The municipal bond market is experiencing an unprecedented storm of volatility, characterized by stark sell-offs and wild fluctuations. In what has been described as one of the most tumultuous weeks in recent history, yields have surged significantly, undermining investor confidence and raising a plethora of concerns within financial circles. As the impacts of President Donald Trump’s tariffs loom large, the repercussions extend far beyond simple metrics; they are reshaping market landscapes and investor strategies alike. It’s essential to evaluate the driving forces behind this volatility in order to understand the implications for high-grade munis and the broader investment environment.

Factors Behind the Sell-off

The selling frenzy that began early in the week can be attributed to multiple converging factors. J.P. Morgan analysts indicated that a remarkable 45 basis points surge in 10-year U.S. Treasury rates triggered forced selling, marking a detrimental shift in market sentiment. Coupled with record outflows from exchange-traded funds (ETFs), increased tax-exempt supply, and a lack of reinvestment capital, the situation was ripe for market disruption. The unpredictability of legislative measures further heightened anxiety, making investors skittish and reluctant to engage in new bond acquisitions.

This week’s market turbulence evokes memories of the catastrophic liquidity crisis seen during the early days of the COVID-19 pandemic. Just like then, quality ratings couldn’t protect high-grade munis from the backlash of broader market sentiments. Investors are grappling with a future filled with uncertainties, and the past week’s performance certainly whipped market participants into a frenzy.

A Historical Context

The recent spate of sell-offs is not an isolated incident; it echoes historical patterns observed during significant market shifts. Analysts emphasized that some of the largest daily sell-offs were reminiscent of conditions faced during previous economic crises—most notably the onset of the pandemic. In fact, recent figures highlight that the fourth, fifth, and eighth largest daily sell-offs occurred just this week. Each sell-off not only acts as a warning signal but also serves as a painful reminder that markets typically rebound, albeit slowly and unpredictably.

While many investors are on high alert—scrambling for safety in the face of turbulence—there remains a contingent arguing that such sell-offs could present a buying opportunity. However, this perspective may be overly optimistic given the rapid rate of decline witnessed throughout this volatile week.

ETF Outflows and Reaction

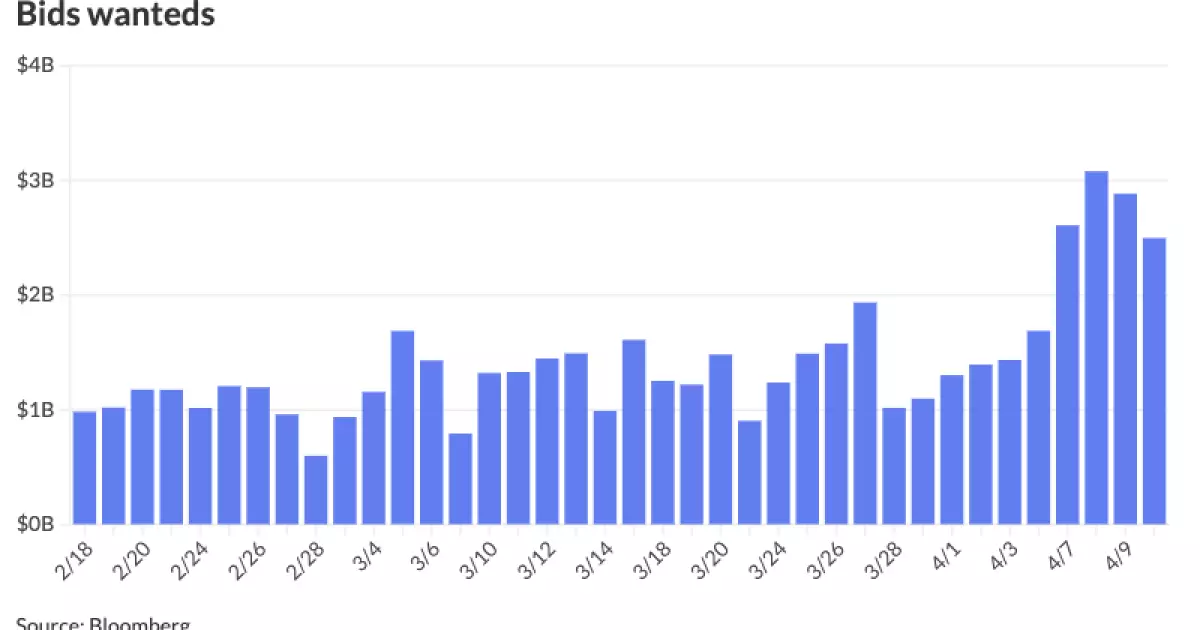

As the municipal bond market experienced unprecedented turmoil, trading data revealed an alarming trend: record outflows from municipal bond ETFs. Investors, fearing further declines, began to liquidate positions en masse. Such behavior not only reduces liquidity but undercuts the credibility of the bonds, causing yields to skyrocket further. ETFs, typically seen as offering liquidity and price discovery, became instruments of panic. The downward spiral was accelerated as market participants rushed to offload bonds, leading to a liquidity crunch.

What’s troubling is that while the higher-rated bonds are taking the brunt of this massive selling, lower-rated bonds are surprisingly showing resilience in this financial tornado. This counterintuitive outcome signals a significant shift in risk appetite among investors, who are now weighing options differently than before.

The New-Issue Calendar and Market Stagnation

With estimates suggesting that new issuance for the coming week could reach nearly $8.9 billion, many issuers are bracing for difficulties. Jock Wright, an underwriter at Raymond James, describes the current environment as “a deal by appointment” market, where only those deals with stability are likely to proceed. It’s this hesitation that reflects not only the instability but also a broader reluctance among issuers to enter the market.

Failure to function smoothly not only hampers the flow of capital but also creates an environment where underwriters are reluctant to embrace risk. The perception that bonds might lose value overnight creates a ripple effect, impacting everything from pricing negotiations to the very structure of deal-making. This stagnation sends shockwaves throughout various sectors, creating uncertainty for investors who are already grappling with volatility.

Outlook: Uncertain Times Ahead

The volatility displayed in the municipal bond market this week exemplifies a growing divergence between high-quality bonds and riskier investments. While some might argue that recovery is on the horizon, the interplay of numerous disruptive factors renders any predictions tenuous at best. Until investors can discern a semblance of stability, municipal bonds may remain fundamentally challenged, navigating a storm fueled by both political turbulence and shifting economic policies.