In the ever-evolving world of finance, understanding market fluctuations is crucial for investors at all levels. As we assess the present dynamics of municipal bonds and the greater economic environment, we observe a notable interaction between liquidity, investor sentiment, and seasonal patterns. Recent reports indicate a marked softness in the municipal bond sector, with various trends hinting at both opportunities and challenges ahead. This article delves into the changing landscape of municipal bonds, highlights recent capital movements, and evaluates the potential pathways for the market as we head into a new year.

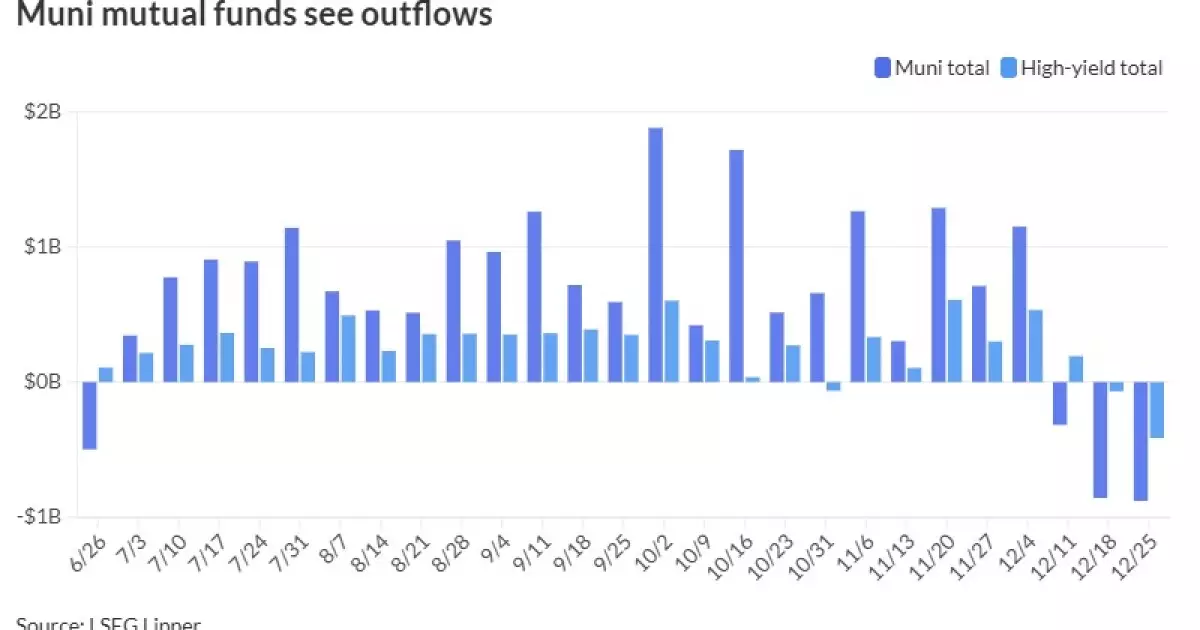

The current stability of municipal bonds is juxtaposed with an observable trend of outflows from mutual funds. As highlighted by Jeff Timlin of Sage Advisory, the market is experiencing what can be termed a “seasonal winter softness.” This phase often corresponds to the end of the fiscal year, where lighter staffing levels and reduced new bond issuances make it difficult for pricing to maintain momentum. Timlin also pointed out the implications of year-end tax-loss selling, which can catalyze volatility and lead to broader bid-ask spreads. Investors appear cautious when reallocating assets, as evidenced by the reported $878.5 million withdrawal from municipal bond mutual funds for the week ending December 25.

One of the fundamental challenges facing the market is the inconsistency in reported capital flows. The divergence between figures from LSEG Lipper and the Investment Company Institute (ICI) indicates volatility in investor sentiment. For example, while LSEG noted a substantial outflow, ICI reported a resurgence of inflows in previous weeks, complicating the narrative. With mutual fund investors pulling nearly $414 million from high-yield funds compared to significantly lower outflows the week prior, one must consider what these patterns signal about risk appetites and investment strategies.

A deeper examination reveals that cash remains somewhat trapped on the sidelines, as evidenced by the massive influx into tax-exempt municipal money market funds totaling $1.477 billion, returning to positive inflow after a previous week of substantial outflows. This influx is indicative of a reactive investment strategy where investors are seeking refuge in safer assets. However, Timlin mentions that as the market reopens on January 2, a wall of money from maturities and coupon payments is likely to prompt reinvestment. The notable aspect of this reinvestment window is the anticipated absence of significant new issuances for the first two weeks of the year, possibly leading to a period dominated by secondary market trading.

Current market behavior showcases a bifurcated structure where substantial capital is awaiting opportunities, while the risk environment appears robust. In a market described as experiencing a ‘gangbuster’ phase, municipal bonds remain attractive for conservative investors trying to mitigate risks associated with more volatile investments. Despite recent fiscal restraints, supply is expected to ramp up significantly in 2025, potentially exceeding $500 billion. Timlin believes any resultant price fluctuations can be easily absorbed given the volume of capital waiting for deployment.

The future of the municipal market appears bright as underlying technicals are projected to improve markedly in January. The challenge, however, lies in the market’s ability to absorb the upcoming record levels of issuance without destabilizing current valuations. The competitive yield spread between municipal and U.S. Treasury securities reflects a healthy interest in municipal bonds, especially as two-year and five-year municipal to UST ratios hover around 65%.

As we assess the current yield curves, we see little movement, suggesting that investors are, at least temporarily, at a standstill until the market regains full operational capacity in early January. As such, both MMD and Bloomberg BVAL scales reflect general stability, maintaining their positions with only minimal changes observed.

The municipal bond market finds itself at a pivotal junction characterized by wavering investor confidence, seasonal softness, and the inherent challenges of managing capital flows during the year-end lull. For investors, careful consideration of the nuanced landscape, informed by emerging trends and indicators, will prove essential in making strategic decisions for the year ahead. As we transition into the new year, the interplay between new issuances, liquidity, and market sentiment will likely shape the outcomes in the municipal sector, offering both opportunities and risks for investors willing to navigate this intricate environment.