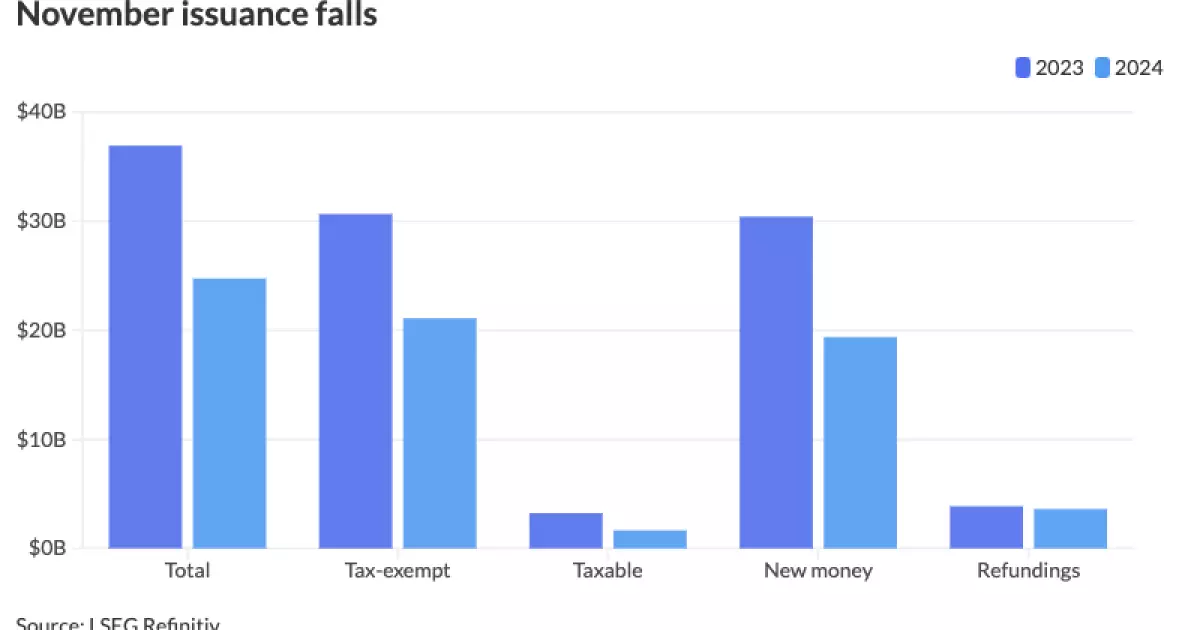

The municipal bond market experienced a significant downturn in issuance during November 2024, registering a year-over-year decline for the first time this year. The total volume stood at $24.743 billion across 607 issues, which represents a staggering 33% drop from the $36.918 billion recorded in November 2023. This dramatic reduction has raised questions regarding market dynamics, particularly how external factors such as election-related uncertainties and limited pricing days contribute to this trend. Despite this monthly decline, the overall bond issuance for the year has been promising, projecting a historic record-breaking total by the close of 2024.

Year-to-date figures reveal that total bond issuance has climbed to approximately $474.755 billion, marking a robust 32.8% increase from the previous year. With just December remaining in the fiscal year, historical averages suggest that the month could surpass the typical issuance volume of around $32.452 billion. Analysts anticipate that with a favorable December, overall issuance in 2024 may eclipse the previous record of $484.601 billion set in 2020, potentially reaching or even exceeding the $500 billion milestone.

However, November’s slump was attributed to the timing of critical events, notably the elections and the Federal Open Market Committee meeting, which limited opportunities for issuers to enter the market. According to Tom Kozlik from HilltopSecurities, the tight window during November, compounded by the Thanksgiving holiday, severely restricted the amount of time available for issuing bonds, which directly impacted overall volume.

Election-related market volatility played a pivotal role in suppressing issuance levels. Market conditions in the weeks leading up to the elections created a rush of activity, with significant supply being pulled forward in expectation of tumultuous market reactions. In the aftermath, however, the declines observed in municipal bond yields were followed by a quick stabilization. This juxtaposition highlights a critical observation — while election periods introduce volatility, they can also lead to a hesitative market climate that discourages issuers from advancing their plans.

The duality of volatility perception, as defined by Kozlik, evolved from pre-election concerns to post-election uncertainty around policy outcomes. This shift indicates a strategic hesitation within the market as stakeholders recalibrate expectations in response to the new political landscape.

Looking ahead, the fragility of the tax-exemption status is casting a shadow over future issuances. Discussions among market analysts suggest that we may witness a significant influx of issuances in 2025, driven by anticipatory behavior as issuers aim to capitalize on tax-exempt opportunities before any potential legislative changes take effect in 2026. While some experts conservatively predict a baseline of $500 billion in issuance, others, such as Kozlik, forecast a much larger figure of approximately $745 billion, driven chiefly by anticipations of tax reform that could dramatically impact the attractiveness of issuing tax-exempt bonds.

Conversely, the outlook is not uniformly optimistic. Contrary perspectives, such as those presented by Matt Fabian from Municipal Market Analytics, warn that early imposition of any tax restrictions could tighten the market sharply, pulling issuance figures down dramatically to between $250 billion and $300 billion—a stark contrast to the prevailing consensus.

Delving deeper into state-specific performance, California led the charge with a remarkable $68.902 billion in issuance, showcasing a 31.1% increase compared to the previous year. Following closely were Texas and New York, achieving significant gains of 16.3% and 37.8% respectively. These figures underscore a regional disparity in market activity, revealing that certain states are better positioned to leverage opportunities within the current landscape.

In states like Florida, which saw an impressive 103.8% increase, the factors driving issuance varied—reflecting local economic conditions, project demands, and strategic planning by issuers.

The decline in municipal bond issuance observed in November serves as a critical marker of the complexities currently shaping the bond market. Factors ranging from volatile pre-election sentiments to the looming shadow of potential tax policy changes will likely continue to influence market behavior as 2024 draws to a close. As issuers and market participants navigate through these uncertainties, the trajectory for December and beyond will depend heavily on both strategic foresight and prevailing economic conditions. The next few months will be pivotal, potentially setting the stage for a new era in municipal finance, defined by adaptability in response to policy and market evolution.