The municipal bond market is currently navigating a shifting landscape as investors brace for significant monetary policy changes expected to come from the Federal Reserve’s meeting. As uncertainties loom, stakeholders are observing key movements within the market, especially in a week marked by the sale of a major municipal issuance. The nuances of this environment highlight broader implications for yield dynamics and market sentiment.

The Anticipated Impact of Federal Reserve’s Decisions

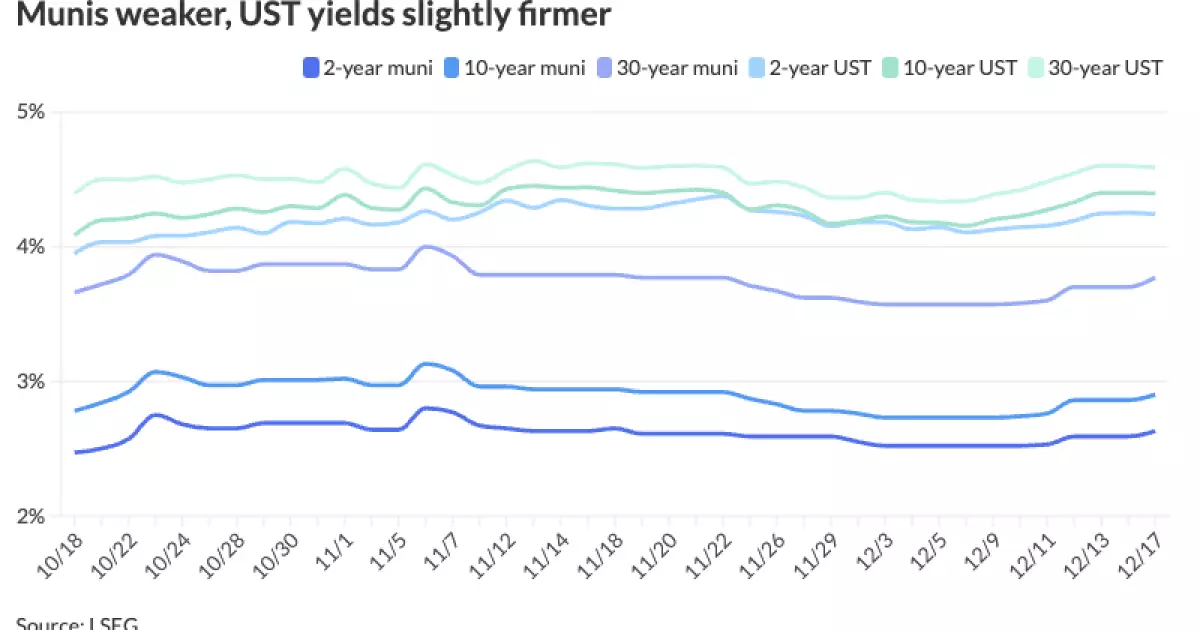

The convergence of economic indicators has set the stage for the Federal Open Market Committee (FOMC) to potentially announce a 25 basis points rate cut by Wednesday. This prospect has fostered a sense of unease in the municipal sector, as bond yields for Triple-A municipals have surged by two to seven basis points. The expectation of a rate adjustment reflects a broader market sentiment, but apprehensions persist about subsequent decisions beyond this initial cut.

Analysts, like Giles Nicholson from Siebert Williams Shank, underscore a growing concern regarding what the Fed might signal in terms of future rate trajectories. The notion that an initial cut may not lead to further ones in January raises questions about the health of the economy. As market participants prepare for Jerome Powell’s addressing of these topics, it is evident that any shifts in the language used could lead to pronounced market reactions.

The ratios that compare municipal yields to U.S. Treasury yields have subtly drifted higher, indicating shifting investor mentality amidst various economic pressures. Ratios for different maturities have positioned themselves at notable levels: 62% for the two-year and rising to 82% for the 30-year. Such ratios convey the relative value investors assign to municipal securities compared to their Treasury counterparts, which informs investment strategies.

The last week saw a notable transaction landscape, highlighted by the issuance of $1.5 billion in future tax-secured tax-exempt subordinate bonds by the New York City Transitional Finance Authority. This deal reflects not just local fiscal needs, but also the overarching trends that lead to investment demand amid fluctuating financial conditions.

Looking ahead, the Congressional Budget Office project a shocking increase in U.S. Treasury Securities supply needs—an additional $22 trillion over the next decade. This figure resonates with market participants who are beginning to perceive the challenges posed by looming federal budget deficits. As analysts like Matt Fabian from Municipal Market Analytics, Inc. indicate, such projections can exacerbate supply-demand imbalances, creating downward pressure on pricing and subsequently affecting municipal bond investors.

Further compounding this issue is investor apprehension regarding the potential impact of fiscal erosion on tax-exempt bonds, particularly amid a context of considerable supply anticipated through 2025, primarily earmarked for infrastructure enhancements. Public finance experts advise that while municipal budgets remain in strong positions, upcoming large issuances hint at a strategic push towards capturing investor interest in projects spanning airports, bridges, and transportation networks.

Emerging Trends and Strategic Responses

As the new year approaches, there are expectations for an influx of new issuances, further testing the market’s robustness. Bond experts have remarked on the necessity for yield adjustments to maintain traction among investors, particularly for premium bonds with higher coupon rates. The projected rise in issuance, coupled with a more cautious approach from buyers, suggests a recalibration of strategies will be fundamental in the months to come.

As municipal deals unfold, recent larger plans by institutions like San Francisco International Airport and the University of California for substantial bond offerings highlight the ongoing demand for tax-exempt financing in capital-expansion efforts. Market analysts remain vigilant, speculating how these significant moves could affect the pricing and availability of bonds across various sectors.

As the municipal market braces for imminent changes stemming from Federal Reserve actions, a myriad of factors influences stakeholders’ expectations and investment priorities. From yield ratios to upcoming supply forecasts, market participants will need to stay nimble in adapting their approaches as uncertainties in fiscal policy, inflation, and economic health persist. The upcoming rate decision, along with evolving responses to macroeconomic conditions, will undoubtedly shape the trajectory of the municipal bond market in the foreseeable future.