As the municipal bond market experiences a marginal tightening this week, it’s clear that underlying volatility cannot be completely wished away. While recent liquidity pressures indicated strain, the gradual easing of U.S. Treasury yields has provided some temporary relief to municipal assets. However, the question remains: is this stability merely an illusion? Evidence suggests that, despite recent slight improvements — such as a notable increase in competitive bond sales in states like North Carolina and Maryland — deeper structural issues loom ominously on the horizon.

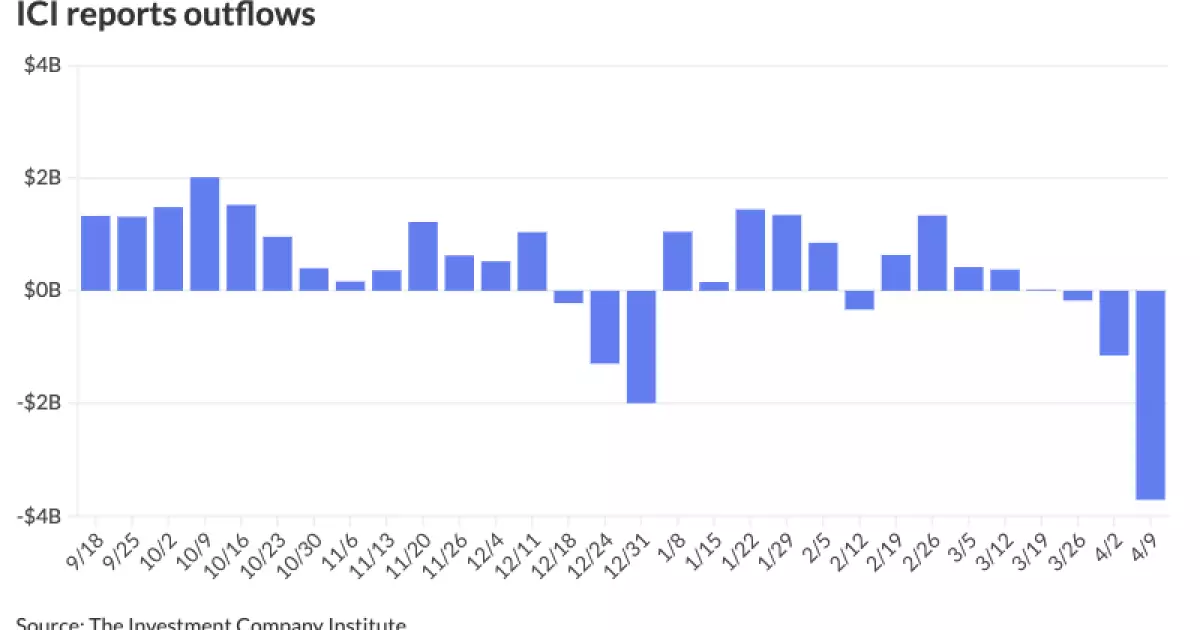

The reality is that every glimmer of progress — like the recent high demand for municipal bonds that approximates AAA reference levels — hinges precariously on the broader economic landscape. Furthermore, the Investment Company Institute’s recent report of significant outflows, to the tune of over $3.7 billion, raises eyebrows. The trend reveals fragile investor sentiment — investors remain jittery, fearing the volatility of the municipal market, which can pivot at a moment’s notice. This wave of caution reflects a financial environment where confidence is an expensive commodity.

Yields and Ratios: A Defective Barometer

Municipal investors often rely on yield ratios as a primary metric to evaluate risk versus reward, but recent movements in these ratios beg for a more nuanced interpretation. Although the two-year, five-year, and ten-year municipal bond ratios hover near 80-82%, this seemingly favorable condition obscures the volatility lurking beneath the surface.

The historical context illustrates that these yields have risen substantially from last year’s lows. Yet, to consider this a signal of health in the municipal market could be reckless. With offers of relative value compelling enough to lure bidders back into the fold, one must wonder whether this is sound investment strategy or merely a reactive response to fleeting conditions. The story is further complicated by the apparent stagnation in movement from A-rated to AAA-rated bonds in the overall landscape. The quality breakdown remains disappointing, with AA-rated bonds dominating trades by a staggering 55%.

Addressing Concerns Over Supply Distribution

The distribution of upcoming bond issuances stands as a formidable challenge that has not been adequately resolved. While market sentiments might indicate a budding optimism brought on by a flurry of new issues, the actual distribution remains perilously complex. Larger players may find themselves immovably entrenched, exacerbating the scarcity that smaller investors face.

Upcoming issuances, including colossal offerings from Connecticut and Massachusetts worth over $1 billion, may appear promising, yet are overshadowed by the specter of supply overload. Such impending saturation could further depress prices or distort yields in an attempt for underwriters to attract buyers in a climate of adverse sentiment.

As Kim Olsan of NewSquare Capital rightly noted, the ongoing struggle for effective distribution highlights the diverging paths of market participants. Those wishing to cash in on dutifully compiled portfolios of municipal bonds face an uphill battle amid the systemic stresses of the current climate.

The Economics of Tax Day: A Double-Edged Sword

Turning to the approaching April 15 tax deadline, the market’s reaction underscores a larger societal truth: taxes breed tension. Olsan’s analysis intimates that reactions to tax season create exaggerated ultra-short yields, an alluring outlook for some, yet a precarious one for many. The pandemonium surrounding tax-related municipal bond activity unveils a troubling reality — investors might view bonds as temporary shelters rather than long-term commitments.

Trading at the $3.15 to $3.69 range only adds confusion to the mix. The one-year AAA MMD yield exceeding the psychological barrier of 3.00% — imbuing a tax-equivalent yield of 5.00% — could entice top-bracket buyers, but it simultaneously highlights the tensions present in the marketplace. A reliance on such transient strategies does little to cultivate a culture of prudent investment or foster confidence in the broader economy.

Implications of Market Dynamics on Future Investments

The municipal bond market’s current trajectory raises questions about how future dynamics will play out. The tension between rising yields and the consistent decline of new CUSIP requests in March does not fill observers with optimism. A decline of 1.1% suggests that the appetite for new city bonds has weakened, despite an 11.4% year-over-year volume increase. Texas leads the charge with 106 new requests, but demographics alone cannot determine a thriving market — they also necessitate confidence and active participation from investors.

The subtle pressure on liquidity further hints at a potential tipping point, characterized by an unhealthy bond appetite from major financial players. This pressure highlights a potential disconnect; market participants’ perception of value does not align with the realities of a robust, stable municipal market. If we expect genuine growth rather than transient superficial gains, substantial reform and a commitment to better distribution methods are imperative.

In this tumultuous landscape, it’s critical for investors to remain alert, adaptable, and most importantly, aware of the ephemeral nature of market trends that could have had them skating on thin ice all along.