The municipal bond market has shown a relatively stable performance amidst modest fluctuations in U.S. Treasury yields. While the focus has been on yields and ratios, several underlying factors shape this sector’s current health and future prospects. As we delve into these recent developments, we can observe both challenges and opportunities that market participants should be aware of heading into 2025.

Yield Trends and Ratios

Recent trends reveal that municipal bond yields are closely intertwined with U.S. Treasury rates. As Treasury yields edged up slightly, municipal-to-U.S. Treasury (UST) ratios experienced a minor decline. Specifically, the two-to-five-year municipal ratios hovered around 64-66%, while longer maturities, such as the 30-year, checked in at about 80%. These statistics indicate a tightening relationship between municipal bonds and Treasuries, suggesting that investors’ appetite for tax-exempt securities may be influenced by broader fixed-income market conditions.

Moreover, the last few weeks of 2024 witnessed a notable uptick in long-dated AAA benchmark tax-exempt rates, leading to enhanced entry points for reinvestment. Strategists from firms like J.P. Morgan have indicated that these spikes in yield could reflect normal market behavior rather than an alarming trend, particularly considering that many market participants have engaged in tax-related trading activities as the year-end approaches.

Market Dynamics and Outlook

From the perspective of market dynamics, Daryl Clements, a municipal portfolio manager at AllianceBernstein, articulated that the latter part of December saw significant volatility. This volatility, however, transitioned into a more stable outlook for the market as 2024 drew to a close. The overall municipal performance has been a mixed bag; despite a cumulative gain of 0.61% for the week, the sector recorded a decline of 1.46% throughout December.

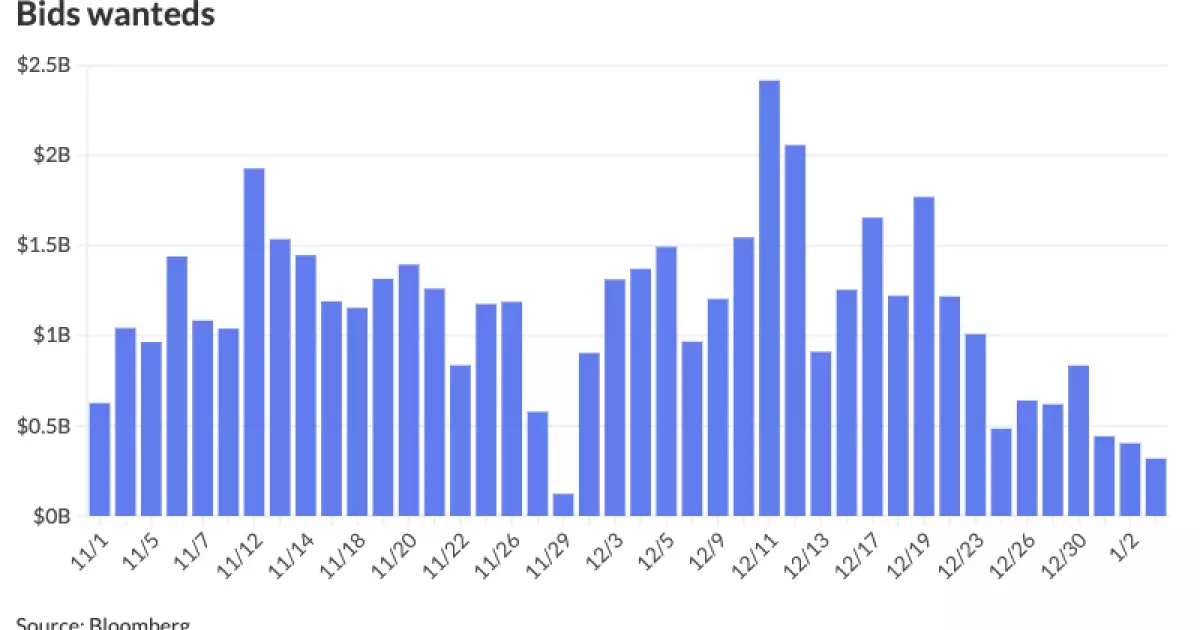

Interestingly, we should consider the implications of increasing supply on market performance. While overall issuance for 2024 exceeded $500 billion, which is indeed historic, the last three weeks suggested a subdued market with only $4 billion worth of issuance. This supply-and-demand anomaly may lead to downward pressure on prices, contributing to potential opportunities for astute investors willing to navigate the evolving landscape.

As we step into the first week of 2025, investors face a notably larger issuance of $5.18 billion, signaling a rebound. However, this figure remains well below the more substantial weekly volumes experienced during most of 2024. The anticipated influx in supply could come from issuers aiming to capitalize on current tax exemptions before any legislative changes arise, especially as Congress contemplates how to address a $4 trillion deficit.

Income continues to be a principal driver of performance in the municipal sector, raising the question of how different credit-quality bonds will fare in the upcoming year. Lower-rated bonds are predicted to outperform higher-rated securities; however, it’s essential to note that such outperformance may stem largely from excess carry rather than significant yield compression. This distinction is crucial for investors looking to allocate their resources wisely in a shifting landscape.

Furthermore, the fundamental credit quality of municipal bonds remains strong, with significant reserves evident in the median rainy-day fund balances. As of 2025, this metric continued to reflect the overall health of municipal finances. A rainy-day fund balance that represents 14.4% of general fund revenue is indicative of preparedness, underscoring resilient credit fundamentals amidst uncertainty.

In the broader context, the yield curve’s behavior is expected to normalize as monetary policy decisions transcribe into the municipal space. With the Federal Reserve potentially easing interest rates, there exists an optimistic view for investors regarding yield compression and increasing relative valuations going forward.

Several significant issuances in the coming days signal robust activity and provide additional insights into current market sentiments. Notable upcoming transactions include $850 million of general obligation bonds from the San Diego Community College District and various school district bonds across the nation. This upsurge in municipal activity underscores investors’ continuous interest, even amid fluctuating yields.

The state of municipal bonds at the onset of 2025 illustrates a blend of cautious optimism and strategic positioning. Investors are advised to remain vigilant about market trends, supply dynamics, and the critical shifts in fiscal policies. Although there are challenges ahead, opportunities abound for those looking to effectively navigate this nuanced and evolving sector.