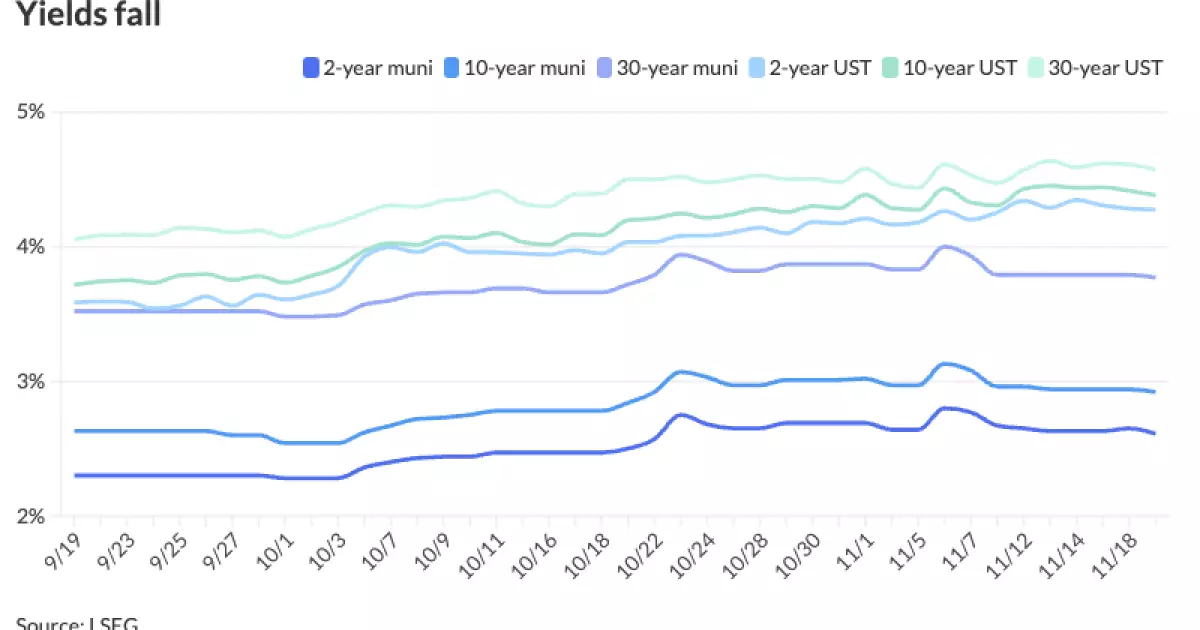

The municipal bond market experienced notable improvements recently, driven predominantly by a decline in U.S. Treasury yields and a mixed performance in equities. As economists and investors analyze these movements, it becomes important to unpack the implications and future trends within this market.

On a recent Tuesday, triple-A municipal bond yields shifted within a range of one to six basis points along the yield curve. This change occurs amidst a backdrop of decreasing Treasury yields, indicating a strengthened demand for municipal securities. Chris Brigati, a seasoned fixed-income strategist from SWBC, highlights that even though the supply of new issues appears lighter than in the pre-election period, it still constitutes a reasonably strong supply week. The demand for bonds, particularly in high-yield projects like the $1 billion United Airlines Terminal initiative in Houston, illustrates that investors are actively seeking opportunities in the municipal market.

Brigati’s assertion about strong absorption of new issues due to pent-up demand reflects a market keen to seize available offerings. Coupled with tight ratios, potential options for acquiring bonds are becoming increasingly limited, making this environment particularly competitive.

The performance of municipal bonds can be further evaluated through yield ratios compared to U.S. Treasuries. Recent data shows that ratios in shorter maturities have decreased into uniformly high levels, which signals a trend where investors are paying a premium for these municipal bonds over their treasury counterparts. For instance, the two-year municipal to UST ratio stands at 61%, while the 30-year ratio is at 82%, according to Refinitiv Municipal Market Data.

These ratios are crucial indicators for investors. They point towards a market that is getting richer but can lead some investors to question whether these yields remain appealing enough amid the rising costs of inflation and potential credit risks. Nevertheless, Matt Fabian, another expert in municipal market analytics, remarks that despite these rich ratios, yields are compelling enough to stimulate strong buying interest from retail investors. This enthusiasm is reflected in the recent significant trade counts, with retail demand primarily being funneled through separately managed accounts.

Challenges and Opportunities Ahead

As we analyze the trajectory of mutual funds and exchange-traded funds, it’s important to note that recent reports indicated modest inflows into these entities. However, money market funds faced a contraction of cash as funds seemed to find temporary shelter rather than a long-term home. The sustainability of this positive momentum through the year’s end remains uncertain. Yet, Fabian notes that excluding ETFs, mutual funds could witness up to $30 billion in inflows this year, a figure that stands out in the historical context of the last 15 years.

This year could be pivotal, especially considering the external factors that may influence supply and demand dynamics. If the total supply aimed for the remainder of the year approaches the anticipated $500 billion, it could potentially unlock new market movements. Last year’s end witnessed $45 billion in supply due to urgent financial needs, leading analysts to remain skeptical about whether this year’s figures will replicate such volumes amidst a changing economic landscape.

Impact of Potential Tax Reforms

As conversations around potential tax reforms continue to unfold, they pose both risks and opportunities for the muni market. The fear of tax-exemptions being threatened could lead to an increase in new issuances, thereby changing the market dynamics substantially. The market may not only face challenges in maintaining yields amid rising supply but could also see shifting investor strategies in response to possible tax regulation changes.

In sum, the recent trends in the municipal bond market indicate a complex interplay of factors affecting investor behavior and market performance. As the landscape continues evolving, fueled by treasury yield fluctuations and potential tax reforms, participants in this market will need to remain vigilant and adaptive.

Investors should weigh the appeal of municipal bonds against their own strategic goals, while analysts will keep a close eye on supply figures and yield fluctuations to gauge how the last quarter of the year may deliver either rewarding prospects or cautionary signals about the future of municipal financing in the U.S.