The municipal bond market experienced a tumultuous October, marked by variable trends in issuance, yields, and fund flows. While the month concluded with slight stability in munis, the overall landscape was shaped by a series of corrections and market dynamics that may have implications for investors and market participants in the upcoming months.

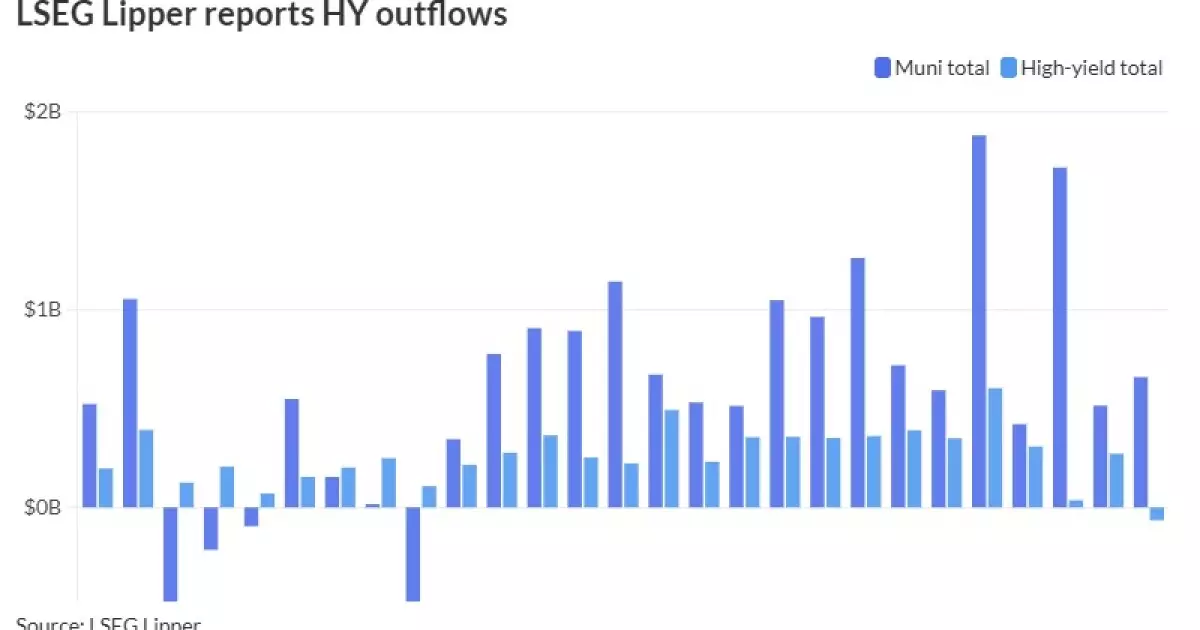

As October came to a close, the municipal bond segment displayed little significant movement. While there were few oversized deals, overall, municipal mutual funds still saw gains in inflows, albeit with high-yield funds experiencing their first outflows since mid-April. This divergence raises important questions about the health of municipal debt instruments and the attractiveness of high-yield offerings. As John Doe, a senior portfolio advisor, stated, “The current environment presents both challenges and opportunities. The outflows suggest a cautious sentiment among high-yield investors, potentially prompting them to reallocate towards more stable investments.”

The mixed performance in U.S. Treasuries and losses in equities further highlights the complexity of October’s trading environment. The Bloomberg Municipal Index registered a decline of -1.51%, which is noteworthy as it marks the most significant loss since October 2009. In contrast, U.S. Treasuries closed the month down by 2.42%, coupled with corporate debt showing a close to similar performance. These trends indicate a shift in investor sentiment and can potentially foreshadow further adjustments in risk appetite moving forward.

Despite the losses, October presented a landscape of appealing raw yields, enticing buyers back to the market. Kim Olsan from NewSquare Capital emphasized that the correction aligned with an upward trend in the yield curve, ultimately benefiting buyers looking for value. Investors were encouraged to seize opportunities, with the municipal-to-Treasury ratios reflecting these dynamics. As observed, the two-year trading at 65% of USTs and extending to 87% for the 30-year bonds signifies a critical juncture for municipal investment commitments.

The trend toward improved taxable equivalent yields in October cannot be overlooked. With the short end of the yield curve shifting into a more favorable range, a one-year maturity in a single-A rated revenue bond reportedly trading around 3.20% drew attention, particularly when compared to historical performance. Such yields, nearing 5% for certain segments, signify a potential turning point where a broader investor base might consider municipal bonds as a viable option once again.

Activity in the primary market showcased the continuing relevance of municipal bonds, with notable deals priced as October wrapped up. BofA Securities’ pricing of nearly $189 million in sustainability lease revenue bonds for Washington State DSHS was a highlight. Here, yields across different maturities reflected a growing interest among investors as market conditions shifted.

However, as supply dynamics reveal, a dramatic drop in issuance is on the horizon. October saw a peak of over $56 billion in new supply, a significant volume. Yet, moving into November, upcoming supply is projected at approximately $3.77 billion as market participants shift their focus towards broader economic indicators leading up to the elections. Such a drastic shift could restructure demand in the short term, highlighting the necessity for investors to remain adaptable.

Investor sentiment towards municipal bond funds remained predominantly positive, with a reported $659 million in inflows in the last week of October. This streak of inflows indicates a consistent interest in municipal securities, yet the outflows from high-yield funds could signal a cautionary shift. The municipal exchange-traded funds played a critical role, suggesting that demand for liquid market options continues to thrive, even amidst fluctuations in performance.

Money market funds also reported substantial inflows, highlighting a preference among investors for more secure, low-risk avenues. The observed decline in the average yield for tax-free and municipal money markets reflects a broader trend towards safety, pushing investors to reassess their portfolios in light of shifting yield curves across the broader fixed-income landscape.

October’s performance in the municipal bond market illustrates the intricate interplay of corrections, yields, and investor behavior. While current trends may pose challenges, the potential for higher yields and attractive municipal offerings remains a focal point for investors. With the arrival of November, a recalibration in strategies will be crucial as the market absorbs economic indicators and election outcomes. Understanding these dynamics will empower investors to navigate the shifting waters of the municipal bond market effectively.