The streaming landscape is undoubtedly competitive, yet Netflix stands as an overwhelmingly dominant force, showcasing a profound ability to innovate and adapt. With a recent price target hike to $1,490 per share, as stated by Bank of America’s analyst Jessica Reif Ehrlich, Netflix not only demonstrates robust earnings momentum but also a solid subscriber growth trajectory that is increasingly resilient in the face of market fluctuations. This well-rounded strength uniquely positions Netflix to capture a larger slice of the advertising revenue pie, a crucial pivot given today’s financial landscape.

Despite the criticisms about its reliance on subscriptions alone, Netflix’s aggressive foray into advertising technology signals a strategic foresight that industry peers seem to lack. One can argue that the combination of high-quality content, expansive reach, and growing profitability from ads positions the streaming giant not merely as a market participant but as a trailblazer set to redefine how streaming services operate. With its stock already up an impressive 39% this year, the momentum suggests there’s much more to come.

A New Dawn for Amazon: Robotics and E-Commerce Supremacy

Amazon, the e-commerce leviathan, finds itself in the limelight yet again with a price target elevation to $248 per share. Analyst Justin Post’s insights reveal a landscape increasingly shaped by robotics and innovative logistics, marking a significant turning point for how Amazon will operate moving forward. The anticipated use of drones and automation technology will create a fortress of efficiency, reducing labor costs while ensuring accuracy and speed in order fulfillment.

What’s particularly compelling here is that Amazon’s expansion into these advanced technologies isn’t just a response to competition; it’s a strategic preemptive maneuver that reinforces its already formidable market position. As e-commerce continues to surge globally, Amazon is expertly positioned to reap substantial rewards from this trend alongside its cloud computing and online advertising ventures. The stock’s more than 15% gain over the past year merely scratches the surface of what could be an impending growth explosion.

Boot Barn: Riding the Western Wave

Boot Barn might not be the first company that comes to mind when discussing high-potential stocks, but its performance tells a different tale. Recently, analyst Christopher Nardone increased its price target to $192 per share, suggesting the retailer has numerous positive catalysts set to drive it higher. Boot Barn’s broad-base growth across various merchandising categories, combined with friendly pricing conditions, creates fertile ground for market expansion.

Nardone’s assertion that the company benefits from scaling, superior selection, and exclusive brands speaks volumes about Boot Barn’s competitive edge in the retail space. This company is not simply a short-term success; its trajectory indicates a solid, multi-year growth story that captures the essence of evolving consumer habits, particularly in niche markets. With an 8% increase this year and a favorable backdrop, Boot Barn is positioned for continued expansion, defying any market skeptics.

