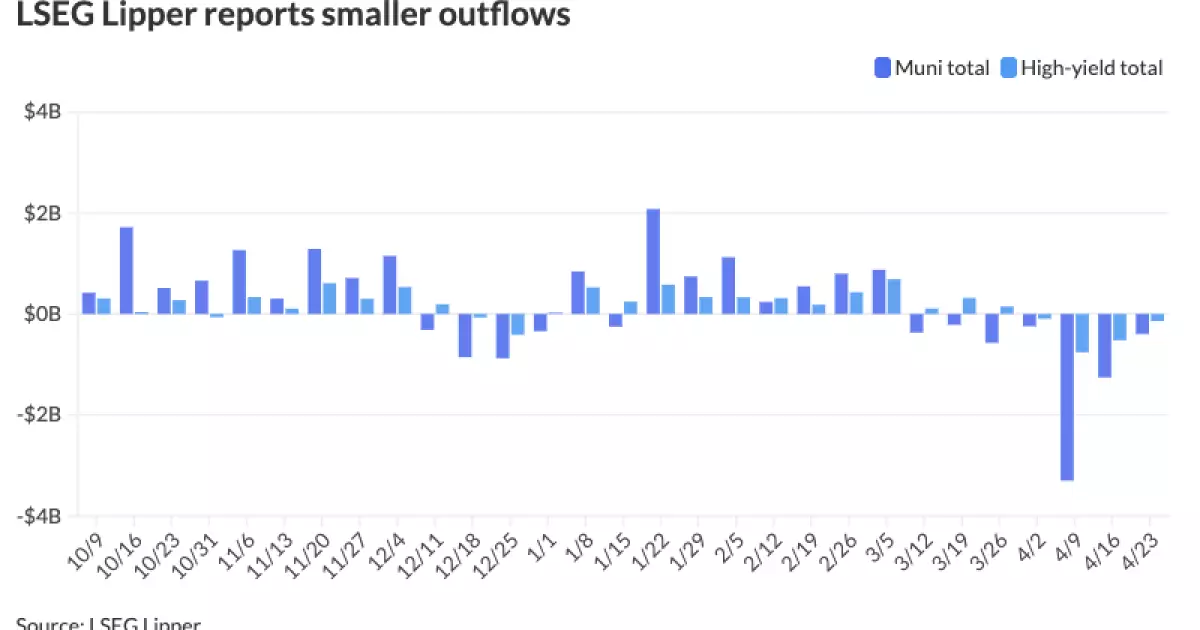

The municipal bond market has recently shown signs of robustness, even as outflows from municipal bond mutual funds have persisted. With recent shifts in U.S. Treasury yields and equities generating a more favorable climate, now might be the time for investors to reconsider their strategies. In stark contrast to the negative returns seen earlier this month, some indicators suggest that municipal bonds may soon rebound. The market dynamics that accompany this asset class, particularly in the context of its relationship with broader economic forces, warrant examination.

The Recent Fluctuations and Their Effects

Recent data indicates that municipal yields were adjusted higher by as much as seven basis points, while U.S. Treasury yields fell. This fluctuating environment has played a pivotal role in shaping investor sentiment. According to Municipal Market Data, the two-year bonds had a ratio of 79%, pointing to some level of stability, despite a backdrop of uncertainty. Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital, describes the municipal demand trend as one of love akin to a fickle relationship; the market is poised on a knife-edge, swinging between attraction and aversion based on the latest economic news.

This narrative underscores the volatility that has characterized the municipal market recently, especially against the backdrop of deleterious tariff discussions between the U.S. and China. However, with a temporary pause in reciprocal tariffs—excluding those imposed on China—it seems that risk markets may regain their footing. But it’s important to remember that while munis have firmed over the last few trading days, they are still suffering from negative returns and are down 1.67% month-to-date.

Understanding Supply and Demand Dynamics

The ongoing supply-and-demand dynamics exacerbate the challenges facing municipal bonds. Reports from BlackRock strategists highlighted a decreased demand driven by heightened economic uncertainty and tax-loss harvesting. In layman’s terms, as investors navigate through turbulent waters, the appetite for new issues appears to diminish. Such conditions can place additional pressures on prices, further complicating the investment landscape.

But let’s take a closer look at the potential for recovery. While several new issues were temporarily sidelined, the market may normalize as issuers attempt to capitalize on any shifts in tax law. This is where astute investors can take advantage of any emerging opportunities. The volatility, while daunting, may also present some favorable pricing options for new issues that are priced correctly.

The Role of State GO Credits

State general obligation (GO) bonds have been a focal point in this trapped market, with significant variations noted. The Massachusetts GO offerings, for example, managed to pare yields by five basis points, suggesting lingering investor confidence in this specific segment. Connecticut’s GO bonds reflected a similar sentiment, addressing larger cuts to yields that could entice investors looking for value in a rocky market.

Such state-level credits are more than just statistics; they signify the underlying economic health of the states issuing them, reflecting their financial commitments and obligations. When state governments demonstrate fiscal responsibility and manage their bonds astutely, they create a more inviting atmosphere for investors. It stands to reason that there is an inherent value in municipal investments, particularly for states capable of navigating the fiscal landscape effectively.

Market Sentiment and Future Projections

Market sentiment plays a critical role in determining the prospects of municipal bond investments. The fluctuations in bond prices are intricately tied to perceptions of risk—from credit ratings to broader economic indicators. BlackRock strategists have hinted at an impending normalization in the new-issue market, suggesting a potential rebound that savvy investors should monitor closely.

Investors need to look beyond the immediate outflows and negative trends. Strong fundamentals can often pave the way for recovery, and the enhancements in credit quality among certain states are compelling. This complexity requires keen judgment—assessing when to enter during downturns versus when to exercise caution.

The municipal bond market is at a pivotal junction. While we must remain sober regarding the ongoing challenges posed by outflows and investor sentiment, emerging factors suggest the potential for a rebound. The interplay of U.S. Treasury yields, state credit dynamics, and evolving market conditions could play a critical role in shaping investor strategies moving forward. For those inclined toward a more center-right liberal economic philosophy, the prospect of capitalizing on the value offered by municipalities may prove fruitful in the long run. Consider this a calling to not merely observe, but engage with a marketplace that is as nuanced as it is rewarding.