The municipal bond market has showcased a nuanced dynamic in the wake of recent election-induced fluctuations in the financial landscape. While municipal bonds exhibited resilience, there were notable divergences from their U.S. Treasury counterparts. This article delves into the recent developments within the municipal bond market, the implications of relative performance against USTs (U.S. Treasuries), and what the future may hold for investors.

On a recent trading day, the municipal bond market displayed a mixed performance. This was characterized by modest adjustments in the yields of triple-A rated bonds, which saw fluctuations varying from a slight uptick of one basis point to declines of two basis points across different maturity curves. In contrast, U.S. Treasuries faced a decline, particularly with the 10-year yield experiencing losses as significant as 12 basis points. The divergence between municipal bonds and Treasuries indicates a period where investors may find more stability in municipal securities, despite broader economic uncertainties.

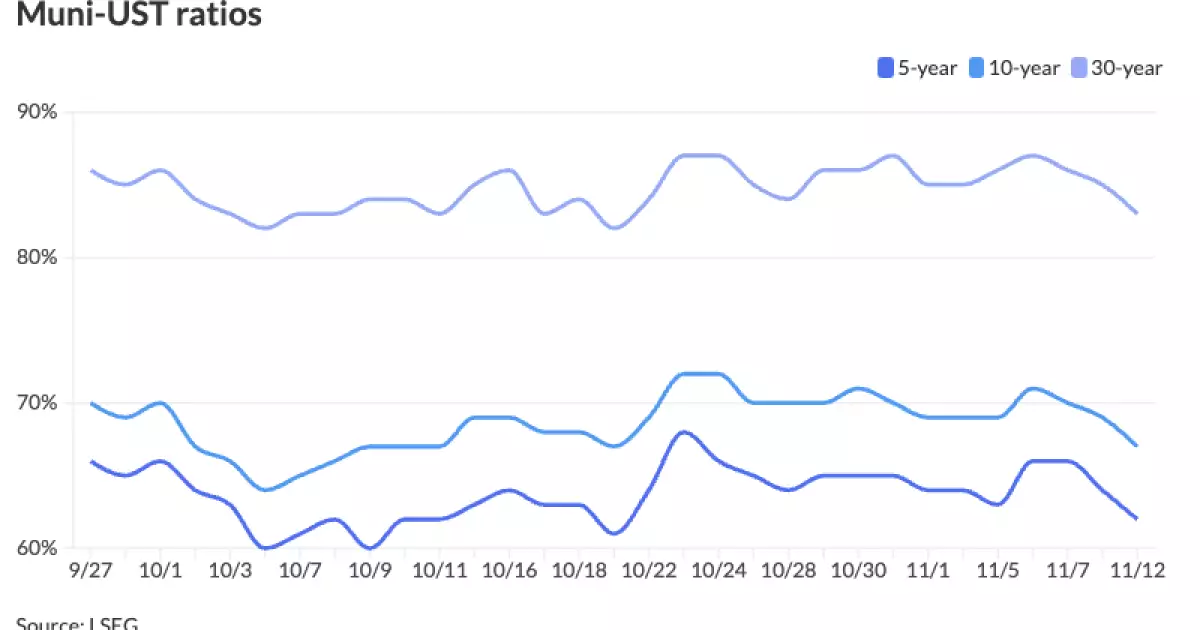

The relative value of the municipal bond market has shifted downward, with the ratio of municipal bonds to UST yields reflecting an inclination for safety among investors. The two-year municipal to UST ratio was logged at 61%, revealing a trend that underscores the growing preference for municipal bonds as reliable instruments, especially in the context of the current economic backdrop.

Performance Comparisons: Municipal Bonds vs. USTs

Recent data highlights a clear outperformance of municipal bonds compared to U.S. Treasuries on both a monthly and yearly basis. As of mid-November, the Bloomberg Municipal Index was positioned positively at 0.52% for the month and 1.33% year-to-date, while USTs remained flat for November, indicating a lack of momentum. Furthermore, the Bloomberg High-Yield Index demonstrated healthy returns, which were significantly superior when compared to their UST equivalents.

This marked performance not only illustrates the strength of municipal bonds but also hints at potential growth in demand as investors recalibrate their portfolios in response to recent economic shifts and the Federal Reserve’s policy adjustments. The Federal Reserve’s decision to reduce the interest rate by 25 basis points has introduced a sensible environment for reevaluating fixed-income investments, particularly in the municipal sector.

Investor sentiment also reflects a continuing influx of capital into municipal mutual funds, evidenced by a substantial inflow of $1.263 billion over the past week. This ongoing trend of positive net inflows into municipal funds, which has persisted for 19 consecutive weeks, indicates a resilient interest among buyers. However, experts like Pat Luby warn that as the year approaches its end, a cautionary note emerges regarding the potential slowing of new-money flows.

The strategic positioning of investors is evident, as many seem to hedge against potential taxable capital gains distributions that can arise when purchasing mutual funds late in the fiscal cycle. Nevertheless, this temporary slowdown could merely be a tactical retreat, rather than a sign of dwindling investor confidence in municipal bonds.

Looking ahead, the municipal bond market anticipates the entry of significant new issues, despite seasonal constraints that might limit supply toward the year-end. Major bond deals are slated to hit the market soon, including substantial offerings such as a $1 billion issuance by the Black Belt Energy Gas District and an opportunity in California with over $455 million in senior living revenue bonds.

This upcoming issuance is noteworthy as it not only addresses crucial funding gaps in infrastructure and community services but also highlights the market’s ability to present attractive investment opportunities against a backdrop of financial uncertainty. The variety of upcoming deals showcases the diversity within the municipal bond market, further entrenching the sector’s importance for both investors and issuers.

The municipal bond market is navigating a complex landscape marked by mixed yield performance and ongoing investor interest driven by relative stability compared to U.S. Treasuries. As year-end approaches, while a slowdown in new-money flows may be anticipated, the fundamental appeal of municipal securities remains strong, supported by substantial upcoming supply and the benefits of investing in a robust market.

For potential investors seeking both safety and yield in a fluctuating economic environment, municipal bonds could represent a prudent choice. As the landscape evolves, staying informed and adaptable will be key to capitalizing on emerging opportunities within this sector.