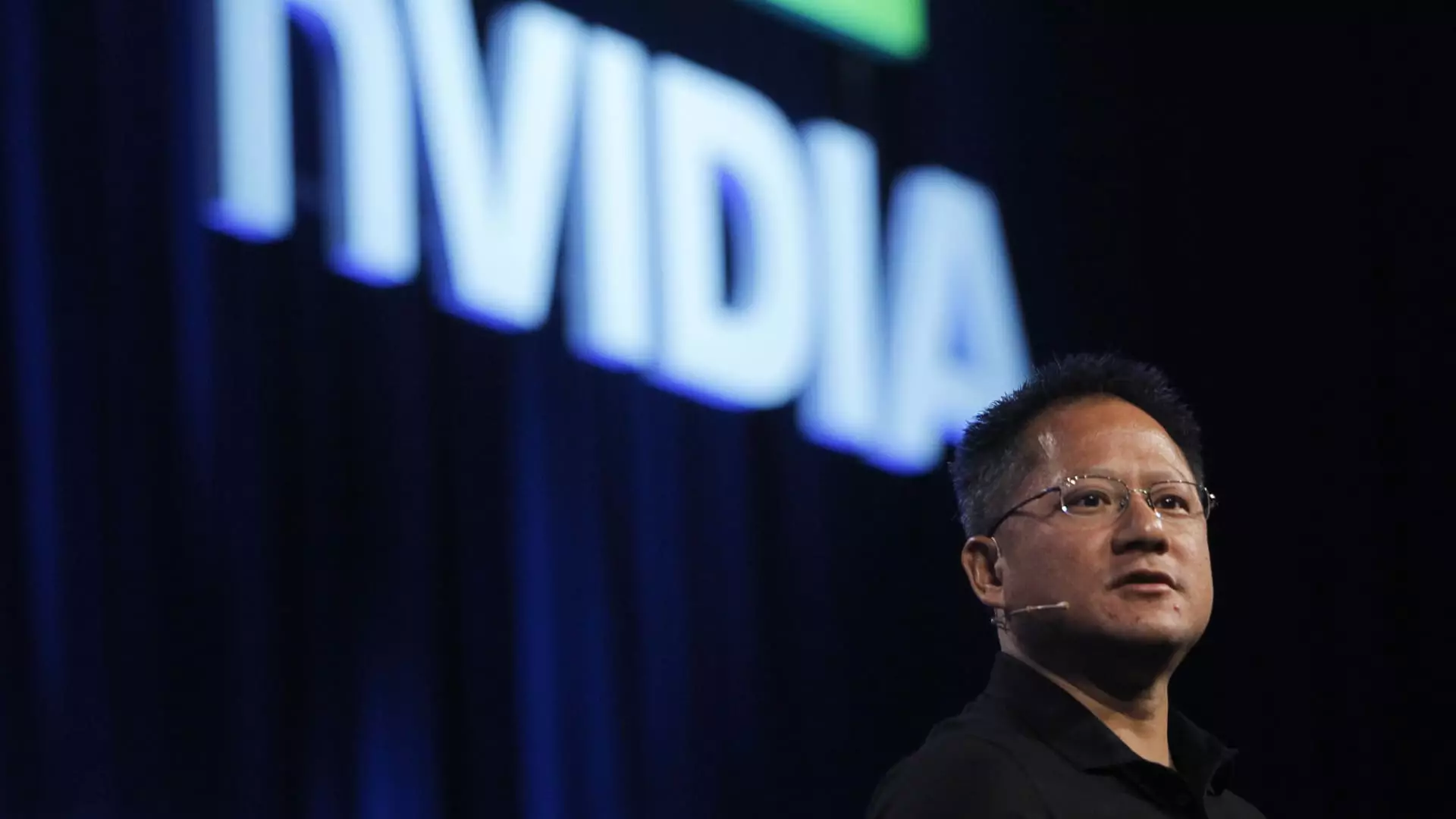

Nvidia: The AI Champion

Few companies have captured the world’s attention quite like Nvidia in recent years, and for good reason. As Bank of America maintains a “Buy” rating on this powerhouse, their analysis pinpointing a price target of $180 reflects broad confidence in Nvidia’s role within the AI revolution. Its unique positioning—thanks to a combination of industry-leading performance and unmatched developer support—has endowed it with a multi-year lead over competitors.

Though market volatility poses risks, Nvidia has continued to demonstrate resilience through its avant-garde innovations in AI applications and chip technology. As industries increasingly pivot towards AI-driven solutions, Nvidia’s momentum builds a case for it being more than just a tech stock; it’s at the heart of a transformative shift.

Philips Morris: A New Tobacco Paradigm

A surprising entry in this stock surge narrative is Philip Morris. While traditional sectors often face skepticism, especially tobacco, the company is successfully retraining its focus on smokeless products and sustainability. Bank of America’s buy recommendation sheds light on an outlook that transcends conventional tobacco valuations. With continuous innovations and a pivot to healthier alternatives, the company is repositioning itself to capture an emerging market that values consumer health without sacrificing shareholder wealth.

This transmutation speaks not just to the future of tobacco but also to broader economic pressures and changing social norms. As consumers embrace new lifestyles, companies like Philip Morris are not merely adapting; they are pioneering a pathway that could redefine their roles in the global marketplace.

The convergence of technological innovation and market dynamics in these stocks illuminates a compelling narrative of resilience amidst challenges. Investors who take heed of these shifts might just find themselves ahead of the curve.