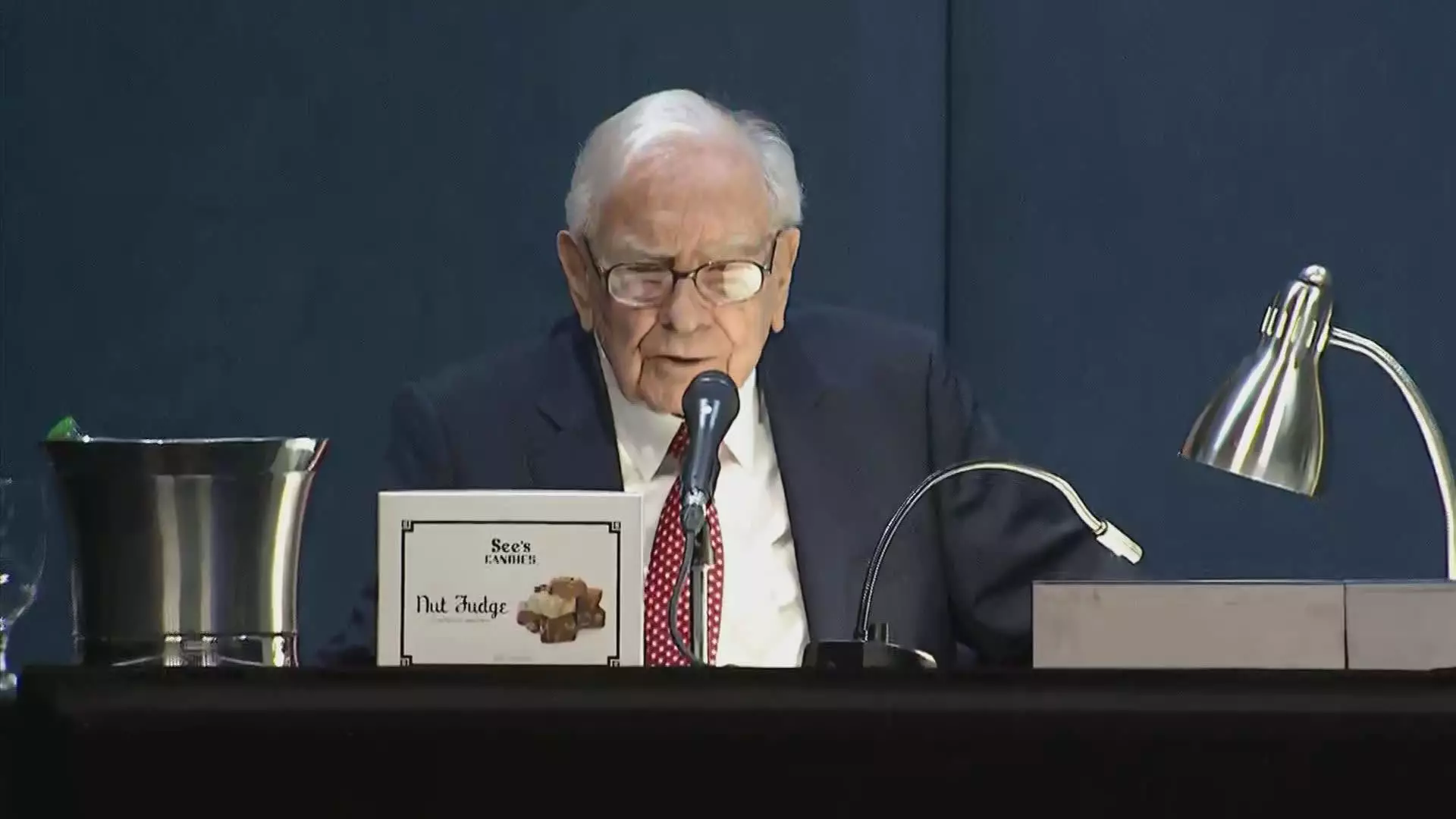

In an era where market fluctuations are a constant companion for investors, few names invoke as much confidence as Warren Buffett’s Berkshire Hathaway. Recently, while the S&P 500 suffered a staggering 9.1% plunge over a turbulent week, Berkshire Hathaway’s Class B shares experienced a comparatively modest decline of only 6.2%. This behavioral anomaly not only highlights the resilience of Buffett’s conglomerate but also raises questions about the broader implications of market volatility against the backdrop of political upheaval, particularly stemming from aggressive policies such as those enacted by President Trump.

