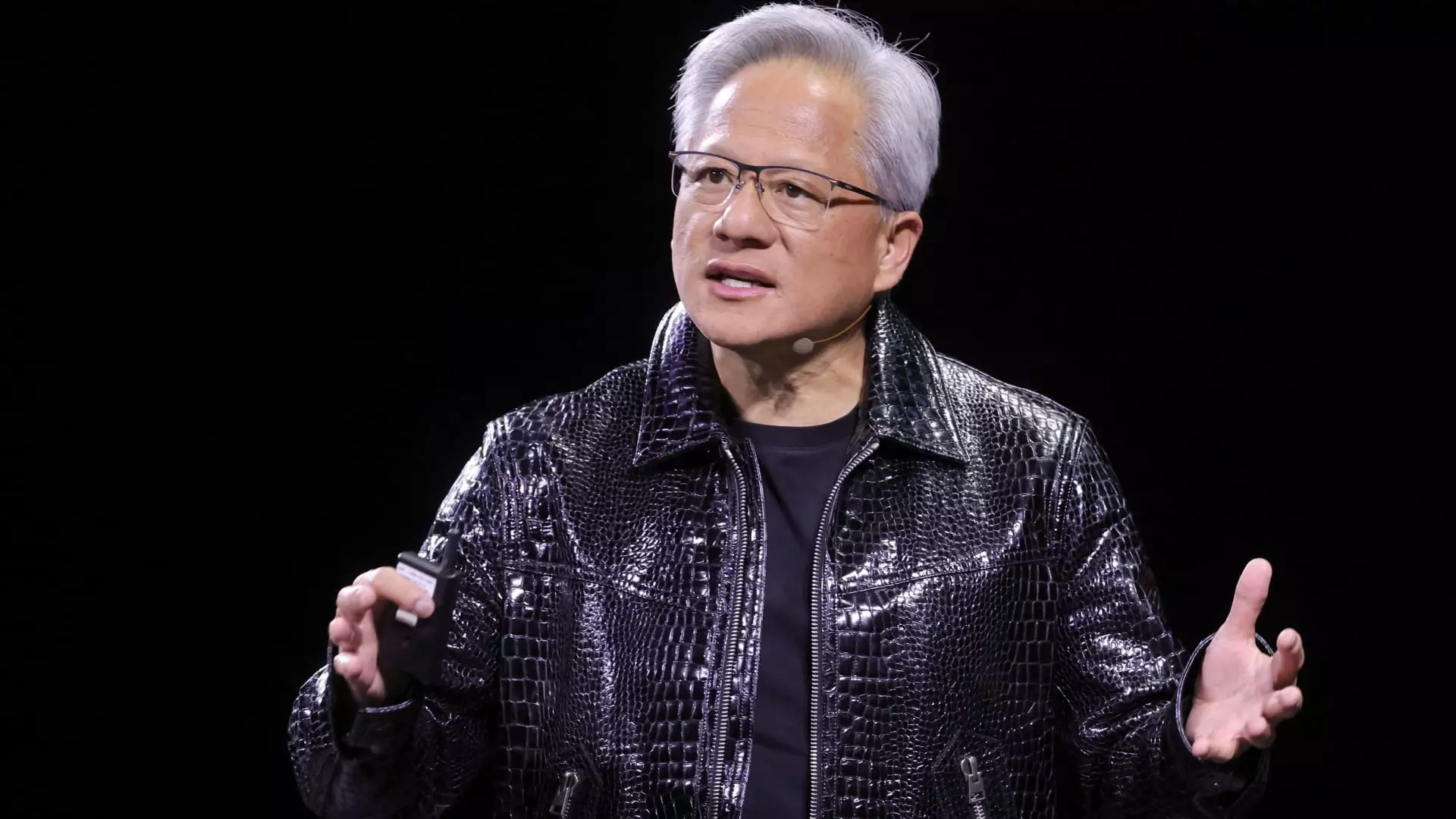

In the fast-evolving world of technology, few names resonate as strongly as Nvidia, led by its charismatic CEO Jensen Huang. At his recent annual conference, particularly during the much-anticipated “Quantum Day,” Huang attempted to rectify his previously controversial statements regarding the timeline for practical quantum computing. Those comments suggested a daunting 15 to 20-year wait for quantum’s utility. Thus, in spite of his efforts to amend his stance and entice investors back into the sector, the narrative did not play out as intended, leading to a dramatic downward shift in the stock values of key market players like D-Wave and IonQ.

