The tragic shooting of Brian Thompson, the CEO of UnitedHealth Group’s insurance arm, has sent shockwaves through both the healthcare industry and stock markets. This incident, which occurred in midtown Manhattan, has raised serious questions about the broader implications of violence against prominent figures within the insurance sector. Thompson was shot by Luigi Mangione, a 26-year-old who harbored critical views toward the healthcare industry, reflecting a growing tension among the public regarding insurance policies and practices. Following this event, major insurance stocks, including UnitedHealth, CVS Health, and Cigna, have seen a decline of over 6%, highlighting how personal tragedies can ripple through financial markets.

The steep decline in insurance stocks following Thompson’s murder is a clear demonstration of investor sentiment and market fluctuations reacting not just to the event itself, but to an intensifying discourse around the insurance business. Industry analysts, such as Jared Holz from Mizuho, have noted that the market reaction stemmed from “renewed rhetoric” that condemns the profit-driven motives of insurers. For many Americans, the health insurance industry’s reputation has been deteriorating for years, fraught with issues such as claim denials, unexpected bills, and a lack of transparency. As criticisms become louder in the wake of such violence, investors grapple with whether to maintain their stakes in these already controversial sectors.

A Crumbling Foundation? Public Disillusionment

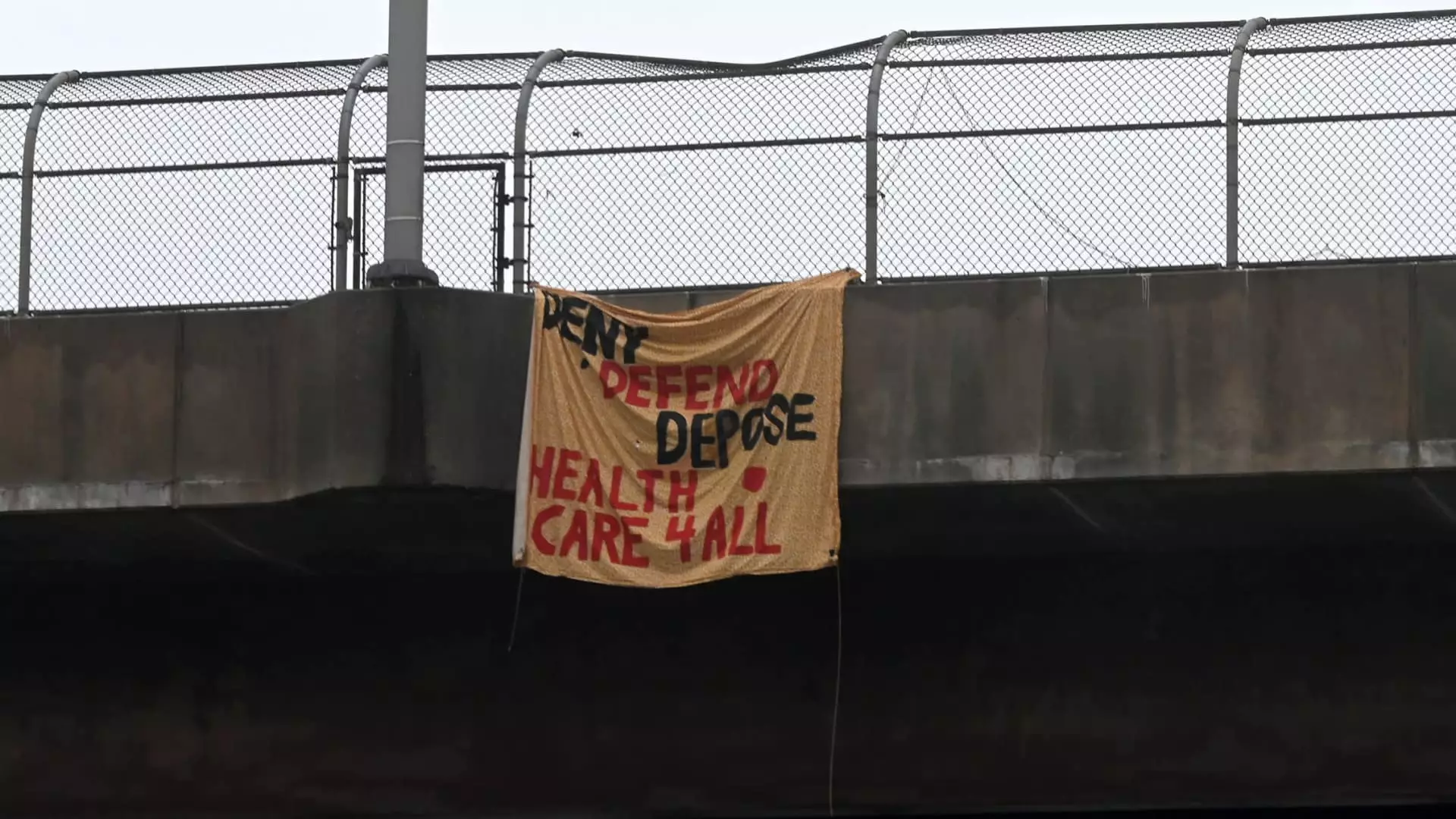

Public discontent with health insurance companies has reached a boiling point, characterized by a chorus of voices echoing dissatisfaction over high premiums and inadequately covered healthcare services. The aftermath of Thompson’s tragic death has underscored a critical view that many hold about insurers profiting at the expense of individual patients. This sentiment aligns with Mangione’s alleged motivations, as he expressed in handwritten notes accusing the healthcare system of being predatory. An examination of this disillusionment reveals deeper societal frustrations, particularly about the perceived inequities and complexities of America’s healthcare landscape.

Legal Proceedings and Social Implications

Following the arrest of Mangione and the subsequent legal actions taken against him, the incident raises further questions about the accountability of leaders in the healthcare sector. The charges of second-degree murder and firearm possession against Mangione exemplify a troubling crossover between personal grievances and public actions. The ongoing investigation into his motives emphasizes the need for a societal reflection on the state of the healthcare system. Will this tragedy propel discussions on reform or engender more indifference toward the real issues facing patients?

While immediate reactions to the shooting by investors manifest as stock declines, experts predict that the negative financial repercussions will likely be short-lived. As Holz suggests, significant changes in corporate policy from major insurers in response to public outcry and violence are unlikely. The healthcare industry has faced scrutiny before, and although it may experience pressure to reform its practices, historical patterns suggest that systemic change tends to be slow and complex. The real question remains: can an industry known for its bureaucratic entanglements adapt to the changing demands of a more socially conscious public?

The Future of Health Insurance

In the coming weeks and months, as the fallout from this tragedy unfolds, industry leaders will need to reassess not only how they operate within the healthcare ecosystem but also how they communicate with the public about their roles as insurers. The narrative surrounding health insurance is evolving, and companies must be vigilant about acknowledging and addressing the concerns of those they serve. While short-term declines are difficult to circumvent, focusing on proactive measures to rebuild trust and transform the patient experience may ultimately prove indispensable to salvaging the industry’s reputation and future profitability.