The current state of the municipal bond market reflects a complex interplay of factors ranging from inflation reports to changing Federal Reserve policies. Recent weeks have demonstrated a marked response in this sector as investors navigate the choppy waters of macroeconomic news, particularly concerning treasury yields and inflation metrics. It is imperative for stakeholders to dissect these trends critically to formulate effective investment strategies moving forward.

In the past month, the municipal bond market appeared to gain traction as U.S. Treasuries improved due to a less severe-than-anticipated inflation data release. This seemingly benign inflation print raises important questions regarding its long-term implications. Olu Sonola from Fitch Ratings emphasizes that although the latest inflation figures signal a slowdown, they are unlikely to shift the Federal Reserve’s hawkish monetary stance. Underlining the Fed’s wait-and-see approach toward future rate cuts, factors such as tariff and immigration policies will play a pivotal role in determining the next steps.

The Fed’s rapid transition in policy has prompted significant changes in the macro rates market. Treasury yields have undergone a substantial repricing, creating a bear flattening of the curve. This creates a critical dynamic, especially for municipal bonds, which may be unduly affected by the fluctuations in treasury rates, given the current low municipal/Treasury ratios. Investors are thus advised to adopt a cautious strategy, perhaps even hedging their positions, particularly if the 10-year Treasury yield remains elevated above 4.50%.

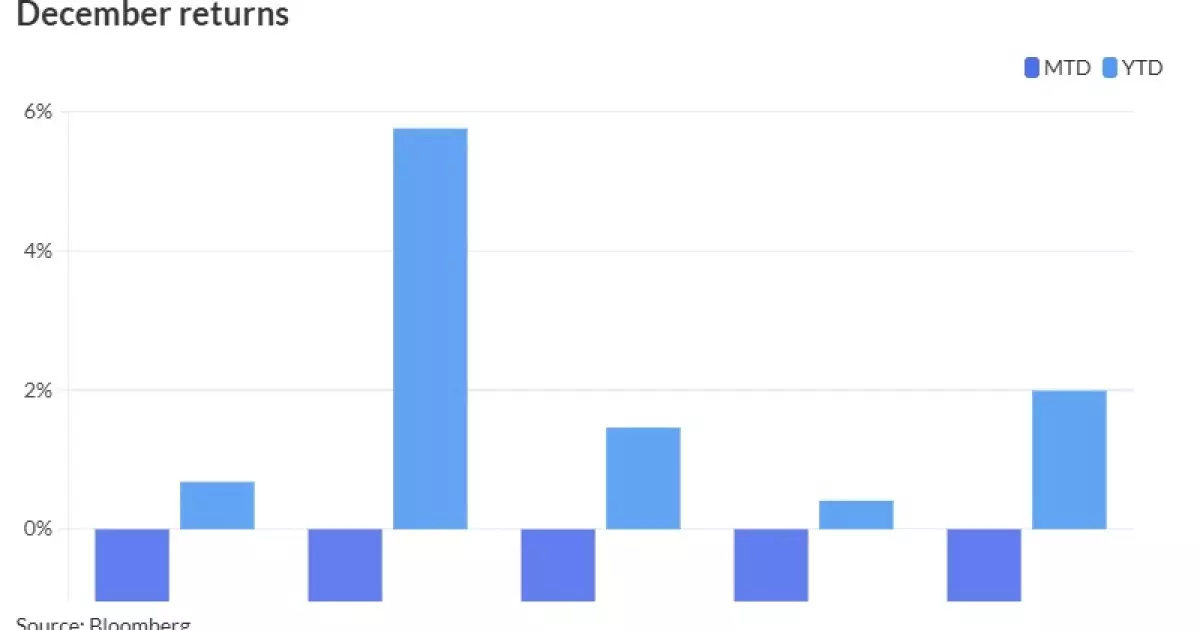

The statistics for December highlight troubling trends for municipal bonds. As of mid-December, there has been a loss of 1.82%, dragging down the overall gains for the year to a modest 0.68%. High-yield municipal bonds have suffered more, with 2.18% losses reported in December, diminishing year-to-date gains to 5.76%. Taxable municipals are even in a worse position, recording losses of 2.56% this month. The sentiment around these assets is becoming increasingly fraught, with Mikhail Foux from Barclays noting that the municipal market is under significant strain, spurring yields to near six-month highs.

Foux’ analysis reveals that although historically, buyers emerge when Treasury yields penetrate the 4.5-5% range, this time municipal ratios have expanded, especially at the longer end. Current metrics indicate that the two-year municipal-to-U.S. Treasury ratio sits at 65%, reflecting the growing caution among investors as they navigate the implications of rising yields.

Investor behavior in the current environment is revealing. Following substantial outflows from municipal bond mutual funds, including a notable $857.1 million in one week alone, it is apparent that caution has taken the lead among market participants. The subsequent $214 million outflow represents a hesitance to engage, as many investors opt to trim their exposure to municipal bonds amid deteriorating market conditions.

J.P. Morgan’s Peter DeGroot speculates that some of these outflows stem from both the recent drop in Treasury yields and tax-related trading activities, suggesting that year-end financial maneuvering plays a role in the actions of institutional investors. The overall inflows for 2024, while still positive at $41.4 billion, reflect a mixed picture where high-yield municipal funds garnered more interest compared to their investment-grade counterparts.

Despite the challenges currently facing the municipal bond market, there may be opportunities for strategic investment. With a prediction of a difficult January arising from unprecedented selling pressure, analysts believe the typically more diverse and stabilizing influence of January cash flows might provide a foundation for potential recovery. For those considering entries into municipal bonds, insights from Foux suggest that current high-grade levels present an attractive entry point, particularly as the market braces for upheaval.

Yet, without sizeable offerings expected until the New Year, liquidity may remain constrained. Therefore, investors must remain vigilant, monitoring the intricate dynamics between Treasury movements and the municipal landscape.

While the municipal bond sector grapples with various pressures from inflation to interest rates, the key takeaway lies in the necessity for adaptability and foresight from investors. Understanding these macro and microeconomic factors will be essential in navigating this challenging yet potentially rewarding investment landscape.