In the complex landscape of stock investments, especially within the pharmaceutical sector, identifying undervalued companies is crucial. Investor Bill Nygren, well-respected for his value-centric approach, recently spotlighted Merck as a prime candidate for investors looking to capitalize on a profitable opportunity. The overarching idea is that Merck, now trading at a discount, exhibits alluring characteristics that can sustain and enhance value over time.

Evaluating Merck’s Market Performance

Merck’s stock has stumbled in the current market climate, facing a decline of over 5% this year. The downturn largely correlates with a slowdown in sales of Gardasil, its well-known human papillomavirus vaccine in China. Despite this dip, Nygren believes that the core fundamentals and strategic direction of the company reveal a more favorable long-term outlook. His insight suggests that while short-term fluctuations may pose risks, they can also create buying opportunities for discerning investors willing to overlook the noise.

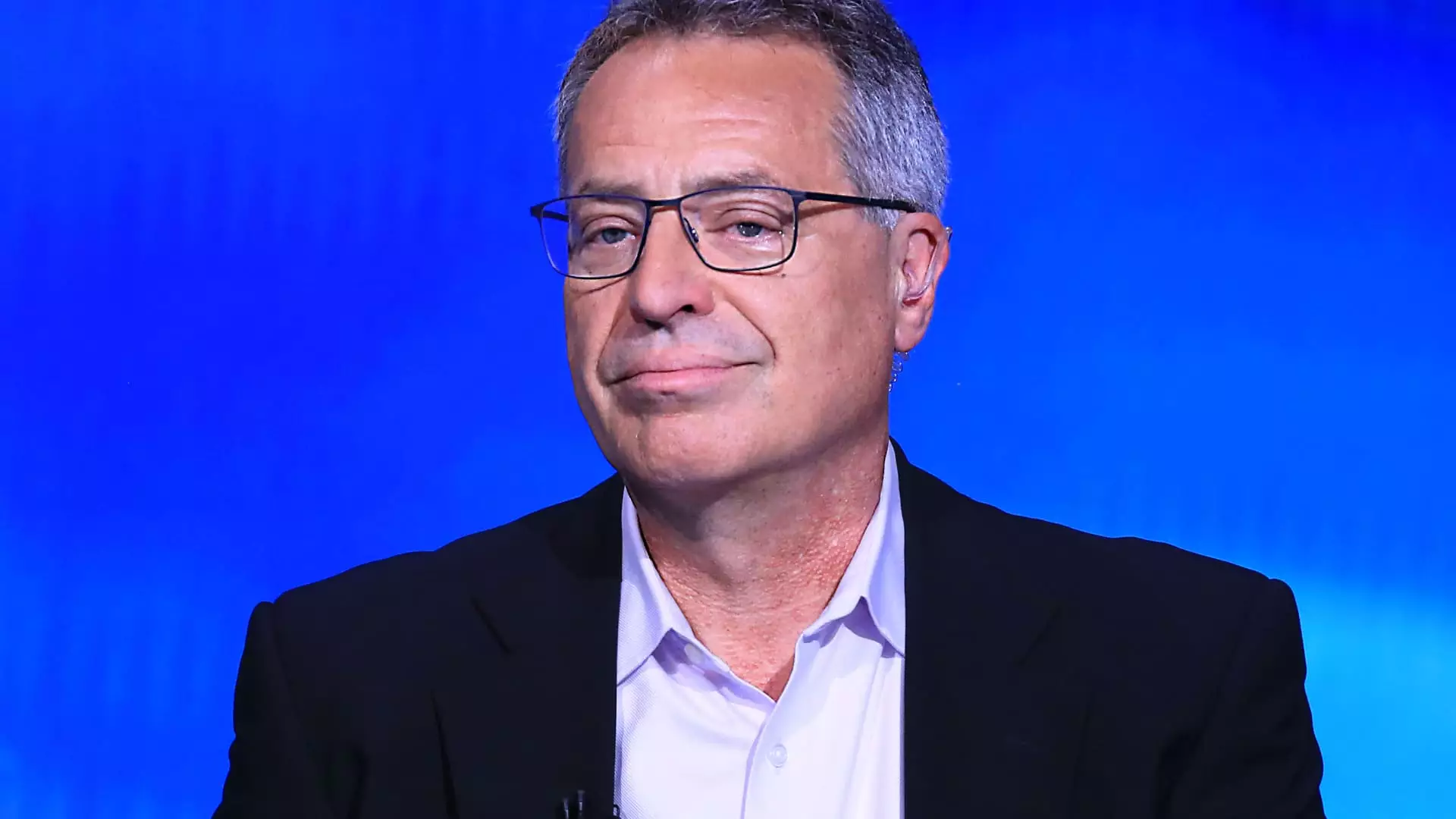

Nygren’s confidence in Merck is reinforced by his proactive approach to understanding the company better, which included engaging with its management team and CEO Rob Davis. Nygren describes Davis as “unusually good” in bridging the gap between finance and science—an essential skill in an industry where understanding both aspects can lead to sound decisions. This nuanced comprehension of Merck’s operations can translate into disciplined investment choices, making it a potential treasure trove for value investors.

A significant driver of Nygren’s optimism regarding Merck stems from its robust drug portfolio, particularly the Keytruda franchise, a leading cancer treatment. Enhancements and extensions within such an established portfolio often signal potential for increased revenue streams and, consequently, upward price movements in the stock. Investors looking at Merck should thus consider not just the current challenges but also the promising avenues for growth that its established products provide.

In addition to Merck, Nygren’s investment philosophy encompasses sectors positioned to benefit from advancements in technology, especially artificial intelligence. He points to examples such as Capital One and Charter Communications, which have successfully integrated AI into their operations. These companies, while not typically associated with tech innovations, highlight the potential of traditional firms to adapt and thrive amid evolving market dynamics. His approach is a reminder that opportunities may arise from unexpected quarters in today’s rapidly transforming economic landscape.

While Merck may currently face headwinds, its strengths in portfolio characteristics, strategic management, and future growth prospects present a compelling case for investment. As seasoned investors like Bill Nygren point out, the key lies in evaluating the long-term potential rather than getting caught up in transient market conditions. By maintaining an open mind towards both established pharmaceutical companies and innovative tech adaptors, investors can strategically position themselves to optimize returns in a fluctuating market.