The investment landscape is witnessing a paradigm shift, as evidenced by BlackRock’s recent announcement to transition its $1.7 billion High Yield Municipal Bond Fund into an active exchange-traded fund (ETF). This strategic move not only reflects evolving investor preferences but also underscores the financial industry’s broader trend of migrating from traditional mutual funds to ETFs, as more investors seek out these newer investment vehicles.

Understanding the Transformation: From Mutual Funds to ETFs

The growing inclination towards ETFs has been attributed to several key characteristics that they offer. Most prominently, ETFs are typically associated with lower expense ratios compared to traditional mutual funds. Investors have become increasingly fee-conscious, gravitating towards products that not only promise returns but also enhance cost efficiency. According to industry veteran Roberto Roffo, ETFs have on average fees that are 50% lower than those of mutual funds, making them an attractive choice for savvy investors. This shift isn’t merely a preference; it signifies a substantial transformation in how investment strategies are defined and executed.

Moreover, the liquidity factor of ETFs is another significant draw for investors. Unlike mutual funds, which operate on a daily net asset value (NAV) basis, ETFs can be traded throughout the day like stocks. This feature allows investors to react swiftly to market changes, facilitating a level of agility that mutual funds fail to offer. Roffo’s insights highlight that the convenience afforded by the ETF trading mechanism has made them increasingly favorable, further cementing their position in investor portfolios globally.

BlackRock’s transition from a mutual fund structure to an ETF model indicates a robust recognition of these shifting dynamics in investor sentiment. The decision is indeed bold, especially considering that it comes with a notable sacrifice in fee income traditionally associated with mutual funds. Pat Luby from CreditSights emphasized that BlackRock’s move signals an anticipated growth within the ETF sector. Following this trajectory implies a strategic foresight, as the firm positions itself to harness future trends rather than merely responding to present conditions.

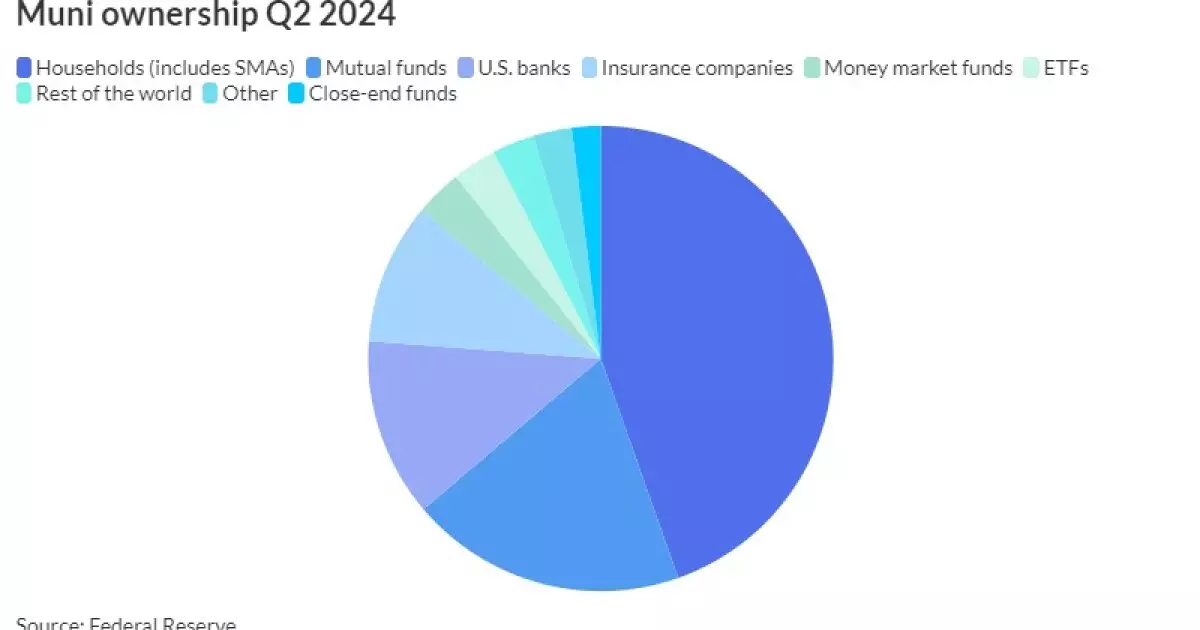

While the transition speaks volumes about the shifting demand, it also raises questions regarding the performance and sustainability of mutual funds within the current market context. Data from the Federal Reserve indicates an overall stagnation for mutual funds, which grew just modestly—a mere 0.5% from Q1 2024. The slight uptick was largely attributed to market value gains rather than significant inflows, suggesting a potential stagnation in investor enthusiasm for mutual funds relative to their ETF counterparts.

The increasing shift towards ETF conversions has sparked discussions about the sustainability of mutual funds. Since 2021, the industry has seen 118 completed mutual fund-to-ETF conversions, with BlackRock’s forthcoming action representing a pivotal milestone. However, it is noteworthy that the conversion trend slowed down despite the growing popularity of ETFs. Market analyst Dan Sotiroff noted that while conversions were once prevalent, only a handful of large-scale firms are considering the switch, emphasizing that “not every mutual fund can be converted to an ETF.”

This sentiment is echoed in the fact that while there is a clear pathway for fixed-income products to transition into the ETF space, equity strategies face more significant hurdles due to capacity constraints. Simple market dynamics suggest that while there may be an appetite for more ETF products, not all mutual fund structures can support a successful transition, reinforcing the reality that strategic conversions require careful consideration.

As the market grapples with these structural changes, questions arise about the long-term viability of mutual funds. Luby’s perspective indicates that asset managers must proactively explore ETF options to remain competitive, particularly if they aspire to be relevant in a rapidly evolving investment landscape. In the context of municipal bonds and other fixed-income assets, the question remains: how many ETFs can the market realistically accommodate without diluting their respective value propositions?

BlackRock’s transition to an ETF model is emblematic of a broader market trend towards more agile and cost-effective investment solutions. As investors continue to shift their preferences towards ETFs, it is crucial for asset managers to adapt strategically to these emerging demands. The future of investment vehicles will likely depend on a careful balance between tradition and innovation, where the evolution of products like ETFs will play a pivotal role in shaping investor portfolios. Thus, understanding these developments is essential for investors and asset managers alike, as they navigate the complexities of this dynamic financial landscape.