As the year comes to a close, the municipal bond market stands at a critical juncture, showing signs of resilience and investor enthusiasm. With the backdrop of a changing economic landscape, this article aims to delve into the recent developments in municipal bonds, including trading patterns, mutual fund inflows, and primary market activities.

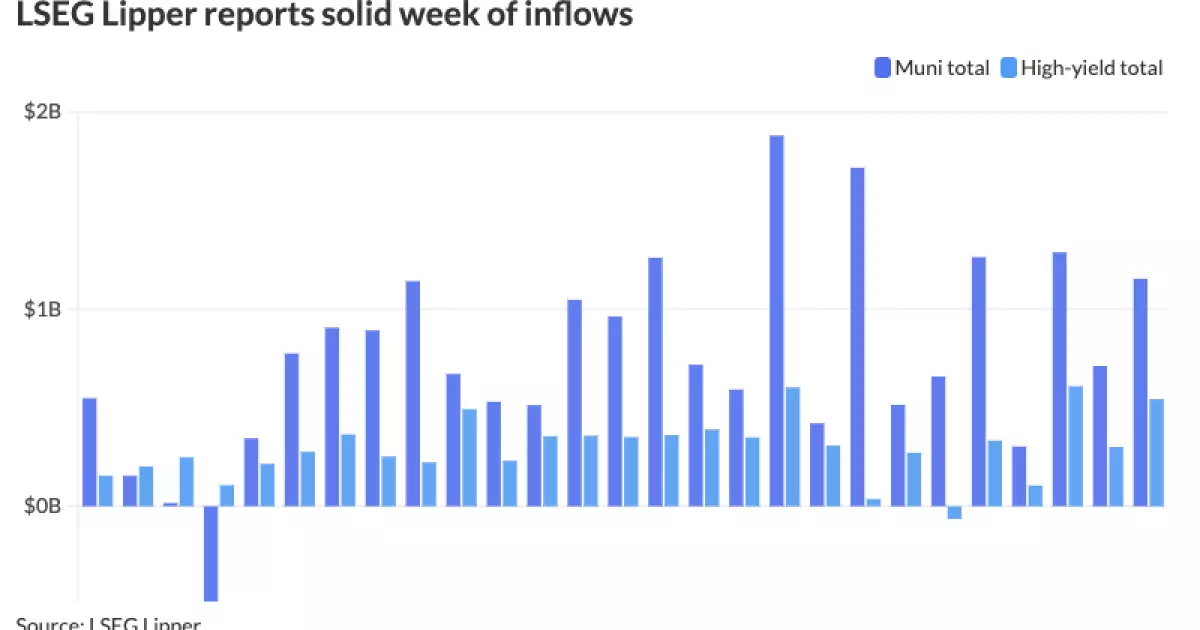

In recent secondary trading sessions, municipal bonds have shown minimal fluctuations, maintaining their value as the spotlight shifts toward the demands of the primary market. Significantly, recent data indicates that municipal bond mutual funds have recorded substantial inflows, surpassing the $1 billion mark for a single week. Specifically, Lipper disclosed an impressive $1.154 billion in fund inflows for the week concluding on December 4—an increase from the adjusted $711.5 million from the prior week. This trend exhibits a robust appetite among investors for municipal securities, suggesting that market sentiments remain favorable despite the fluctuations in other asset classes, such as U.S. Treasuries and equities.

Chris Brigati, a senior vice president at SWBC, highlights this persistent interest in municipal bonds. “The consistent inflows we observe suggest that investors are not yet fatigued by the market opportunity, indicating a sustained inclination towards purchasing these assets,” Brigati explained. The ratios comparing municipal bonds to U.S. Treasuries reveal a healthy yield environment, with the two-year municipal to UST ratio hovering around 61% and extending to 82% for the 30-year securities. Such metrics support the argument for the attractiveness of the municipal bond market over Treasuries, especially in a climate characterized by low-interest rates.

The demand for bonds in the primary market remained robust on Thursday, with significant transactions occurring. A notable trend in the primary market is the seasonal recalibration of issues, although concerns linger regarding potential legislative changes that may impact tax exemptions for municipal bonds. Matt Fabian from Municipal Market Analytics pointed out that recent months have seen decreased supply, but the larger calendar anticipated for December could represent a systematic return to historical issuance patterns.

The potential legislative changes, particularly threats to tax-exempt status, could cause issuers to hasten bond offerings, especially as the tax exemption serves as a significant incentive for municipalities to borrow. Historically, December issuance averages around $31 billion, fluctuating between $21 billion and $56 billion in previous years. Given the current landscape, the prospect of reaching an issuance volume of $500 billion this year appears increasingly plausible. Analysts emphasize that municipalities must act cautiously, considering both opportunities and risks.

Matthew Norton from AllianceBernstein and Daryl Clements echoed concerns regarding the repercussions of tax changes, remarking that eliminating or limiting the tax exemption could undermine economic growth and hinder vital infrastructure investments, effects felt nationally. They argue that bipartisan recognition exists concerning the necessity to refresh and rehabilitate the nation’s infrastructure, indicating that the preservation of tax exemptions is crucial, as their removal would generate only a minor fraction of the federal budget.

The marketplace saw several significant bond transactions on Thursday. Barclays took the lead, pricing a staggering $1.5 billion in transportation bonds for the New Jersey Transportation Trust Fund Authority. The various tranches of bonds issued smartly navigated yield pricing, with the 2030 maturity setting at 2.90% and extending to 4.21% for longer-term bonds.

Other notable transactions included the Greater Orlando Aviation Authority issuing almost $772.65 million in AMT airport facilities revenue bonds, reflecting resilience in travel infrastructure amid economic turbulence. Such transactions underscore municipal bonds’ critical role in financing essential services, which remains attractive to investors focused on long-term returns.

Additionally, the Sales Tax Securitization Corporation in Illinois managed to price $653.63 million in refunding bonds, showcasing the unwavering interest in projects secured by stable revenue streams. These transactions, among others, epitomize both the dynamism and the stability that municipal bonds offer to a diverse array of investors.

The municipal bond market is exhibiting notable stability and investor interest despite looming uncertainties regarding tax exemptions and broader economic pressures. The sustained inflow of capital into mutual funds dedicated to municipal securities highlights a strong underlying demand amid shifting market dynamics. As December unfolds, observant investors will be crucial in tracking issuance trends and assessing strategies that municipalities may deploy to mitigate potential risks—balancing investor enthusiasm against legislative uncertainty. Ultimately, the importance of municipal bonds in infrastructure financing and community economic health cannot be understated, as they represent a critical bedrock for future growth and development.