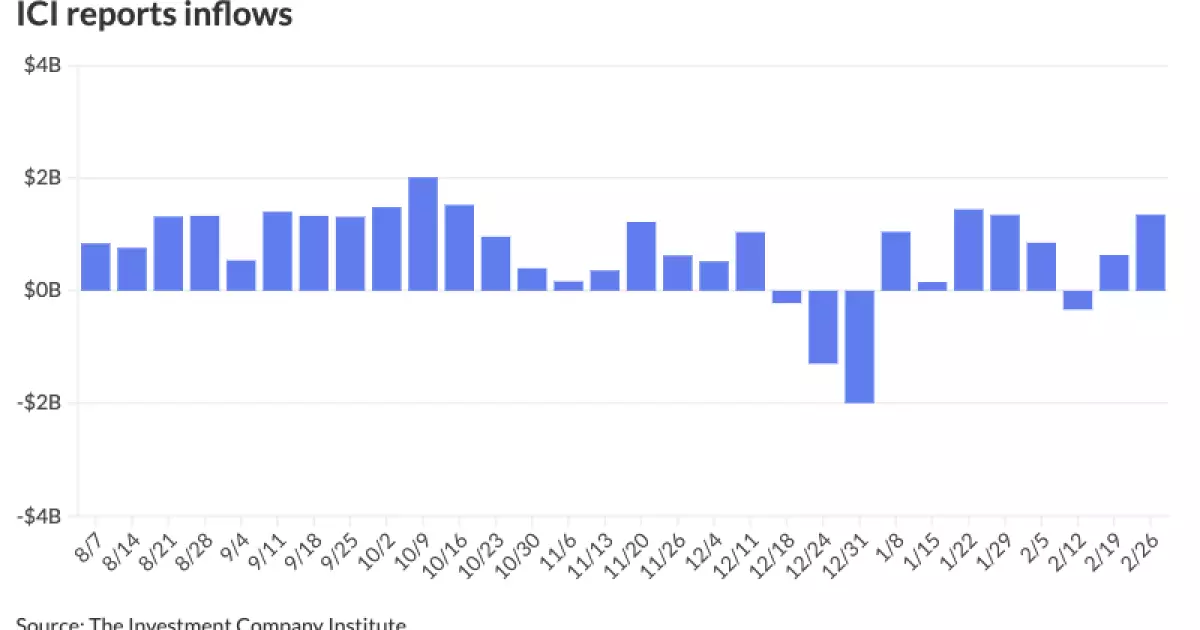

Municipal bonds have historically been a safe haven for conservative investors seeking stability amidst market volatility. Yet, as data from recent months indicates, there lies a troubling gap between supply and demand that could signal deeper underlying issues. With municipal market issuance significantly outpacing coupon payments and redemptions, the suggestion of a substantial headwind comes through loud and clear. Demand for tax-exempt income remains robust—$1.35 billion has been funneled into this market just last week alone—but one has to wonder: can this demand truly sustain a market that is increasingly undersupplied? Optimistic forecasts predict a need for $750 billion to $1 trillion in annual issuance to adequately address crumbling infrastructure. Yet, while this may sound feasible in theory, practical implications suggest a potential avalanche of unsuitability for existing market dynamics.

Tax Season’s Unwelcome Visitor

The arrival of tax season tends to bring with it a customary wave of demand for liquid cash as investors seek to shore up their financial positions. However, according to seasoned experts in the field, this influx may be mitigated by the ongoing strength of market inflows. This is a double-edged sword. While the potential for cash withdrawals looms and adds pressure on the munis, the presence of steadfast inflows can reassure those nervously eyeing their portfolios. Yet this leads to a critical question: Are these inflows genuine endorsements of long-term trust in municipal bonds or merely short-term reactive maneuvers in the face of tax deadlines?

Heavy Lifting on Infrastructure

As infrastructure deterioration continues to plague cities across the nation, the looming question of funding has necessitated a sharp focus on issuing more public debt. With experts asserting that a substantial increase could be digested well, the possibility arises that exceeding current issuance benchmarks could introduce an entirely different spectrum of risk. During a time when we desperately need significant reinvestments into public works, the current issuance level of approximately $500 billion becomes alarmingly inadequate. Concerns grow that the federal-level prioritization of spending might leave local municipalities without the tools needed to address catastrophic infrastructure failures. This raises a red flag: Are we collectively prepared to confront the mounting costs associated with deferred maintenance versus the immediate allocation of funds to fresh debt offerings?

The Role of Returns in Shaping Market Behavior

Examining the returns associated with municipal bonds also reveals a complex narrative. While the historical appeal of stability and tax-exempt status continues to vie for the attention of conservative investors, the reality is that anticipated yield improvements may not be sufficient to entice new capital into this underwhelming market. The attractiveness of municipal bonds has often been overshadowed by their fixed income nature in an era where equities are delivering robust returns. Therefore, a fundamental question arises: are investors willing to forgo higher returns in favor of the traditionally conservative shelter offered by munis, especially given their potential for underperformance in the current climate?

Innovative Solutions or Futile Endeavors?

The introduction of AI-powered platforms aimed at enhancing pricing efficiency within the municipal bond sector introduces a fascinating twist to the existing landscape. Projects like ficc.ai could significantly improve market transparency and accessibility. However, as admirable as this technological evolution may be, one must question whether mere improvements in pricing yield will stimulate genuine interest or participation in an already beleaguered market. The risks of perpetuating monopolistic pricing structures, despite advancements, pose a fundamental challenge: will such technologies merely gloss over deep-rooted inefficiencies in the system, or can they fundamentally shift the dynamics of investor participation in the municipal market?

Closing the Gap Between Optimism and Reality

The sentiment surrounding municipal bonds is far from straightforward. While some experts bravely assert that substantial growth is possible, the palpable anxiety in the air suggests the opposite. As we grapple with the realities of national debt, insufficient infrastructure funding, and wavering investor confidence, it is essential to ask ourselves: can we afford to overlook the dangers posed by this disconnect between the bolstered optimism for municipal bonds and the stark reality of market fundamentals? Ultimately, the market’s path forward hinges on whether the collection of voices in the financial realm can align on a shared vision—one that not only champions growth but remains grounded in the practical challenges we face today.