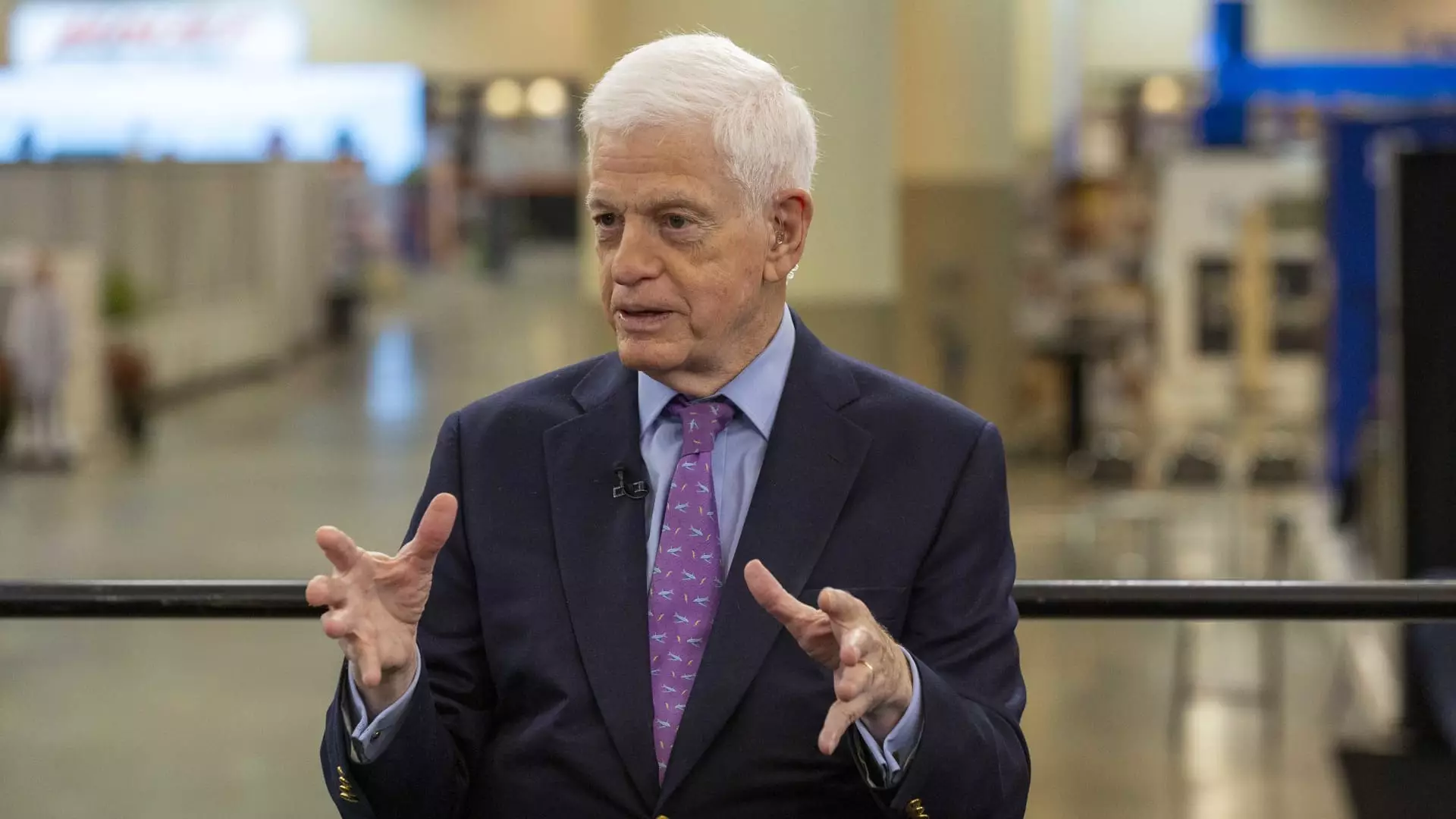

In a world where investment choices can often feel overwhelming, the words of Mario Gabelli, chairman and CEO of Gamco Investors, resonate strongly. During a recent segment on CNBC, Gabelli urged viewers to consider purchasing shares of the Atlanta Braves instead of traditional holiday gifts. His plea might sound whimsical amidst the serious fabric of the stock market, yet it encapsulates the tremendous potential that sports franchises possess.

