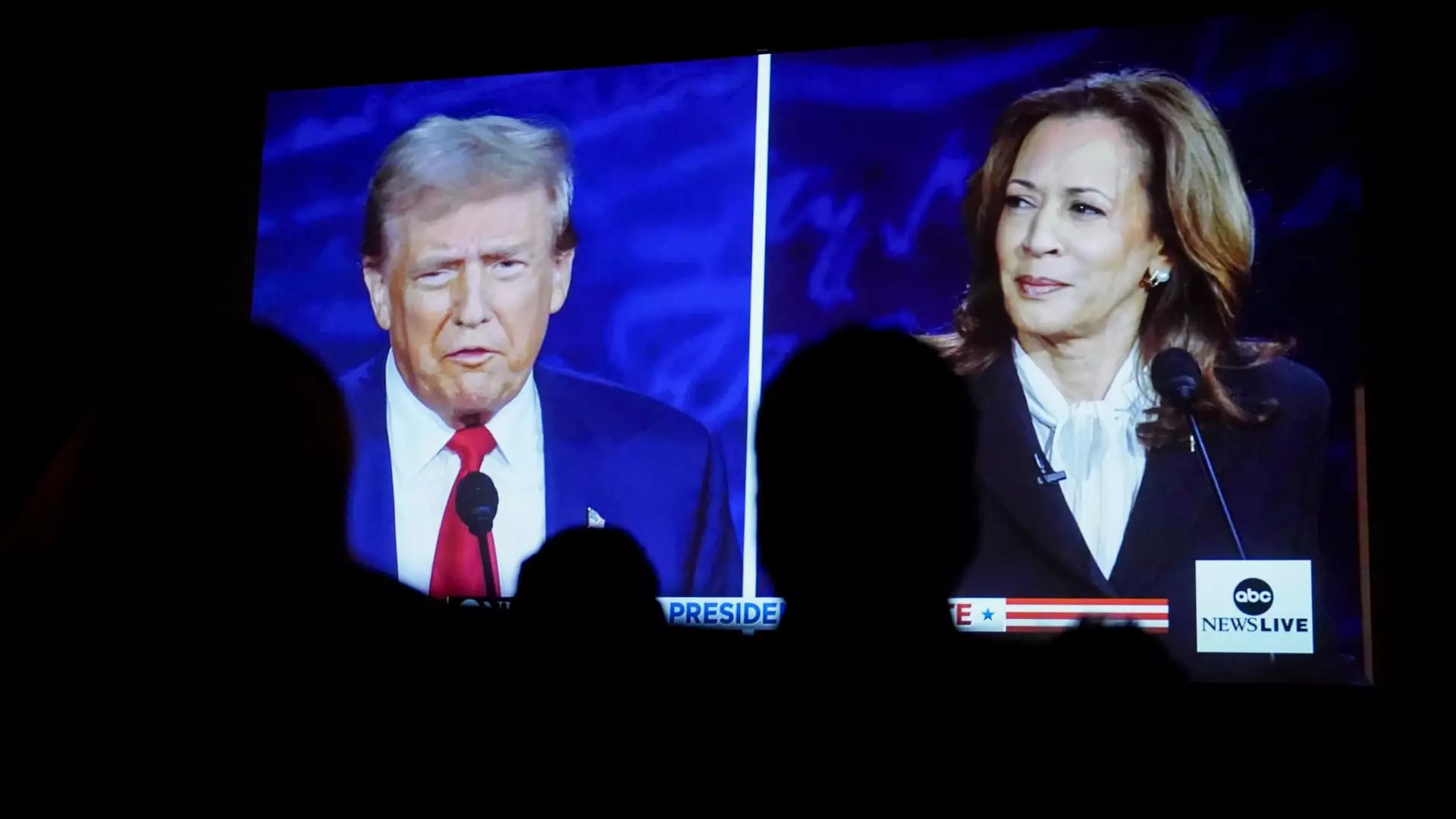

In the unpredictable world of finance, political outcomes can significantly influence market behavior. As we approach the 2024 electoral cycle, BMO Capital Markets released an insightful election guide detailing how various sectors might experience gains or losses depending on which party secures the presidency. Their analysis emphasizes crucial policy issues, namely tariffs, taxation, immigration, regulation, and socially responsible business practices. This isn’t merely a forecast of election results; it’s an analysis rooted in policy implications that can drive stock performance.

If Kamala Harris comes out victorious, certain stocks, particularly in the renewable energy sector, might flourish. Brookfield Renewable, for instance, is highlighted as a prime beneficiary. The demand for renewable energy is expected to gain traction with Democratic leadership. Despite an 8% rise that trails the overall market, analysts remain optimistic about Brookfield’s future, presenting a notable buy rating with a target suggesting potential growth exceeding 6%. This scenario reflects broader trends favoring sustainability, which could lead to significant institutional support.

Moreover, companies like Dollar Tree also stand to gain a rebound in a Democrat-led administration. The discount retailer has suffered a drastic share price decline of over 50% this year, positioning itself for what analysts believe could be a relief rally post-election. With an optimistic projection suggesting a spike of more than 25% according to LSEG’s average price target, the recovery narrative is compelling, even as the overarching sentiment remains a cautious hold among analysts.

Conversely, the financial landscape appears favorable for select sectors should Donald Trump secure a second term. The Dow Jones Industrial Average, a traditional indicator of economic strength, could receive a boost alongside U.S. commodity producers. Currently trailing with a 5% decline in 2024, the Dow’s potential recovery is intriguing. Analysts’ targets indicate a possible increase exceeding 10%, although a prevailing hold consensus represents a degree of skepticism about its short-term trajectory.

Adtalem Global, a player in the for-profit education sector, stands poised for significant advantages should regulations be relaxed under a Republican administration. Having already gained over 22% this year, all analysts covering the stock seem bullish, predicting an additional growth of over 20% in the coming year. This scenario showcases the larger context of educational reforms aligning with the political climate.

Broader Market Considerations

As investors navigate this politically charged landscape, understanding distinct sectoral shifts becomes vital. The analysis by BMO offers an essential perspective on how various policies could reshape stock performance in the wake of electoral outcomes. While navigating the uncertainties of the future, decision-makers would do well to monitor these sector-specific indicators, aligning investment strategies with the anticipated political scenarios and their resultant economic impact.

The connection between the 2024 election prospects and stock market movements underscores the importance of diligence in investment choices. The interplay of politics and finance will invariably shape the market, making it imperative for investors to stay informed and adaptable.