The municipal bond market is caught in a peculiar state: seemingly stable but subtly stagnant. Despite minor fluctuations in yields and consistent inflows to muni funds, the market struggles to ignite robust investor enthusiasm. This dynamic reflects a broader uncertainty among investors, who find munis cheap in relative terms but remain hesitant to push the market into rally mode without clear catalysts. The past month’s limited volatility masks an underlying challenge—municipal bonds are trapped between attractive valuations and a lack of momentum drivers.

After-Tax Yields: A Hidden Treasure for Long-Term Investors

One of the more encouraging signals is the generosity of after-tax yields for high-grade municipal debt, some offering over 8% tax-equivalent returns. This is a compelling proposition, especially for long-term holders seeking stable income streams immune to federal taxation. However, the market’s tepid response suggests that many investors remain cautious—perhaps influenced by a combination of broader economic uncertainties and the lure of safer Treasuries at lower but seemingly more stable rates. The takeaway is that while muni debt offers exceptional value, extracting that value requires patient investors with a well-defined strategic horizon.

Primary Market Activity: The Underrated Engine

What often gets lost amid discussions of yield curves and ratios is the vitality of the primary market. Currently, municipal issuance may appear subdued due to seasonality and holiday lulls, but upcoming sizeable deals, such as California’s $1 billion clean energy bonds and New York’s substantial infrastructure financings, promise to inject fresh dynamics into the market. The primary bond market’s health is crucial because it continuously sets benchmarks and attracts heavy subscription rates when spreads are attractive. These substantial transactions reflect a resilient demand for well-priced muni debt but also underscore an inefficient market where supply timing and scale matter far more than many analysts acknowledge.

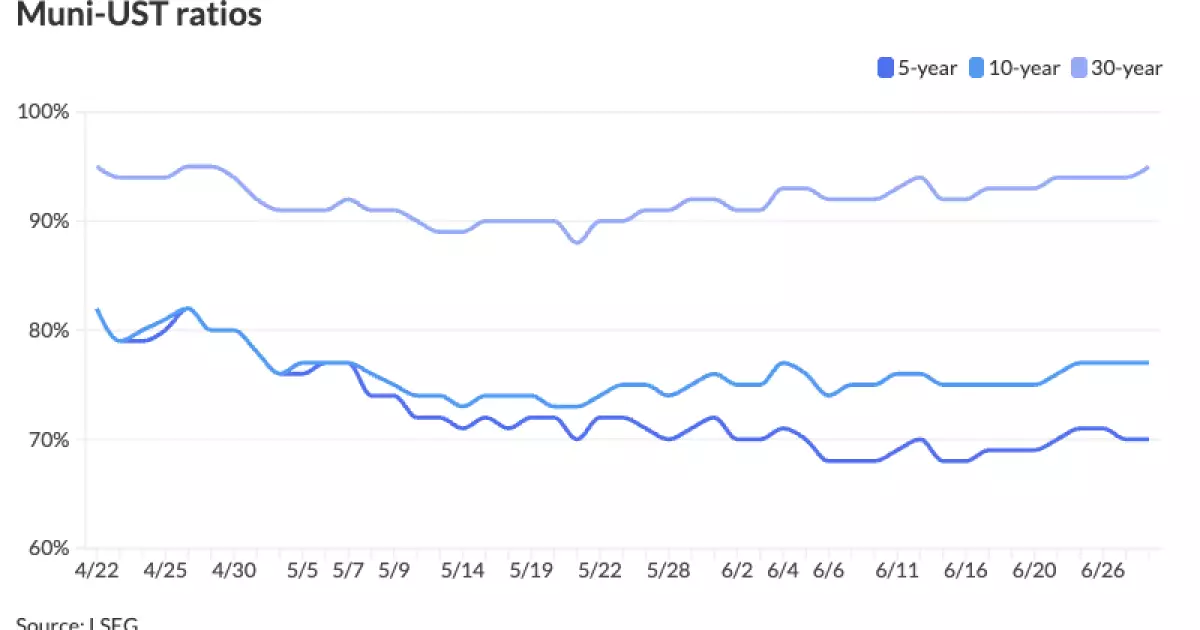

Ratio Spreads and the Elusive Muni Outperformance Catalyst

The ratio spreads between municipals and U.S. Treasuries remain stubbornly wide, suggesting municipal bonds are undervalued relative to their risk profile. Yet, this valuation disconnect does not automatically translate into outperformance. The market’s failure to rally decisively despite cheap valuations points to a lack of fueling elements such as robust fund inflows, policy stimulus, or dramatic economic shifts. It highlights a fundamental truth in fixed income: cheapness alone cannot spark price appreciation if macroeconomic or technical catalysts are absent. This nuance is frequently overlooked when pundits simplistically declare munis as “too cheap to ignore.”

State-Level Redemption Pressures and Regional Impacts

Breaking down redemptions offers a revealing lens on where muni market pressures are most concentrated. Heavy principal redemptions in California, New York, and Florida suggest liquidity challenges and could influence local demand and supply balances. These states, being significant issuers and holders of muni debt, create asymmetries in the national market. Investors ignoring these regional variances may misjudge underlying risk or miss opportunities where selective issuance presents above-average yields. Furthermore, understanding where redemption pressures lie aids in predicting which sectors might lead or lag in the coming months, an insight crucial for center-right investors advocating fiscal prudence and targeted capital deployment.

The Political and Economic Subtext: A Call for Fiscal Responsibility

From a center-right liberal perspective, the muni market’s current state underscores the necessity for sound fiscal management by state and local governments. The demand for increasingly attractive spreads—especially for projects tied to clean energy or transport infrastructure—should be matched by governments’ commitment to credible repayment sources. The cautious nature of investors reflects skepticism about unchecked debt growth and political interference. Moreover, the lack of a clear catalyst for muni outperformance may serve as a market signal calling for more disciplined budgeting, transparency, and structural reforms to underpin long-term creditworthiness. Investors, therefore, should emphasize quality over quantity, rewarding issuers who demonstrate responsible fiscal stewardship rather than those indulging in rapid expansion financed by generous spreads alone.

Looking Beyond Numbers: The Investor’s Psychological Barrier

Beyond the yield curves and redemption data lies the intangible but influential psychology of muni investors. The trauma of sharp corrections earlier in the year haunts the market’s collective psyche, resulting in measured, if cautious, activity rather than reckless speculation. The muni market’s slow and steady nature is not just a function of fundamental values but also of investor sentiment—often driven by macroeconomic skepticism and geopolitical concerns. This cautious optimism signals that any rally will likely be incremental and demand rigorous due diligence. For investors who can navigate this landscape with patience and discernment, municipal bonds offer not just refuge but a dependable yield opportunity amid uncertain economic winds.

—

The municipal bond market stands at a crossroads. Cheap valuations coexist with investor hesitancy, while strong primary offerings promise supply but not yet a decisive rally. It is a market illustrating the complex dance between fiscal reality, investor psychology, and the broader economic environment. Only through disciplined capital allocation and fiscal prudence can municipal bonds transcend their current lull and reclaim their role as a core component of stable investment portfolios.