The municipal bond market has demonstrated noticeable resilience and growth in the third quarter of 2024, despite underlying challenges and shifts in investor ownership patterns. This article delves into the intricate dynamics of this sector, evaluating key trends, major stakeholders, and the implications for future investment strategies.

In an encouraging development, data from the Federal Reserve indicates an increase in the supply of municipal bonds along with overall market growth. The total outstanding face amount of municipal bonds rose by 0.8% from the second quarter of 2024, reaching approximately $4.171 trillion, and marking a 2.9% increase year-over-year. This expansion in available bonds reflects not only market resilience but also a potential uptick in governmental and infrastructural financing needs that bolster bond issuance.

Importantly, the market value of these bonds has also shown a robust increase. It stands at around $4.152 trillion, up by 2.8% since the previous quarter and an impressive 9.8% compared to the same period last year. This dual growth in face value and market valuation illustrates the underlying strength of the municipal bond segment, which is often viewed as a stable investment class, particularly during economic uncertainties.

Despite the hopeful trends in market growth, institutional ownership, particularly from banks, has significantly declined. Banks reduced their municipal bond holdings to $497.2 billion, reflecting a 0.3% drop from the previous quarter and a notable 4.3% decline year-over-year. The pronounced decrease in broker and dealer holdings by 10.5% further highlights a shifting landscape where traditional banking institutions are retreating from the municipal bond space.

Strategists assert that the downturn in bank holdings arises from a confluence of factors: diminished deposit bases for regional banks, ongoing regulatory challenges, and shifting priorities within institutional portfolios. For instance, Wells Fargo highlights that a shrinkage in balance sheets has led to decreased demand for municipal bonds, which are generally favored for their credit quality and long-term returns.

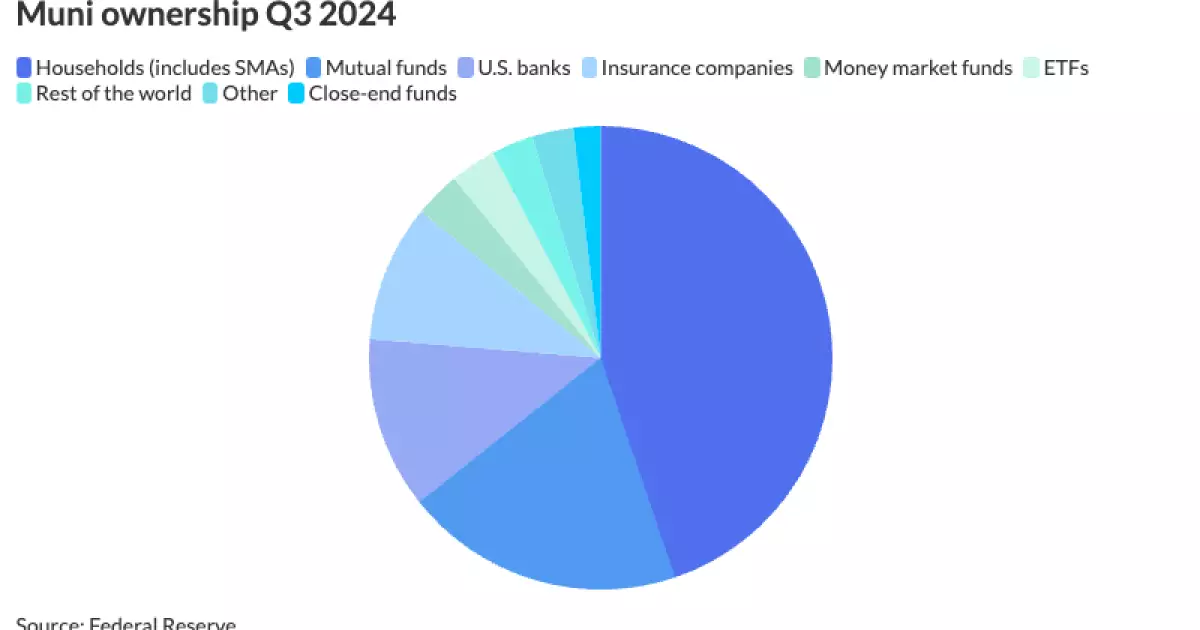

In contrast, the individual investor category is thriving, with households now owning the largest share of municipal bonds at 44.8%. This surge of interest among households, which now totals approximately $1.86 trillion, can largely be ascribed to the growing trend of separately managed accounts (SMAs). This pivot towards individual bond ownership signals a shift in investor confidence and a possible response to market volatility, positioning individual investors as key players in the municipal bond arena.

One of the most striking developments in the third quarter of 2024 has been the substantial growth in mutual funds and exchange-traded funds (ETFs) investing in municipal bonds. Mutual funds experienced an increase to $810.9 billion, representing a 4% rise from the prior quarter and an 11.4% year-over-year growth. Similarly, ETFs have surged to $133.3 billion, demonstrating a remarkable 7.2% increase over the last quarter and a staggering 23.4% growth compared to Q3 2023.

This shift underscores a broader movement towards market liquidity and efficiency, particularly enhanced by the relatively lower transaction costs associated with ETFs compared to traditional bonds. Wells Fargo strategists have pointed out that as trading costs continue to play a crucial role in selection for investors, ETFs often present a more attractive option than cash bonds, attracting inflows that reflect investor preference for flexibility and lower fees.

Amid these trends, the preference for passive investing strategies over actively managed products has become evident, especially in the context of stable credit conditions within the municipal market. Investors, feeling secure in the absence of significant credit stress, find compelling value in passive ETFs. As a result, this trend is expected to shape the competitive landscape within municipal investment strategies in the months and years to come.

While the municipal bond market shows encouraging signs of growth and diversification of ownership, several factors merit close attention moving forward. The decline in institutional ownership, especially from banks, raises questions about long-term stability and liquidity. Conversely, the burgeoning role of individual households and the rapid growth of mutual funds and ETFs could serve to reinvigorate the market, promising new strategies and opportunities for long-term investors.

Ultimately, understanding these evolving dynamics is critical for stakeholders at all levels, from institutional investors to individual bondholders. The interplay of supply and demand, regulatory shifts, and investor behavior will play a pivotal role in shaping the future of the municipal bond landscape in 2025 and beyond.