The tumultuous week in Washington culminated in a temporary measure to keep the federal government operational until March 14, 2024. Amidst the ongoing debate about the future of the debt ceiling, significant funding victories emerged for the states of Maryland and Washington D.C. The resolution, designed to maintain government functions, highlights the complexities of modern political negotiations in an increasingly partisan environment.

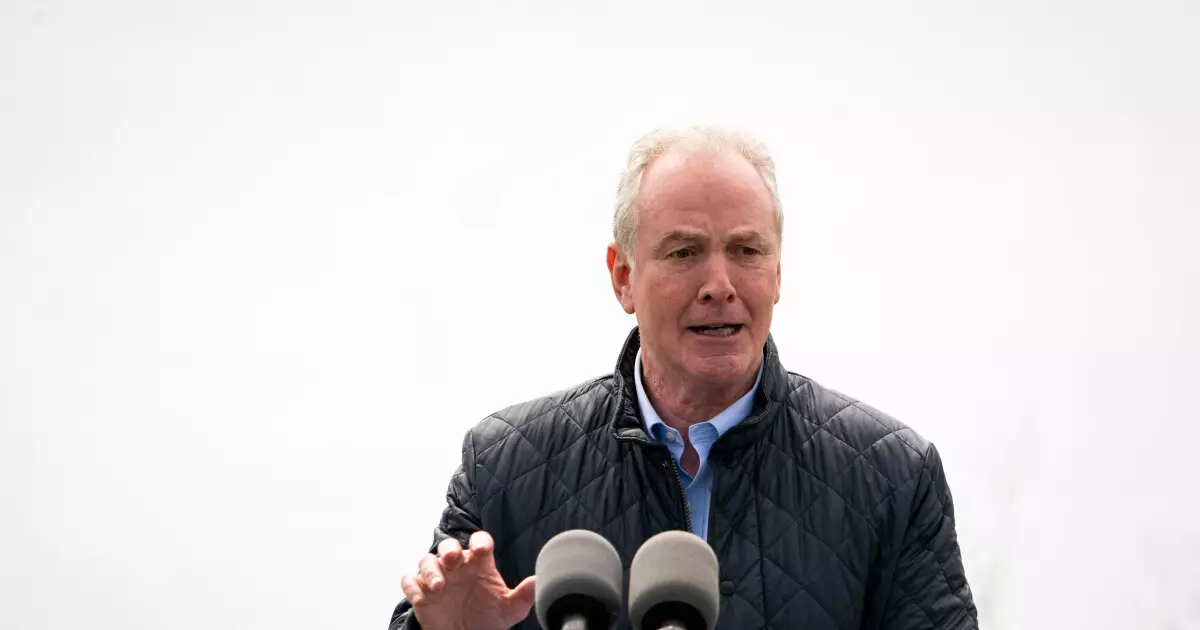

Senator Chris Van Hollen announced a considerable achievement: the allocation of full federal funding to replace the Key Bridge in Maryland, which suffered damage from a disabled cargo ship earlier in the year. Initially met with resistance, particularly from the incoming Trump administration, this funding was ultimately signed into law by President Biden. The contentious nature of such funding showcases the deep divides within Congress concerning the use of federal taxpayer money for local infrastructure projects, particularly when state governments promise to reimburse federal funds after resolving legal and insurance issues.

Further victories for Washington D.C. came with the transfer of the RFK Stadium site from federal control to local governance, a measure that had initially faced removal during negotiations in the House but was later reinstated in the Senate. Congresswoman Eleanor Holmes Norton heralded this decision as a crucial step toward D.C.’s autonomy, especially timely as the holidays draw near. This illustrates not only the importance of localized governance but also the passion behind the ongoing pursuit of self-determination for the district.

Moreover, the continuing resolution allocated $90 million to fund the upcoming Presidential inauguration, a rare instance where city leadership collectively presented their case before Congress. This unified front reflects the increasing necessity for municipalities to actively engage with federal lawmakers to secure vital funding, especially for major events that impact both local and national interests.

However, the resolution was marred by an escalating conflict over the contentious issue of the debt ceiling. Former President Trump’s insistence that any continuing resolution must also address the debt ceiling reflects deeper ideological rifts within the Republican party. Trump’s public statements, relayed through his Vice President-elect, assert that immediate discussions on the debt ceiling are critical to gauge Democratic cooperation. This approach underscores the growing complexity of bipartisan negotiations, particularly in an environment rife with competing interests and personalities.

The ongoing discussions surrounding the debt ceiling raise pertinent questions about the nation’s fiscal health and its implications for the Treasury bond market. The reluctance of 38 House Republicans, identifying themselves as fiscal conservatives, to support the current funding plan signals a fracture within party lines, leading to speculations of potential upheaval within party leadership. The resulting standoff inevitably prolongs the uncertainty around critical financial governance, potentially endangering the economic stability of the country.

As the 119th Congress grapples with these pressing issues, upcoming legislative challenges loom large, including the future of the Tax Cuts and Jobs Act (TCJA). This signature achievement of Trump’s first term has implications for both individual taxpayers and the municipal bond market. The impending debate centers on extending provisions that have met with mixed reactions, particularly from stakeholders concerned about the limitations imposed on state and local tax deductions.

Chairman Jason Smith of the House Ways and Means Committee remains steadfast in his commitment to preserving the successes of the TCJA. His statements reflect a broader conservative philosophy that prioritizes tax stability and aims to mitigate disruptions to the economy. As Congress transitions leadership and policy priorities, the pressure to sustain economic growth while navigating complex tax legislation intensifies.

The convergence of funding agreements and political conflicts within the current legislative landscape paints a picture of an administration caught in a tightrope of competing demands. The discourse around infrastructure, fiscal responsibility, and tax policy continues to evolve, revealing a dynamic and challenging future for both lawmakers and constituents alike. The coming months will be crucial in determining how effectively the government navigates these intertwined issues.