The recent monetary policy decision from the Federal Reserve, led by Chair Jerome Powell, has created ripples across the financial markets. With a hawkish stance accompanying a quarter-point interest rate reduction, investors were initially caught off-guard, prompting a sharp downturn in stock values. However, the narrative shifted dramatically by the week’s end as the markets rebounded with notable vigor. The Dow Jones Industrial Average’s recovery — an increase of nearly 500 points — sparked discussions about the potential for a festive end-of-year rally, particularly within the semiconductor sector.

Federal Reserve Chair Jerome Powell’s comments following the interest rate cut, although aimed at providing relief to the economy, nonetheless sent mixed signals. The investors perceived the Fed’s caution regarding inflation risk and economic stability as less than reassuring. This dichotomy can cause volatility; a proactive central bank may instigate confidence, whereas an overly cautious approach could lead to skepticism. Following Powell’s announcement, immediate panic gripped the markets, resulting in a noticeable decline in share prices. Yet, the swift recovery demonstrated the resilience of the U.S. economy, reflecting underlying strength that effectively countered the initial shock.

As December typically ushers in what is known as the “Santa Rally,” many investors are keeping a close eye on potential profits in sectors anticipated to outperform. An intriguing candidate in this context is Nvidia (NVDA), a heavyweight in technology and semiconductor markets, which appears to be regaining traction and attracting renewed interest. The upward momentum in Nvidia’s shares could signify broader investor confidence, setting a positive tone not only for Nvidia but also for companies within the semiconductor space.

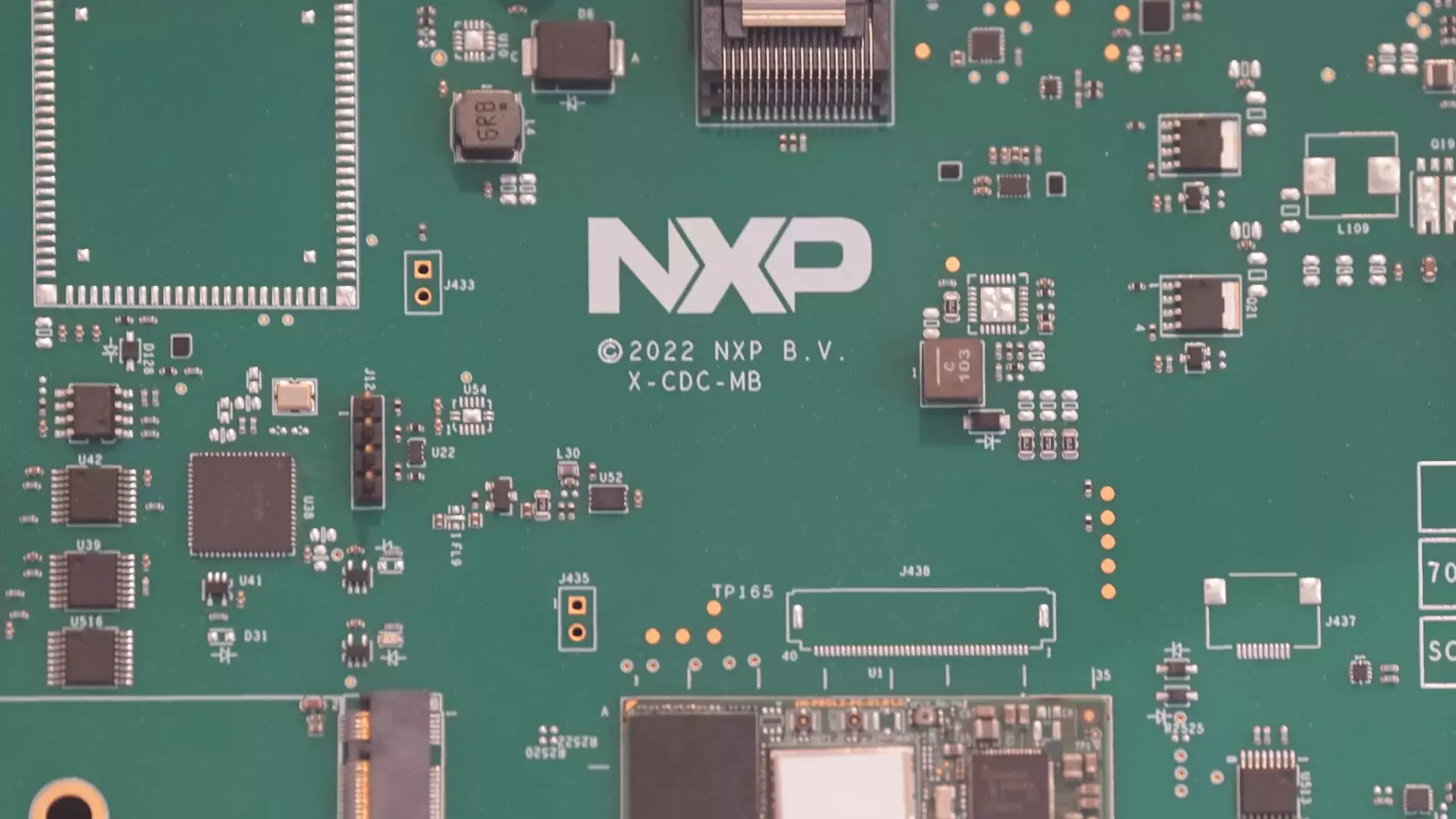

One stock that merits particular attention is NXP Semiconductors NV (NXPI). As investors look for opportunities, NXPI’s recent technical signals present a compelling case. Notably, the stock appears to have rallied after testing its previous lows, and this recovery trajectory is garnering attention.

A close analysis of NXP’s technical indicators reveals a shift in investor sentiment. The Relative Strength Index (RSI) for NXPI has reversed from its lows, indicating a potential transition toward bullish conditions. An RSI that rises suggests an increasing buying interest, thereby increasing the probability of a positive price trend.

Additionally, the Directional Movement Index (DMI) provides insights into market trends. A rising DMI indicates a potential weakening of an existing downtrend, hinting at the formation of a new upward trend. This technical analysis suggests that NXPI is not merely experiencing a temporary bounce; rather, it could indeed be on the verge of a sustained increase.

For investors contemplating exposure to NXPI, a bull call spread strategy makes sense under current market conditions. By purchasing a $210 call option while simultaneously selling a $215 call option, investors can limit their risk while capitalizing on potential upward movement. This defined risk/reward structure appeals to risk-averse investors who wish to take advantage of bullish momentum without exposing themselves to unlimited risk.

For instance, if NXPI can reach a price point of $215 by its expiration date, investors could see significant returns on their initial investment— an alluring prospect for those looking to maximize their portfolio’s performance.

The confluence of the Federal Reserve’s policies and evolving market dynamics presents both challenges and opportunities for investors. While the initial response to Powell’s hawkish tone spurred a sell-off, the subsequent recovery reflects underlying strengths in select sectors, particularly in technology and semiconductors. As we approach year-end, staying attuned to technical signals and employing strategic options plays, such as the bull call spread in NXPI, can provide effective avenues to take advantage of potential market upswings. However, investors must remain prudent, actively assessing risk while navigating this complex financial landscape. In a world marked by volatility, informed decision-making and strategic foresight become paramount for achieving investment success.