The municipal bond market has demonstrated resilience in the face of fluctuating U.S. Treasury yields and a mixed performance in equities. Recent trends reveal nuanced investment behaviors and market stability, particularly in the context of tax-exempt municipal bonds. This article explores the current dynamics of the municipal bond market, analyzing key drivers behind investor sentiment and emerging opportunities within the sector.

Historically, municipal bonds have served as a reliable asset class during periods of economic turbulence. Jeff Timlin, a partner at Sage Advisory, emphasizes the comparative stability of munis relative to U.S. Treasuries (USTs), particularly in the wake of recent market challenges. While equities experience sharp fluctuations, the municipal bonds have sustained less volatility, attracting conservative investors looking for shelter in stable growth.

Timlin’s assertion underscores a broader trend in the market that favors stability. This has incited increased interest among investors, particularly those who seek steady income streams rather than chasing high-risk tactical moves. As activity in equity markets continues to exhibit unpredictability, the municipal bond market remains an appealing destination.

Recent data indicates a steady flow of investments into municipal mutual funds, with a notable 20 consecutive weeks of inflows. According to Pat Luby from CreditSights, the primary market has witnessed robust buying activity from investors, partly informed by tax considerations and attractive yield spreads compared to USTs. However, as new data reveals a drop in fund flow—$305 million compared to a staggering $1.264 billion the previous week—investors appear to be deliberating their next moves more cautiously.

This adjustment in inflows signifies an evolving investor sentiment. While the previous weeks suggested exuberance in the market, the latest behaviors reflect a more nuanced approach from buyers who are weighing opportunities against broader economic indicators.

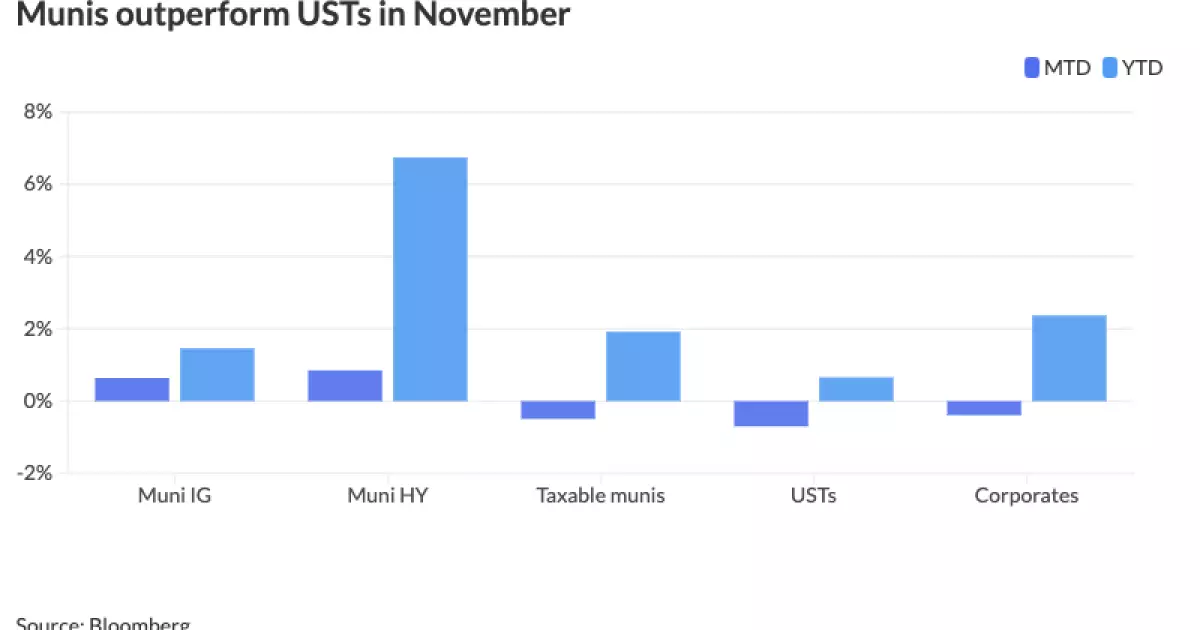

Significantly, the performance of municipal bonds has outstripped that of USTs and corporate bonds, effectively pushing down municipal to UST yield ratios. Recent statistics from Refinitiv Municipal Market Data indicate that the two-year municipal-UST ratio stands at 62%, while the 30-year ratio is at 82%. Such favorable ratios signal a compelling argument for investors considering tax-exempt options, especially in light of interest rate fluctuations driving UST yields higher.

While principal yields remain relatively stable over the past week, the underlying dynamics reflect ongoing competition within fixed-income sectors, particularly for longer maturities. This accelerating demand for municipal bonds may well serve investors looking to hedge against potential interest rate hikes in the near future.

Current market conditions indicate a robust issuance pipeline, with an estimated $8.4 billion set to be raised, featuring diverse projects from transportation infrastructure to educational facilities. Notable deals this week include a $1 billion issuance for United Airlines Terminal Improvement Projects and a $317 million offering from Ector County, Texas.

Market participants anticipate a surge in activity as issuers aim to capitalize on favorable conditions before the upcoming holiday season. As stated by Daryl Clements, a municipal portfolio manager at AllianceBernstein, the current supply of bonds is expected to be well received. This demand could also correlate with the desire for investors to secure their portfolios ahead of potential market variances.

Looking ahead, the municipal bond market is well-placed to absorb further supply while maintaining its attractiveness relative to other fixed-income options. With several large deals awaiting pricing, including major issuances from Connecticut and the Greater Orlando Aviation Authority, investor attention will remain keen as they evaluate credit quality and yield prospects.

The current market offers a stable avenue for investors prioritizing income generation and capital preservation amidst economic uncertainty. As fund flows stabilize and issuance ramps up, the landscape for municipal bonds seems poised for continued attractiveness in the coming weeks, thereby reaffirming their status as a cornerstone investment within a diversified portfolio.

The persistent preference for municipal bonds during turbulent times exemplifies their enduring appeal, underscoring a broader investment philosophy that favors stability, income, and fiscal responsibility. The insights drawn from recent market trends not only reflect current conditions but also serve as a roadmap for navigating potential shifts in the future.