Your Safe Haven in a Sea of Uncertainties

As investors look for refuge in a climate marked by uncertainty and wild swings, Berkshire Hathaway offers an unparalleled buffer. With cash reserves amounting to an astonishing $334 billion by the end of 2024, the company’s finances are structured to weather economic storms. Its diverse portfolio, spanning insurance, railroads, manufacturing, and energy, allows Berkshire to stabilize its income despite fluctuations in specific sectors. Such financial fortitude stands in stark contrast to many companies overly reliant on government policy or international trade, which have suddenly found themselves precariously positioned.

The modern investor craves security, and when the winds of economic pessimism howl, names like Berkshire Hathaway shine brighter. They aren’t merely enduring the storm; they are thriving.

The Resilience of Long-Term Focus

Berkshire’s success isn’t purely due to the balance sheet; it reflects a deeper philosophy about investing. While many firms scramble for short-term gains influenced by daily headlines, Buffett has consistently advocated for a long-term approach. This discipline enables Berkshire to be selective about its investments, choosing those which are not merely financially viable but also strategically aligned with broader economic trends.

This long-term mindset becomes particularly invaluable during tumultuous times. For instance, the recent trade tensions initiated by the Trump administration sparked anxiety across multiple sectors, prompting many investors to sell off. Yet, savvy investors recognized that not all companies are on the same risk spectrum. Berkshire, with its strong U.S. market exposure and a business model less susceptible to political whims, emerges as a safe harbor.

Financial Independence in a Polluted Political Landscape

The recent volatility raises pressing questions about which companies can stand resilient without direct alignment to the Trump administration. Industry giants tethered to the administration’s policies have proven to be riding a roller-coaster of uncertainty as they navigate ever-changing tariffs and policy decisions. Conversely, the fundamental strength of Berkshire Hathaway means it can exist independently of such political machinations.

Investment professionals, like Josh Brown from Ritholtz Wealth Management, have pointed out that Berkshire is one of the rare stock options that remains largely unaffected by the erratic nature of political maneuvering. Companies like these can operate under their own steam, immune to the implications of the 10-year Treasury yield fluctuations or international tensions. It’s a refreshing departure from the usual narrative that businesses need political backing to thrive.

The Importance of Momentum Indicators

As a point of interest, it’s notable that Berkshire Hathaway remains one of the few stocks within the top ten in the S&P 500 still trading above its 200-day moving average—a momentum indicator used extensively in technical analysis. Although some may argue that such indicators play a minimal role in longer-term success, the weight of this data cannot be ignored during periods of extreme volatility.

Evercore ISI’s Rich Ross highlighted that Berkshire is thriving when many others are faltering, an affirmation of the company’s robust operational strategies and the confidence of investors in Buffett’s proven leadership.

Navigating the Noise of Misinformation

In a society rife with misinformation, even titans of industry like Buffett find themselves tangled in fabrications. Recently, he faced unfounded accusations of endorsing harmful market actions supposedly orchestrated by Trump. Such speech voiced upon platforms like Truth Social not only muddles investor confidence but also unfairly tarnishes the reputation of industry leaders like Buffett, who remain committed to sound investment principles.

Thus, while the proverbial storm rages on and markets tremble, Berkshire Hathaway stands as a paragon of financial wisdom, reliability, and resilience—a refreshing bastion for investors seeking clarity amid confusion. The company’s strategic decisions and disciplined approach to investment continue to provide a stark contrast to the chaotic tendencies of contemporary economic politics.