The financial landscape has been experiencing a distinctive shift as investors simultaneously grapple with uncertainty from looming elections and changes to Federal Reserve interest rates. The implications of these variables have led to a surge in money market funds, both taxable and tax-exempt, reaching unprecedented levels not seen since the start of 2024. This shift indicates a strategic pivot among market participants toward defensive positions, revealing insights into how economic fluctuations influence investment behaviors.

Recent data underscores a remarkable growth in money market funds, with tax-exempt funds seeing an inflow of $3.2 billion in just one week, achieving a staggering total of $136.84 billion by the week ending on a Wednesday in 2024, as reported by the Investment Company Institute. Such figures signify a notable rebound from earlier lows, painting a picture of investor caution amid a fluctuating economic climate. According to Kim Olsan from NewSquare Capital, the advent of higher short-term interest rates has attracted capital to these funds, as investors seek immediate returns during a period characterized by uncertainty.

The pandemic induced singular market shocks that spurred a significant influx of capital into money market funds, initially valued collectively around $2 trillion to $3 trillion before skyrocketing in the wake of COVID-19. Eric Golden, CEO of Canopy Capital Group, echoes this sentiment, recognizing that the Federal Reserve’s rate hikes further heightened the attractiveness of these funds, contributing to the current total of approximately $6.585 billion in assets across these investment vehicles.

The Impact of Interest Rate Changes

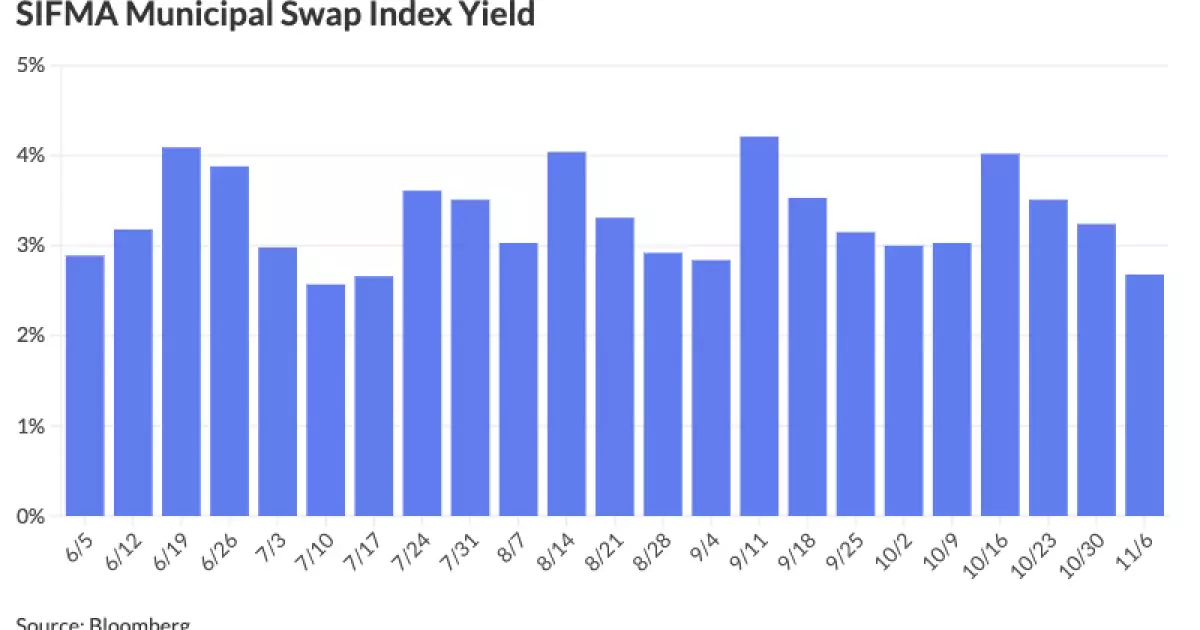

The financial dynamics outlined reveal that the yield differential between short-term rates and long-term government securities has created an unusual and inverted curve. Olsan highlights that the current inversion reflects approximately 50 basis points between money market funds and 10-year yields. As money market balances rise, the operational strategies of these funds shift accordingly; they are diversifying their investments beyond traditional variable-rate demand notes to include commercial paper and municipal notes.

Moreover, Rick White, an independent financial consultant, emphasizes that the recent inflow of cash into these funds has been erratic. With substantial market flux, the initial capital influx can rapidly diminish as daily rates fluctuate, reflecting a volatile but opportunistic investment environment. The need for consumers to balance risk and return has never been more pronounced, indicating potential challenges ahead.

Looking ahead, the compass of investment flows will predominantly hinge on the Federal Reserve’s actions regarding interest rates. Market participants experienced a surprising outflow from money market funds when the Fed first indicated it would cut rates, as the market was initially buoyed by favorable economic indicators and declining inflation. Golden points out that as momentum shifts towards lower interest rates, the allocation of this liquid capital will be critical.

Interestingly, the anticipation exists that a portion of the funds flowing out of money market vehicles may transition into the bond market. This trend is particularly pronounced among higher tax bracket investors, as tax-exempt municipal products could present a favorable option. However, the disparity in sizes between tax-exempt and taxable funds raises questions about the sufficiency of incentives that might prompt such transitions.

Olsan provides a sobering perspective on the prevailing market conditions, asserting that a downturn in yields for U.S. Treasury securities would be a significant catalyst for capital extraction from money market funds. Nonetheless, current projections do not support a decline in yields to indicate a rapid transition. White reiterates the complexity of subsequent flows and stresses that the dynamics of shifting capital will remain contingent on external economic factors.

In summation, as volatility continues to permeate the market environment, investors must navigate an intricate web of decisions regarding capital allocation. While money market funds are thriving amidst this uncertainty, the potential for heightened shifts in asset distribution remains palpable, underscoring the need for continuous monitoring of economic indicators and Fed policies. Ultimately, understanding these evolving dynamics will be crucial for informed decision-making in the financial arena, as participants seek stability amid unpredictability.