The municipal bond market has once again found itself at a crossroads as various economic indicators point to a mixed outlook. Recent trends suggest a tightening in yields amid broader fluctuations in U.S. Treasuries and equities markets. Understanding the nuances of these movements is crucial for investors navigating the complexities of this market.

On the surface, municipal bonds exhibited relative stability recently; however, a closer inspection reveals a subtle weakness. As U.S. Treasuries, particularly on the shorter end, experienced an uptick in yields, the municipal market lagged behind but not dramatically. The spreads across different maturities indicate a minor adjustment, with yields on Triple-A rated bonds experiencing a rise of up to two basis points. This reaction underscores the broader economic sentiment shaped by inflation data and Federal Reserve policies.

As reported, the ratios of municipal yields to USTs reflected an ongoing trend of tightening. For instance, the two-year ratio stood at 61%, gradually rising to 80% for 30-year bonds. Such ratios can signal relative value dynamics; as munis consistently follow Treasuries, the greater the ratio, the more attractive munis may become to investors seeking safety.

The inflation landscape remains a focal point for bond markets. The recent consumer price index data, which aligned with market expectations, underscores ongoing inflation concerns. Analysts suggest that inflationary pressures have driven yields higher, albeit in a restrained manner within the municipal sector. As articulated by experts such as Jason Wong from AmeriVet Securities, the municipal market appears to be riding the wave created by the UST market, albeit at a “more contained pace.”

Furthermore, expectations surrounding the Federal Reserve’s forthcoming decisions loom large. There’s speculation that potential rate cuts, particularly a 25 basis point reduction anticipated in December, could inject some optimism into the municipal landscape. However, as Daryl Clements from AllianceBernstein noted, the choppiness expected in December might create a volatile environment despite the positive technical backdrop.

Investor sentiment is also reflected in supply dynamics, with the municipal market entering what could be considered a quieter phase as issuance declines. The forecasted volume for the week—a mere $2.5 billion—highlights the drop in new offerings, with the New York Transitional Finance Authority’s $1.5 billion deal being the week’s most significant item.

Moreover, despite the reduced supply, outflows reflect a prevailing caution among investors. The exit of $316.2 million from municipal mutual funds, breaking a streak of consistent inflows, signals thus the market’s sensitivity to overall economic sentiment. Such outflows suggest that investors are recalibrating their strategies as year-end deadlines approach.

In contrast, the high-yield municipal bond sector has witnessed inflows, demonstrating that even amidst market adjustments, certain segments continue to attract interest. Analysts attribute this phenomenon to a performative edge within high-yield bonds relative to investment-grade options, emphasizing a selective appetite among investors.

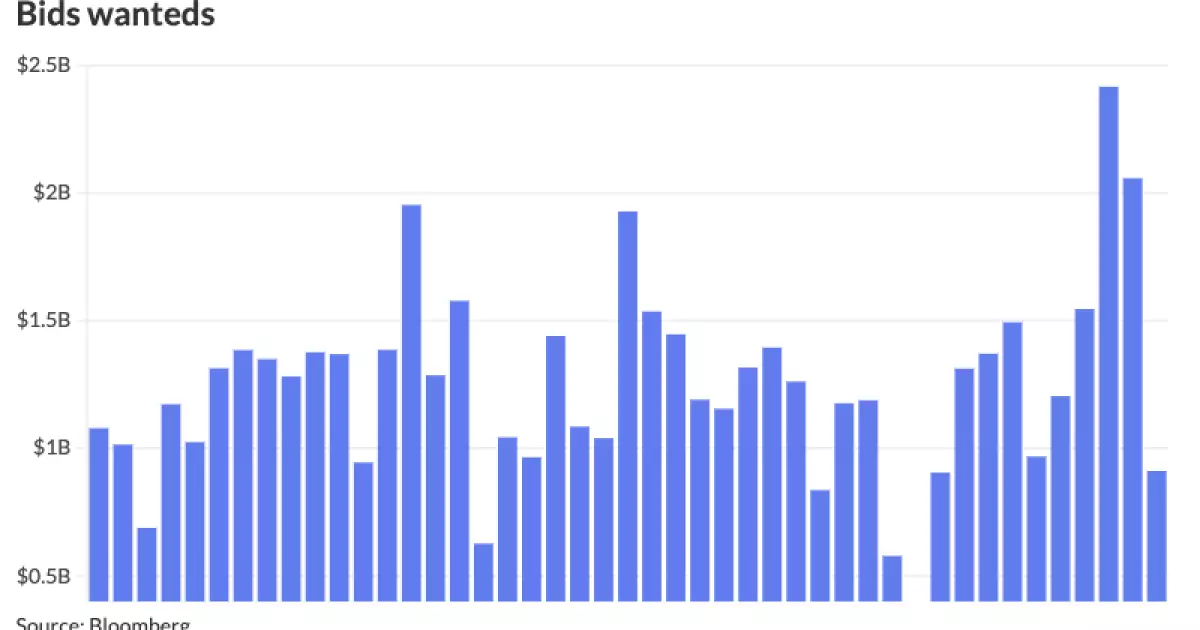

A noteworthy development in the municipal market is the surge in customer bid lists—a reflection of liquidity demands. As the market absorbs substantial bidding requests, estimated between $3 billion and $4 billion daily, strategists from Birch Creek emphasize this uptick as a critical factor in maintaining market equilibrium. The problematic nature of forced liquidation from certain accounts in the near future could lead to further volatility, especially as investors prepare to close their financial books for the year.

The recent trends in yield curves indicate that the market is in a period of adjustment. The unchanged nature of key yield options, despite visible shifts in shorter maturities, suggests a cautious approach from investors as they evaluate yield curves, capitalizing on potential opportunities without being overly aggressive in positioning.

As the municipal bond market navigates these intricate dynamics, it becomes increasingly clear that investor strategies will hinge on broader economic indicators. The interplay of inflation, interest rate policies, and supply-demand balance will likely dictate performance in the upcoming months. While some may approach the market with trepidation due to anticipated volatility, informed investors could find avenues for strategic positioning, especially in the realm of high-yield offerings.

As year-end approaches, the convergence of technical factors and investor psychology may set the stage for a highly dynamic market, making it essential for stakeholders to remain vigilant and adaptable in their investment strategies. The municipal bond market, steeped in history and complexity, requires a nuanced understanding as it prepares for an uncertain, yet potentially rewarding, future.