The Rise of Sports Investment

Historically, sports franchises have proven to be lucrative investments. Unlike many other industries, the sports sector thrives on passionate consumer loyalty. The Atlanta Braves exemplify this, boasting not just a storied history but an engaged fan base. Gabelli’s proposition to buy shares as an Easter gift underlines the emotional investment fans have in their teams. When economic landscapes are shaky, a well-managed team can weather the storm, offering fans and investors alike a sense of stability that typical consumer goods lack.

As Gabelli pointed out, the Braves’ public stock has seen a remarkable uptick. His call to action highlighted a crucial point for potential investors: sports franchises, often perceived as frivolous investments, can provide exceptional returns as they capitalize on viewer engagement and merchandising. Shares that rise in value often do so because of the franchise’s performance and market strategies, two areas where the Braves excel.

Spotlight on Innovation and Management

Gabelli didn’t stop at the Braves; he also identified other promising investments such as Crane Co. and GATX. The lesson here is profound: the success of any company, be it in sports or manufacturing, is often rooted in sound management. Crane Co.’s CEO, Max Mitchell, for instance, has implemented strategic financial engineering that has led to noticeable earnings growth. Such leadership is what investors should genuinely scrutinize, as it often dictates the trajectory of a stock.

Gabelli’s admiration for companies driven by innovative leadership suggests that investors should seek out not just the product or service, but the vision behind it. In an era where many companies struggle under traditional modes of operation, those like Crane Co. and the Braves, led by capable executives, represent golden opportunities.

The Role of Timing in Capitalizing on Trends

The market can shift in a matter of days, making the timing of investment decisions critical. Gabelli’s endorsement of Sony Group also highlights the potential of leveraging market trends for profit. With the imminent release of a new Grand Theft Auto installment and anticipated streaming price increases for platforms like Spotify, it would be illogical not to act now. Investors willing to recognize these shifting consumer behaviors often capitalize on substantial market gains.

Thus, the timing of one investment over another becomes a strategy in itself. Investors must acclimatize to the rapid pace of innovation and consumer interest—a skill not every investor possesses.

Community Engagement: The Heart of Sports Franchises

Investing in a franchise like the Atlanta Braves goes beyond merely stock performance; it encapsulates a community’s heartbeat. The passion with which fans support their teams can translate into consistent revenue streams through ticket sales, merchandise, and broadcasts. Gabelli understands that the financial ecosystem around sports teams flourishes with fan engagement.

Purchasing shares in the Braves represents a shared stake in a culture, a narrative steeped in tradition and excitement, bolstering community morale. This goes beyond mere dollars and cents; it’s about becoming part of something significant—an intangible asset that can often outweigh mere financial returns.

Risk is Part of the Game

Of course, no investment comes without its risks, and Gabelli’s commentary does not gloss over this. The ups and downs in the sports sector can be dramatic. However, as history has indicated, sports franchises tend to bounce back stronger after downturns, making them a more resilient choice compared to traditional corporate entities.

Investors must therefore weigh the volatility of sports investments against more stable options. An awareness of the cyclical nature of sports can guide you in navigating the complexities of a market that some might deem unpredictable.

Gabelli’s call for investing in the Atlanta Braves is not just a whimsical suggestion; it’s an investment strategy that challenges paradigms. In a world increasingly skewed towards technology and intangible assets, maybe it’s time for us to step up to the plate and reconsider the tangible joys that sports investments can offer.