In the complex financial web that is municipal bonds, the recent pattern of behavior is nothing short of unsettling. While the recent weeks showcased some stabilization in the municipal market, the underlying volatility raises serious questions about the economic future. A brief upward trend had been observed after the tumultuous swings the previous weeks, but beneath this façade lies a concerning reality: the municipal bond market is teetering on the edge. Recent metrics illustrate a mixed picture: two-year and five-year yields are at an uninspiring 80%, and a meager rise in yield doesn’t translate to genuine recovery.

Furthermore, the dynamics observed in Treasury yields depict a grim scene. Rising rates are not merely numbers; they signify increased costs for municipalities and an impending strain on public finances. The yield damage from the prior weeks could have hurt investor sentiment, generating a lingering sense of apprehension. It’s difficult to overlook the fact that while the market may seem on the mend, it is merely a façade with broader economic uncertainties looming on the horizon.

The Inflation Dilemma

Among the most pressing concerns is inflation. This issue is not new, but as rates rise against the backdrop of tariff negotiations, the implications become alarmingly concrete. Inflationary pressures could result in a long-term downturn, an economic condition that many are beginning to anticipate as we head into the latter half of the year. The Federal Reserve Chair’s recent remarks underline the precariousness of the current economic scenario. Waiting and watching is not a sustainable strategy; it’s akin to watching a pressure cooker on high heat. And when the pressure builds too much, well, the results are never pretty.

Monetary policy hasn’t provided the anticipated safeguards, either. The Fed’s approach to price stability appears almost paradoxical when the pressures from potential tariffs could exacerbate inflation. High-street expenses keep surging, from groceries to housing; it makes investors cautious, and cautious investors translate to subdued market activity. The irony here is hard to miss: rapid market adjustments amid impending doom reflect not just market instability but a gaping disconnect between policy response and real-world economic needs.

Credit Spreads and Investor Sentiment

The widening of credit spreads is another concerning sign. Investors are unwilling to take risks, a sentiment that could hinder meaningful progress. The mere act of assessing potential economic damage seems to have instigated a more cautious investment atmosphere. Although some strategists still express optimism about the market rebounding later in May, their predictions lack the certainty that investors crave. Instead, the ongoing tightening of fiscal conditions is leading to a more profound unease.

What makes matters worse is that tax-exempt municipal bonds are being deemed less attractive compared to other investment vehicles, particularly as higher-rated bonds are seeing their yields inch higher, closing the gap between perceived risk and reward. While investment banks are keen to highlight potential value, the air of skepticism is palpable. Many seasoned investors are left wondering if their trust has been misplaced.

The Outflow Ripple Effect

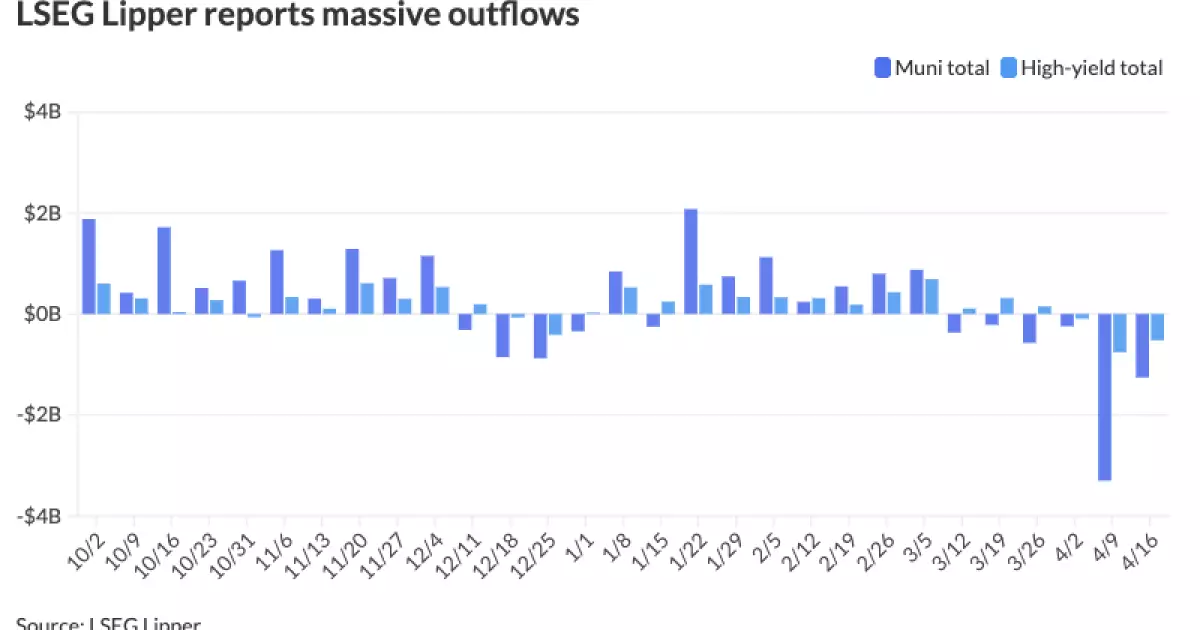

The statistics are sobering; a staggering $1.258 billion was pulled from municipal bond mutual funds recently. Six weeks of continuous outflows don’t just paint a picture; they reflect an exodus of trust from the entire sector. This behavior is not just symptomatic of panic; it represents a palpable wariness among high-yield and tax-exempt fund investors, most of whom feel that they would rather sideline their stakes than swim against the current economic tide.

What’s particularly troubling is that as total assets in municipal money market funds plummet, the allure of higher yields in other financial products becomes undeniable. With the average yields barely making headlines, many investors feel compelled to explore greener pastures, away from municipal bonds, leaving a vacuum that exacerbates the existing fragility within this market.

Panic Amidst the New-Issue Calendar

As municipalities prepare to issue bonds, the landscape looks murky. This includes significant deals like Connecticut’s $1.651 billion GOs and Massachusetts’ $1.07 billion GOs, initiatives that should ideally inspire confidence but instead raise red flags. The competitive calendar, while robust, is still fraught with challenges amid high visibility supply, taxing uncertainties, and the persistent volatility that seems to shackle the recovery.

Coming into the new-issue calendar without visibility into future market conditions only contributes to anxiety among investors. The pattern seems clear: cautious optimism is warranted, but the present tenor of the market feels more akin to deflection rather than resolution. Unless these mounting pressures are addressed comprehensively, it’s hard to envision a robust uptick anytime soon.

In essence, the current state of municipal bonds serves as a warning to all stakeholders. The potential for recovery exists, but buried beneath a heap of uncertainty, distress, and investor trepidation is a reality that is increasingly difficult to ignore. The complexities involved in navigating this landscape make clear that while recovery is possible, it will not happen without significant changes within macroeconomic policies and investor sentiment.