In recent weeks, the situation has taken a sobering turn for municipal bonds, marking a serious downturn that has raised eyebrows among savvy investors. The municipal market, notoriously seen as a safe harbor amid the ever-changing tides of bonds, appears to be losing its luster. Observers are noting a marked deterioration in performance, as yields climb and investor enthusiasm wanes. Unlike the asset class’s past, which was characterized by stability and steady returns, these developments suggest a bumpy road ahead—one characterized by uncertainty and opportunity loss.

Investors could be forgiven for questioning the wisdom of holding municipal bonds in an environment where U.S. Treasury yields are rising. As explained by experts in the field, the growing gap between municipal yields and UST yields signals a shift, and not a favorable one at that. With the two-year municipal to UST ratio dipping to alarming lows, the evidence is hard to overlook: investors are growing weary of bonds that once seemed so secure. It’s hard not to wonder if municipal bonds have lost their former status as the bedrock of a conservative portfolio.

Weak Fundamentals and Headwinds

As the storyline continues, a chorus of voices within the investment community—like that of Kim Olsan from NewSquare Capital—reiterates the grim realities facing municipal bonds. The prevailing theme is a “one-way trade up in rates,” driven by shaky fundamentals and a slew of headwinds that could stymie any hopeful recovery. The statistics tell a tale of increased inventory levels and rising yields that paint a rather bleak picture. Dealers, facing formidable distribution challenges, report record inventories that can undermine market stability.

Olsan asserts that many of the factors contributing to the current yield climate may unlikely shift anytime soon. Investors are left grappling with a landscape where yield opportunities are slim, pushing them to make difficult choices as they chase better returns. The fact that generic AAA credits have increased by 60 basis points in just six months is not merely a statistic; it’s a warning that cannot be ignored. With raw yields now breaching the 3.00% mark, what was once a haven is turning into a turbulent sea of options.

Demand-Led Versus Supply-Led Increases

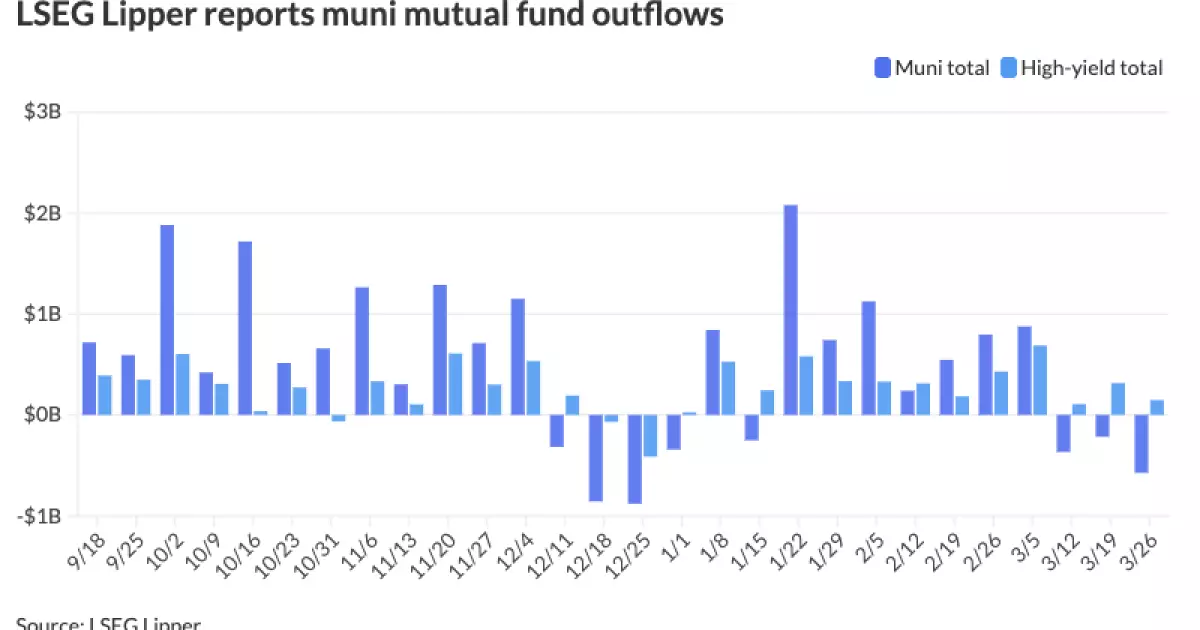

One must question who will bear the brunt of this adjustment: the investors looking for safety, or the issuers struggling in a harsh economic climate. As the average seven-day simple yield for tax-free and municipal money-market funds has fallen significantly, it’s clear that demand is struggling to keep pace with supply pressures. Despite a slight rise in high-yield fund inflows, the persistent outflows from municipal bond mutual funds indicate a deep-rooted lack of confidence in this traditionally stable asset class.

High-grade credits, such as those tied to Washington State, are generating yields that feel incongruous when compared to historical norms—yielding 14 basis points more than previous trades isn’t just a blip, but a signal of investor anxiety. The municipal market is becoming a confusing maze for investors to navigate, particularly as they weigh prospects for return against the echoing uncertainty that looms over the broader economic landscape.

Strategic Allocation: A Necessity for High-Yield Opportunities

As market participants try to find their footing amidst growing yield curves, NIM (net interest margin) strategies are being reshaped. Credit structures can dictate much of the market’s dynamics, and successful investors will need to remain adaptable, seeking high-quality bonds that maintain sound call structures. The ability to allocate properly becomes essential if one hopes to achieve an optimal return on investment amidst a sea of underwhelming offerings.

Take for instance the competitive sales over the past few weeks. Deals from various municipal issuers have pushed yields above 4%, and in some instances, even higher—these offers could transform into gold for risk-tolerant investors. However, the disconnect between yield expectations and the underlying credit quality creates a precarious position for opportunistic buyers. It gives rise to the pressing question: is it worth extending oneself into riskier territory to chase those incremental yield gains?

Commercial and Institutional Dynamics Under Strain

Also noticeable is how institutional attitudes are evolving amid this volatile climate. The dual role of providing capital while ensuring profitability is becoming increasingly complex for municipal bond dealers and investment firms. Institutions are tweaking their models to benefit from short-sighted opportunities in a transitional market, yet the sustainability of such practices is in question. Not only are institutional offerings shadowed by changes in market dynamics, but their ability to accurately price bonds is being undermined by fluctuations in supply and demand pressures.

Is the promise of stability in municipal bonds fading or simply evolving? As these trends unfold, both retail and institutional investors need to reevaluate their bond strategies and risk tolerance. In a landscape where once-sought-after assets now feel increasingly precarious, taking a cautious and measured approach is perhaps the only path to achieving reliable returns while avoiding the pitfalls of a market that has shown its vulnerabilities in recent weeks.