The municipal bond market has been a focal point for fixed-income investors, offering distinct advantages amid fluctuating economic conditions. As 2023 draws to a close, a pronounced weak sentiment has been pervading this sector, particularly as heavy new issuances clash with the backdrop of a fragile U.S. Treasury market. Investors are eagerly analyzing trends, seeking to navigate the opportunities and challenges inherent in this evolving landscape.

Recent market movements indicate a slight weakening for municipal bonds, attributed to an overwhelming influx of new issuances. The dynamics have been rolled in tandem with the performances of the U.S. Treasury market and equity shifts. With municipal yields experiencing upticks of up to two basis points and UST yields mirroring similar patterns, investors are faced with a carefully orchestrated balancing act. Muni yields are nuanced, with short-term bonds showing a 61% ratio compared to UST yields, indicating a cautious approach from investors as they reassess future yield curves.

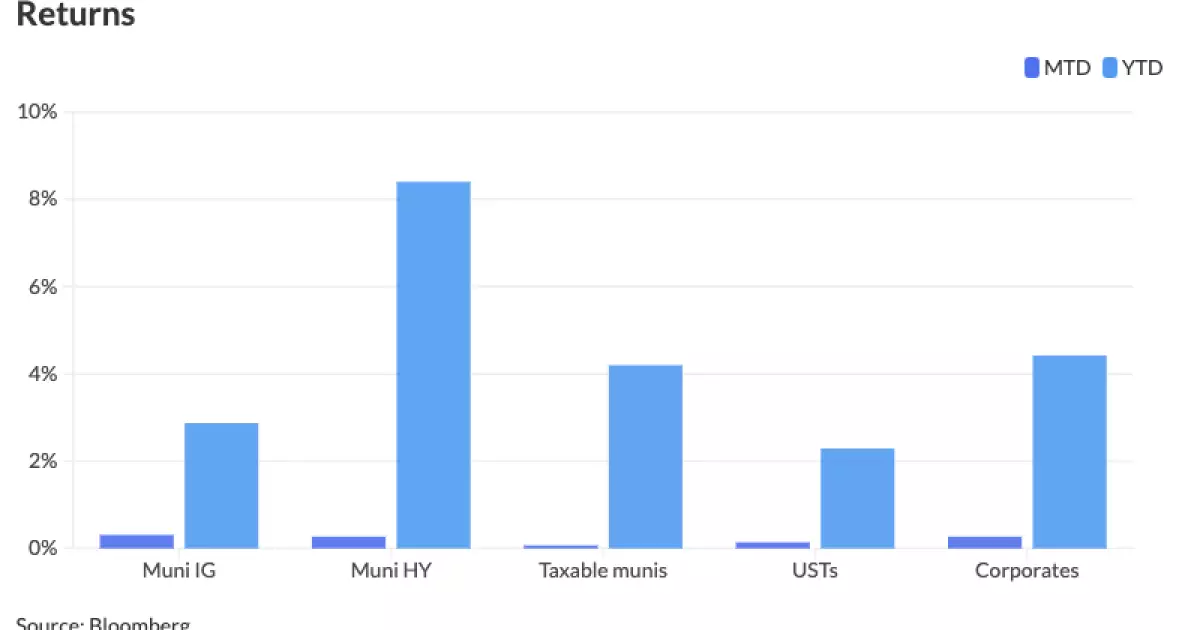

Expert analysts, including Anders S. Persson and Daniel J. Close from Nuveen, have emphasized the surprising resilience that municipals have displayed in a year dominated by nearly $500 billion in new issuances. They point to year-to-date returns of 2.87% as indicative of a market that is not only enduring but also thriving amidst adversity. Such returns, particularly evident as year-end approaches, could signify a broader expectation of sustained performance into early 2024, influenced by expected robust reinvestments.

Technical factors now play a pivotal role, acting as a double-edged sword in the fluctuating municipal bond landscape. With a net supply of negative $23 billion expected, analysts note this could provide a tailwind for returns. Daryl Clements, a municipal portfolio manager at AllianceBernstein, underlines this sentiment, suggesting that robust technical underpinnings and resolute investor demand are crucial during this downturn. The market’s recovery from losses earlier in November—1.73% gains versus 1.52% October losses—reveals hints of stabilization and potential for further growth.

The backdrop of upcoming Federal Reserve rate decisions adds another layer of complexity. Though yields saw a spike ahead of the presidential election, a subsequent decrease of 28 basis points for ten-year AAA municipal yields has set a favorable scene for increased investor engagement moving forward. Investors should keep a close watch on these developments, as they are pivotal in shaping future yield adjustments.

This year’s data showcases a pronounced appetite for high-yield municipal bonds, with $42 billion directed into mutual funds and exchange-traded funds (ETFs). Notably, high-yield funds account for a striking 38% of total inflows, signaling a ‘risk-on’ mentality prevalent among investors. Clements notes that high-yield munis are up 8.4% year-to-date, highlighting the growing interest as yields become more attractive due to anticipated Fed rate cuts.

The Fed’s positioning signals an 80% probability of a rate cut in December, further enhancing the attractiveness of municipal bonds. As expectations grow, market participants are pricing in a series of cuts, with analysts foreseeing a favorable environment for continued muni navigation. However, any unexpected shock—be it political, economic, or market-driven—could significantly disrupt this trajectory.

The primary market is witnessing an array of sizable offerings. For instance, Morgan Stanley has recently priced a robust $2.155 billion of state sales tax revenue refunding bonds for New York’s Dormitory Authority, showcasing the persistent appetite for municipal securities. Pricing strategies reveal nuanced adjustments across various maturities, indicating a demand for competitive rates suited to current market conditions.

In addition, upcoming issuances point to a market actively participating in diverse projects, ranging from school funding to housing developments. Notably, the National Finance Authority’s planned pricing of $435.357 million in municipal certificates reflects ongoing SEC-rated opportunities amid market fluctuations.

As the municipal bond market gears up for the close of 2023, investors are poised at a crossroads. With a blend of technical support, strong demand, and underlying economic signals pointing toward potential rate cuts, the immediate future may be bright for munis. However, vigilance remains essential, as unforeseen disturbances could swiftly alter expectations. As we advance into 2024, market participants will need to carefully navigate this evolving landscape, embracing opportunities while remaining acutely aware of risks that may lie beneath the surface. The evolving technical backdrop and investor sentiment will undeniably shape the narrative of municipal finance in the months to come.