The state of America’s municipal bond market is unsettling, and recent developments have added layers of distress that even seasoned investors cannot ignore. The relationship between supply and demand, adverse policy shifts, and looming economic uncertainties indicate that a minor adjustment in this market could trigger widespread repercussions. It’s these unsettling trends and the underlying motivations that make the current climate so concerning, particularly within the context of center-right wing liberalism that values both economic conservatism and a responsibly managed state.

Supply Suffocates Demand

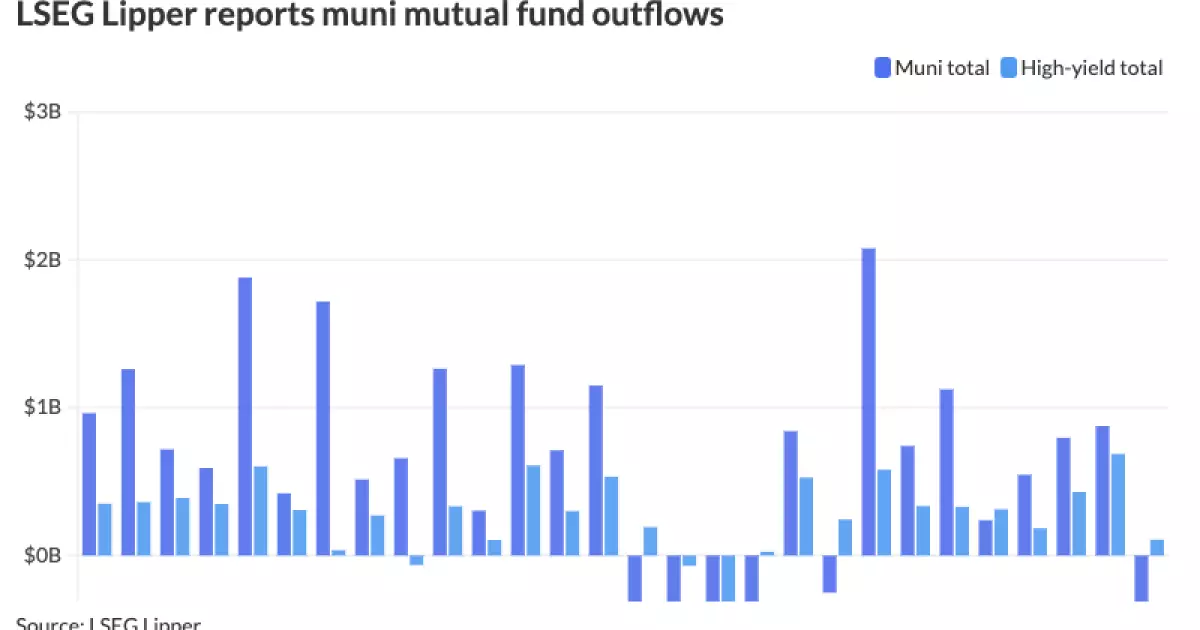

It’s striking how a foundational principle of economics—supply and demand—has been evidently inverted in the municipal bond market. The observation that “more supply than demand” underscores a critical imbalance helps us understand just how dire the situation has become. Municipal bonds, designed to offer a low-risk investment option typically favored by retail investors, are now amid a suffocating oversupply. Since the beginning of the year, issuances have aggressively ramped up, leading to an alarming surplus of bonds available for purchase, which in turn dilutes their value and yields.

Kim Olsan’s remarks criticizing the lack of alignment in muni fundamentals are spot on; unfavorable conditions exacerbated by tax season approaches, paired with low levels of redemptions, paint a grim picture for those hoping to capitalize on munis. If state issuers have had a “pretty good run” despite these conditions, it’s merely an indication of the temporary masking of underlying issues. Once the market reaches saturation or external volatility peaks, investors may quickly retract, leaving state issuers watching helplessly as their bonds’ perceived value plummets.

External Influences and Political Consequences

A notable worry for bondholders emerges from Washington, D.C., where a “no holds barred” policy stance has unsettling implications for both domestic and international financial landscapes. A political environment that encourages unchecked spending can naturally lead to an inflationary spiral, which is the opposite of what prudent fiscal policy ought to achieve. With new tariffs and trade considerations morphing into a potential trade war, the counterintuitive nature of government interventions sends shockwaves across financial markets.

The threat of eliminating the municipal tax exemption is disturbingly real, and while the precedents suggest retroactive taxation may not be a legal path forward, its mere consideration should instill panic among municipal bond managers. What could be the rationale behind such a move? A short-sighted attempt to raise tax revenues without considering long-term repercussions suggests a fundamental misunderstanding of the financial mechanisms that sustain public projects. Impacts of this nature could shake institutional confidence in municipal bonds, leading to plummeting investments from both retail markets and tax-free money market funds.

The Growing Sense of Volatility

With the perceived safety of municipal bonds steadily eroding, volatility has taken center stage. Investors tend to be skittish in fluctuating environments, and what may have once been considered stable investments now carry a cloud of uncertainty. Jeff Lipton’s mention of increasing volatility stemming from external pressures positions municipal bonds in an increasingly precarious state. This level of unpredictability is not only alarming for seasoned investors but is also a disservice to retail investors who typically seek secure investment avenues.

In turbulent financial waters, retail investors tend to overreact, causing further fluctuations that can easily rattle the market. This exacerbation of volatility becomes a vicious cycle: when prices drop, fear exacerbates selling, and muni yields cut a deeper path into unfamiliar territory that can induce even further selling pressure. Investors are no longer just watching the yields; they’re assessing the long-term viability of an asset class that holds the promise of simplicity and stability, yet appears increasingly complex.

The Dark Cloud of Infrastructure Needs

An impending crises lurks when it comes to the state of America’s infrastructure. With so many of our nation’s roads, bridges, and public utilities teetering on the edge of obsolescence, the immediate need for substantial investment is glaring. However, the very foundation that enables such investment—the municipal bond market—is in jeopardy. As Lipton pointed out, while infrastructure demands urgent attention, the current financial environment puts municipalities at risk.

In this light, the long-standing assumption that municipal bonds would be a constant funding source for public infrastructure projects is now being challenged. If demand for these bonds diminishes due to tax reforms or political miscalculations, municipalities could face dire funding shortages at precisely the moment they can least afford them. Such a scenario would lack imagination, as it runs counter to the center-right objectives of promoting fiscal responsibility while allowing for necessary investments in public utilities.

The state of today’s municipal bond market is a reflection of the urgent need for strategic thinking and policy adjustments. Failure to wantonly continuously evolve with changing economic realities will lead us further down a path littered with fiscal irresponsibility. The time for a concerted approach to stabilize and reinvigorate the municipal bond market is not just timely; it is imperative.