The irony of Huang’s self-reflection is evident; rather than pacifying the anxious investors, his attempt at transparency may have exacerbated their fears. When market reactions can swing as dramatically as the pendulum of public opinion, the advanced technologies that promise to revolutionize industries are often only as reliable as the leaders guiding them. Huang’s open admission of past miscalculations raises questions about the foresight of industry leaders in this high-stakes field; are they genuinely invested in the pursuit of progress, or are they merely deftly maneuvering through the industry’s turbulent waters?

The Consequences of Expectations

It’s baffling how much weight is placed upon a CEO’s insights, especially when it comes to cutting-edge technology like quantum computing. Huang’s earlier assertions that quantum technology was at least 15 years away from being truly useful triggered significant sell-offs, highlighting the delicate balance between confidence and ambition. By suggesting that it might take even longer — a shift to 20 years — he appeared to better align with the perceptions of seasoned critics and skeptics. This adjustment, however, paradoxically echoes the struggles of an industry that seems increasingly backpedaled in the face of public relations crises.

Huang’s dialogue about the need for realistic branding of quantum technologies points to a larger industry dilemma. Is the phrase “quantum computer” helping or hurting their cause? The industry may need to reframe its narrative from that of a revolutionary replacement to a supportive enhancement alongside classical systems. Until quantum computing can tangibly prove its worth beyond theoretical promise, market confidence will remain tenuous at best.

An Industry in Turmoil

Despite Nvidia’s prominence amidst the buzz of groundbreaking technology, investors’ skepticism grows. The Quantum Defiance ETF’s downturn further signifies mistrust and uncertainty surrounding the prospects of quantum computing, following Huang’s ambitions. The potential of quantum computing remains a beacon of hope; however, continuous cycles of hype and disillusionment raise an essential concern: is the tech world in danger of over-promising and underdelivering?

The industry faces a dearth of practical applications, leading to contentious debates about scope and efficacy. Analysts like Needham’s Quinn Bolton argued that branding is critical — insinuating that the technology must be effectively marketed to bridge the gap between potential and public perception. Yet, as Huang’s remarks suggest, the optimism surrounding quantum computing raises more questions than answers, particularly concerning the readiness of corporations to embrace its capabilities.

Nvidia’s Role in the Quantum Ecosystem

Nvidia is undeniably positioned well, as its core business still thrives on the back of classical computing, which flourishes in its GPU infrastructure. As the company invests in partnerships and research initiatives, it demonstrates its interest in sustaining its leadership role in a burgeoning market. The new research center in Boston, intended to foster collaboration with elite institutions like Harvard and MIT, symbolizes Nvidia’s commitment to bridging the gap between classic and quantum technologies.

Yet lessons learned from Huang’s statements implicitly signal an alarming trend for investors — one that may endanger future collaborations and investments. The brilliance of AI and classical computing may pull resources and focus away from the nascent quantum industry at a crucial junction in its formative years.

The Future Looks Grim?

Overall, the essence of Huang’s remarks reflects a troubling undercurrent in the quantum computing sector. One can’t help but gaze into what appears to be a murky horizon, dominated by uncertainty. As innovation continues to unfold, the question lingers: will the potential of quantum computing deliver the extraordinary impacts promised, or will it remain an exhausted narrative filled with unrealized dreams? With high expectations and skepticism colliding, the path forward will be critical in shaping the trajectory of both the technology and the market.