The municipal bond market is currently grappling with a multifaceted array of challenges that threaten to inhibit its performance in the coming weeks. A combination of rising U.S. Treasury yields and robust new issuance has left municipals on shakier ground. On Monday, the market witnessed weakening as the sell-off in Treasury securities pushed yields upward, aggravating an already delicate situation for municipal bonds. With the two-year municipal-to-U.S. Treasury (UST) yield ratios revealing concerns—66% for two years, 69% for five years, and 89% for 30 years—investors are left wondering whether the allure of munis is fading. These ratios are indicative of relative values in the market; as they rise, it typically signals a move away from more appealing investments, emphasizing a trending distaste for the asset class.

Interestingly, some strategists, including those from Birch Creek, note that while performance has recently faltered, a firmer trend may have begun to emerge. However, such optimism appears premature given the capacity for volatility to strike unexpectedly within the fixed-income space. For now, it seems this assertion may serve as little more than a facade over a deeper-seated issue—investor confidence is wavering, and that’s concerning.

The Ripple Effects of Tax Season

Tax season has historically been a tumultuous time for municipal bonds, and this year is proving no different. Investors have shown a tendency to withdraw their investments as they weigh the benefits of higher yields elsewhere against the potential drawbacks of sticking with munis. With last week’s $216.4 million pullout, it’s clear that some investors are losing patience—or worse, faith—in municipal bonds. There’s a growing narrative that higher yields in competing markets are cannibalizing the interest in munis, a choice that could be seen both as sensible and short-sighted.

Emerging from a prolonged period of relative underperformance, the long end of the muni curve tentatively found its footing last week, offering a glimmer of hope. Yet, this doesn’t alter the stark reality that factors like sustained rate volatility coupled with the looming threat of heightened supply could continue to compress valuations into the foreseeable future. It’s difficult not to think about the implications of these trends: as outflows continue, will we eventually see a cascading effect that undermines the integrity of the market?

Searching for Stability Amidst Dislocation

Despite these significant setbacks, it would be naive to completely dismiss the potential for stability in the municipal bond market. The current lighter supply, estimated at a modest $7.9 billion this week, creates conditions that could tilt the scales back in favor of munis. J.P. Morgan’s strategists express optimism regarding perceived attractive valuations, implying there may be opportunities lurking beneath the surface. But let’s be clear: this optimism requires caution as the underlying volatility continues to rear its ugly head.

Even with some analysts pointing to bright spots, like the tightening of 30-year after-tax spreads by three basis points last week, the underlying conditions warrant skepticism. Investing in this environment requires a discerning eye and a firm grasp of risk management. The reality is that while some may deem these debt instruments attractive, others could see them as high-risk gambles ripe for underperformance.

Shifting Buyer Dynamics

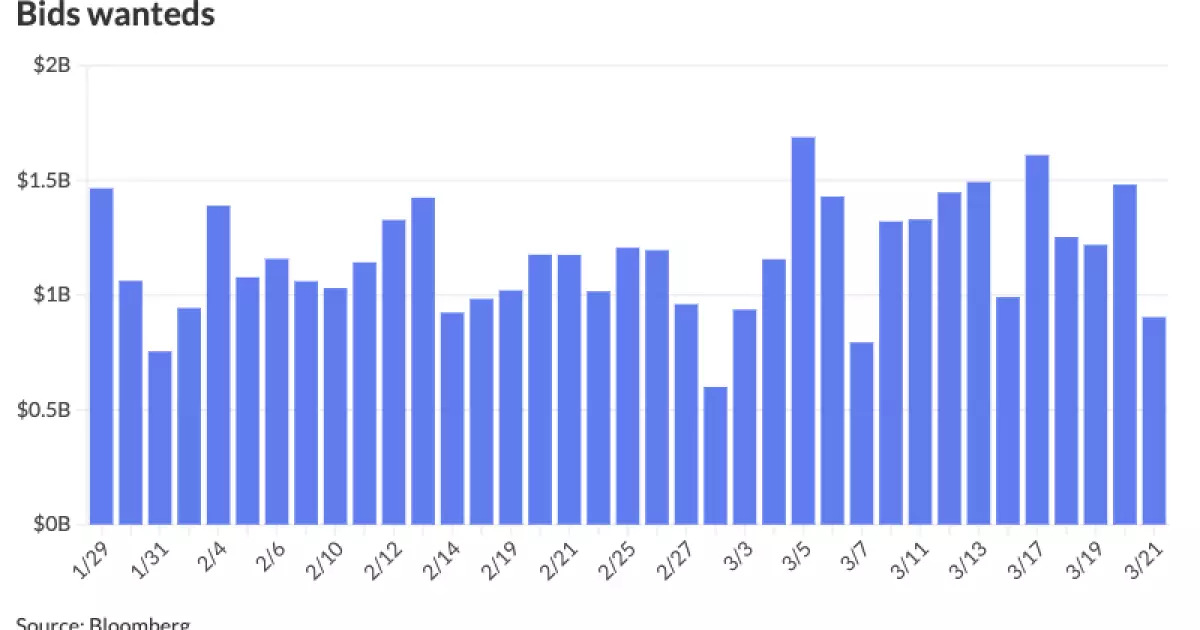

Another interesting facet of the current municipal market situation is the emerging shift in buyer dynamics. The relative cheapness of munis has sparked renewed interest, with a reported 20% uptick in customer purchases, suggesting that some investors are cautiously re-entering the space. Nevertheless, we need to recognize that this uptick may not represent a seismic shift in sentiment.

The increased purchases could be attributed to short-sighted attention to perceived bargains rather than robust underlying market health. Dealers have noted this increased activity, leading many to assume that a lasting recovery is underway. But we must question whether this activity is sustainable. The growing disconnection between buyer enthusiasm and fundamental performance metrics raises red flags about the market’s potential trajectory.

The Road Ahead and What It Means for Investors

Looking ahead, municipal bond investors must brace themselves for a potentially rocky ride. The anticipated supply bolds its weigh on the market, threatening to dampen any newfound enthusiasm. A looming deal for the Los Angeles International Airport bonds and other sizeable issues expected across the nation could exacerbate existing tensions in the munis market.

As yields rise and volatility persists, coupled with the uncertainty of the economic landscape, investors in municipal bonds are faced with difficult choices. Should they hold their positions or hedge against expected downturns? The answers to these questions will depend largely on individual risk appetites and the capacity for navigating the unpredictable waters of the municipal market. This landscape demands a thoughtful and measured approach, an understanding that while opportunities may abound, the risks are equally pronounced.