The municipal bond market has experienced a period of relative stability, with slight fluctuations that reflect broader economic conditions and investor sentiment. As market dynamics continue to evolve, it is crucial for investors to remain informed about the ongoing changes in interest rates, supply, and overall market health. This article delves into the recent trends affecting municipal bonds, highlights key upcoming issues, and outlines strategies for investment in this unique space.

Investors observed a slight weakening in municipal bonds amid a broader market landscape where U.S. Treasuries faced losses along the yield curve. The steady increase in yields, particularly on longer-dated Treasuries, signals a cautious outlook among market participants. Notably, municipal yield curves showed minor reductions in value, correlating with shifts in Treasury performances. The ratios of municipal yields relative to Treasuries fell, indicating tighter spreads, which can influence investor behavior as they reassess their portfolios.

These yield movements have several implications for both short and long-term investors. For example, with the two-year municipal-to-Treasury yield ratio at about 61% and the 30-year ratio at approximately 81%, investors are faced with decisions on whether to seek higher yielding long-term holdings or focus on shorter-term issuances. This delicate balance between risk tolerance and return expectation is critical as investors navigate through a market characterized by both opportunity and uncertainty.

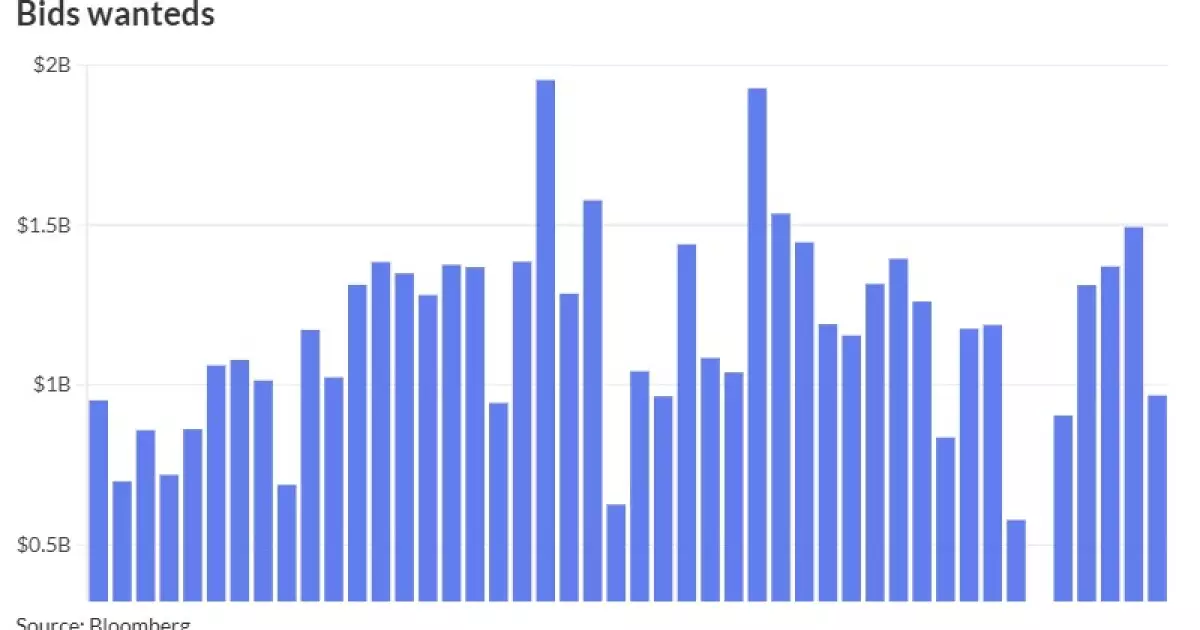

The municipal bond market is poised for a series of significant bond offerings in the coming weeks. Key issuances, such as the $2.158 billion in state sales tax revenue refunding bonds for the Dormitory Authority of the State of New York, represent opportunities for retail investors to capitalize on favorable pricing as larger deals enter the market. Notably, this offering features a range of maturities, and the rates available for bonds maturing over different timeframes can draw interest from various types of investors.

In addition to New York’s substantial offering, Massachusetts is set to attract attention with three competitive loans totaling $800 million scheduled for sale. This is particularly noteworthy as Massachusetts has demonstrated economic resilience through diversified revenue streams, making its general obligation bonds attractive to income-focused investors. The anticipation of moderately lower supplies in certain states could heighten demand, potentially resulting in price appreciation for high-quality bonds from areas like Massachusetts.

As of the latest readings, municipal bonds have maintained a positive trajectory, outperforming benchmarks in both monthly and yearly returns. The Bloomberg Municipal Index supporting a +0.33% return for December showcases the asset class’s resilience, with cumulative year-to-date performance reflecting +2.88%. Such performance figures highlight the critical role of municipal bonds as stabilizers within broader investment portfolios, particularly as challenges in equity and corporate spaces persist.

Investors should not overlook the historical context, as December and January typically yield strong total returns, often accounting for a significant portion of annual performance due to increased demand and seasonal factors. Awareness of market seasonality can lead to strategic positioning, which will be essential as analysts continue to assess interest rate changes and any forthcoming Federal Reserve policy adjustments.

Given the prevailing market circumstances, investment strategies may need to be adjusted. Analysts advocate maintaining a neutral duration posture while employing a barbell strategy that emphasizes both shorter maturities and the intermediate 15-20 year segments of the yield curve. Such a strategy balances the risk-reward profile while capturing yield opportunities across varying maturities.

Furthermore, there is a clear inclination towards an ‘up-in-quality’ bias, where higher-rated bonds are favored over lower-rated options, mainly given the current economic uncertainty. Yet, high-yield municipal bonds present viable opportunities for risk-seeking investors, offering appealing carry and robust structures. As findings suggest, thoughtful selection within higher-rated securities can generate alpha, enhancing overall portfolio gains.

The evolving landscape of the municipal bond market presents an array of investment opportunities. Investors are encouraged to remain vigilant and adaptable, capitalizing on market dynamics while pursuing strategies that align with their financial goals and risk tolerances. By understanding the interplay between interest rates, supply-demand mechanics, and historical performance trends, investors can navigate this unique bond market with greater confidence.