In a period marked by cautious trading, Asian currencies faced slight declines this Tuesday, continuing a trend of weakening as market participants advanced a risk-averse stance. This behavioral change appears to be influenced by looming economic data releases that are set to shape traders’ perceptions. While the general trend for regional currencies was downward, the Japanese yen managed a minor recovery from its recent slump, which brought it perilously close to three-month lows. This pause, however, comes amidst considerable political turmoil, particularly as Japan grapples with implications from a recent general election that has intensified uncertainties.

Despite the broader trend of currency depreciation, the Japanese yen bucked the odds slightly, gaining strength as it recuperated from earlier losses. This resurgence followed a rough patch triggered by a general election that saw the ruling Liberal Democratic Party (LDP) lose its grasp on legislative control, further insinuating political instability. Finance Minister Katsunobu Kato’s remarks regarding the government’s vigilance over currency fluctuations signal an ongoing commitment to stability amidst the chaos. However, the overall market sentiment appears tormented by uncertainty regarding future interest rate adjustments by the Bank of Japan (BOJ), which are expected to remain unchanged in the short term. This situation casts a shadow over the currency, contributing to its earlier dive.

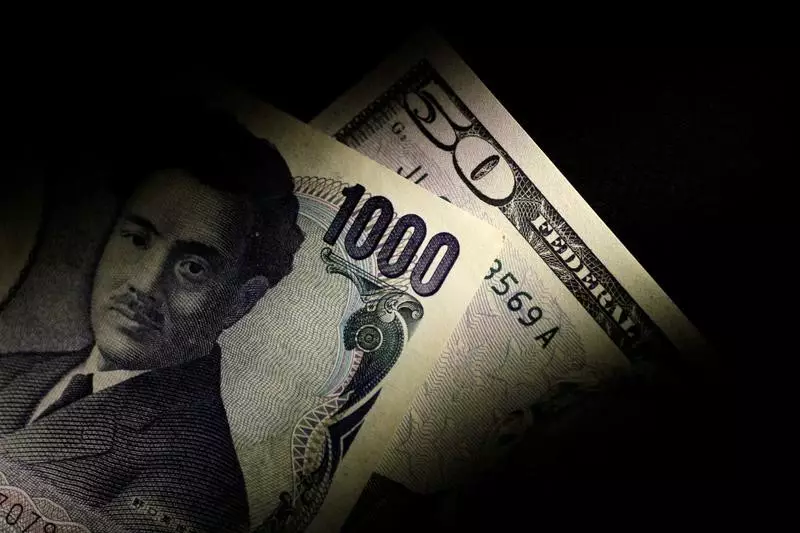

The dollar’s robust performance further complicates matters for the yen. With the U.S. dollar continuing to demonstrate strength, traders remain doubtful about the future trajectory of the yen. The prevailing dollar index has been propped up by favorable economic indicators, indicating a potential for the Federal Reserve to approach monetary policy changes with caution.

The upcoming schedule of robust economic data from the United States looms large over the currency markets, making traders particularly sensitive to any fluctuations. The third-quarter Gross Domestic Product (GDP) figures, consumer spending metrics, and most critically, inflation rates due later this week will provide essential insights into the health of the U.S. economy and the subsequent path of interest rates. Economic projections point towards a slower pace of interest rate cuts, serving to solidify the allure of the dollar.

As these indicators approach, confident bets are already forming around potential political outcomes in the upcoming presidential election, with Donald Trump’s policies anticipated to incline towards protectionism. This expectation is likely to provide an additional lift to the greenback while simultaneously placing further pressure on Asian currencies grappling with their constraints and vulnerabilities.

Among the various currencies in the region, the Australian dollar has also faced pressure, dropping 0.2% as the market anticipates quarterly consumer inflation data that could reveal significant trends in spending habits. Meanwhile, the Chinese yuan experienced a minimal shift, edging up by 0.2%. This movement seems speculative, banking on upcoming purchasing managers’ index (PMI) figures that could shed light on the effectiveness of the stimulus measures deployed by the Chinese government recently.

Interestingly, the South Korean won indicated some resilience, climbing 0.4%, while the Singapore dollar registered a slight increase of 0.2%. The Indian rupee, however, remained stagnant, hovering near record lows. This mixed bag of reactions underscores the varied economic contexts and localized factors at play for each currency across the Asia-Pacific region.

The current landscape for Asian currencies is intricately tied to multiple factors encompassing global economic indicators, domestic political developments, and international trade dynamics. As traders navigate these turbulent waters, the emphasis remains firmly on awaiting crucial data releases, which could serve as pivotal junctures for both the Asian and global currency landscapes. With heightened vigilance and an awareness of the implications of geopolitical strife, the trajectory of regional currencies in the coming days is likely to reflect complex interdependencies at play within the global market framework.