surface, the bond market appeared stable at the outset of the week, but as underlying factors began to unravel, it became clear that municipal bonds are hardly the safe harbor they once represented. The sentiment across the market is growing increasingly pessimistic, reminiscent of echoes from a troubled past.

The municipal bond yield curve experienced a significant uptick last week, rising by an average of 15.1 basis points, a trend that signals stress within the market. Notably, the long-end of the curve has faced steep declines, leaving seasoned investors scrambling for solutions amid uncertainty. Market experts like Jason Wong from AmeriVet Securities articulate that the bonds have lost 1.41% month-to-date, effectively wiping out earlier gains. How can we expect investors to remain optimistic in such an environment?

Demand Discrepancies and Market Friction

For years, demand for municipal bonds flourished, buoyed by their tax-exempt status and perceived safety. However, recent trends suggest that this demand is becoming increasingly fickle. A staggering outflow of $373 million from municipal mutual funds last week, predominantly from investment-grade categories, illuminates a troubling pattern. This outflux not only raises questions about investors’ confidence but also reflects broader market dynamics, where buyers are now adopting a more cautious approach.

With demand gradually receding, we have witnessed a corresponding increase in bid-wanted lists, escalating by 31% just to keep up with the selling pressure. Simply put, sellers flooding the market far outweigh buyers who are attempting to regain footing. As the wall of newly issued bonds continues to grow—up 16.7% year-over-year—an uphill battle looms for munis that may soon feel the weight of investor skepticism settling in.

Unpacking Volatility and Tension

In the financial arena, volatility is often equated with risk, and the current landscape for municipal bonds is increasingly volatile. The market is caught in a tug-of-war between rising yields and diminished investor appetite, producing an environment rife with tension. Investors seeking refuge during rocky times are reevaluating their strategies in light of consistent underperformance in munis.

With substantial sell-offs taking place, we have to wonder whether investors will find themselves rewarded or punished for their decisions. Birch Creek strategists argue that astute investors who take the plunge into undervalued securities may eventually reap dividends, but how can this spark of hope counterbalance the prevailing narrative of uncertainty? The potential for reward seems outweighed by the risk of continued volatility in the coming weeks.

Long-Term Prospects and Emerging Opportunities

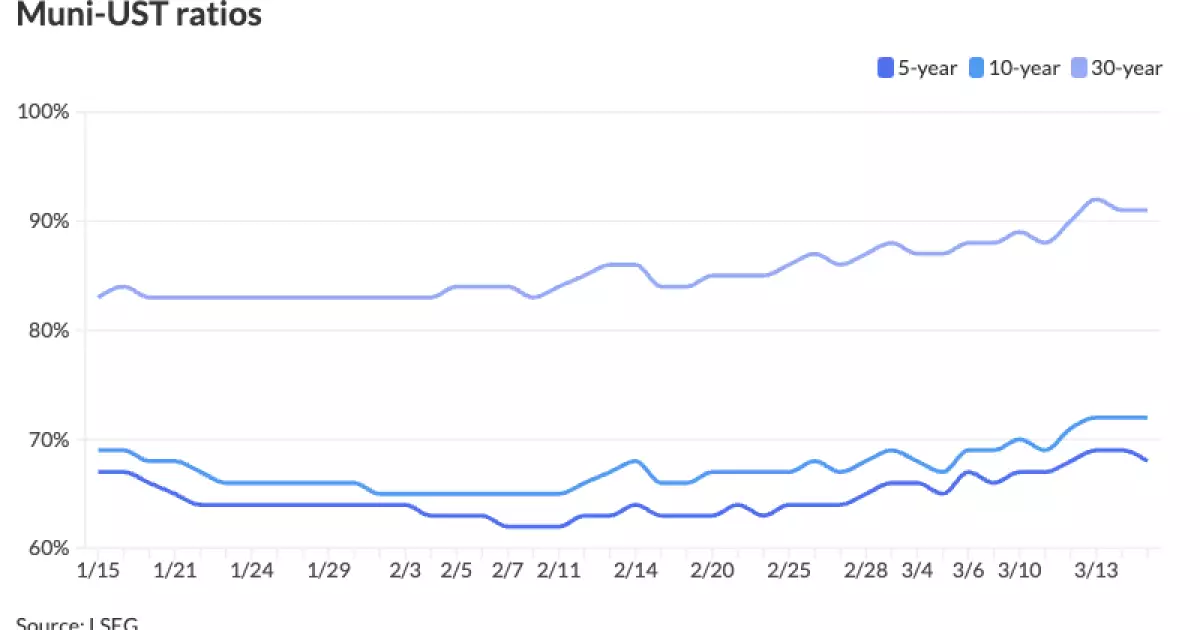

According to industry insiders, the future of municipal bonds may exhibit silver linings amidst encroaching doom. As yields for longer-term bonds hover satisfyingly low compared with U.S. Treasuries, valuations of munis are reaching their most attractive in over a year. For certain sectors, like climate-focused bonds issued by authorities like the Metropolitan Transportation Authority, there may be a degree of opportunity for discerning investors.

This dualism—between attractive valuations and heightened risk—can make or break an investment strategy. The conventional wisdom of “buy low” may be riddled with caveats in this current climate. Without question, utilizing expert insights and market trends may help navigate this precarious financial territory.

The Impending Impact of Policy Changes

Investors face an uphill battle, not solely due to market dynamics but also because of looming policy changes. The Fed’s monetary policy, with its incessant discussions on interest rates and potential tariffs, has a tangible impact on the bond market. Political factors will continuously shape investor perceptions, and the fluctuating nature of government stability contributes to an uncertain landscape. The Federal Reserve’s policy direction could either catalyze recovery or deepen stagnation.

Amidst this ambiguity, one thing is crystal clear: municipal bonds are no longer the invulnerable tools they were once considered. In a time when many factors are serving to amplify risks across various financial instruments, municipal bonds must contend with an image shift from stability to uncertainty. The long-standing comfort associated with these local government debts has begun to erode, leaving both seasoned and novice investors anxiously evaluating their positions.

In a market increasingly riddled with challenges, investors must adapt to a transformed landscape where they refine their strategies and continuously reassess their assets. The question remains: can municipalities rebound, or is this the beginning of a long, hard decline for these once-esteemed financial instruments?