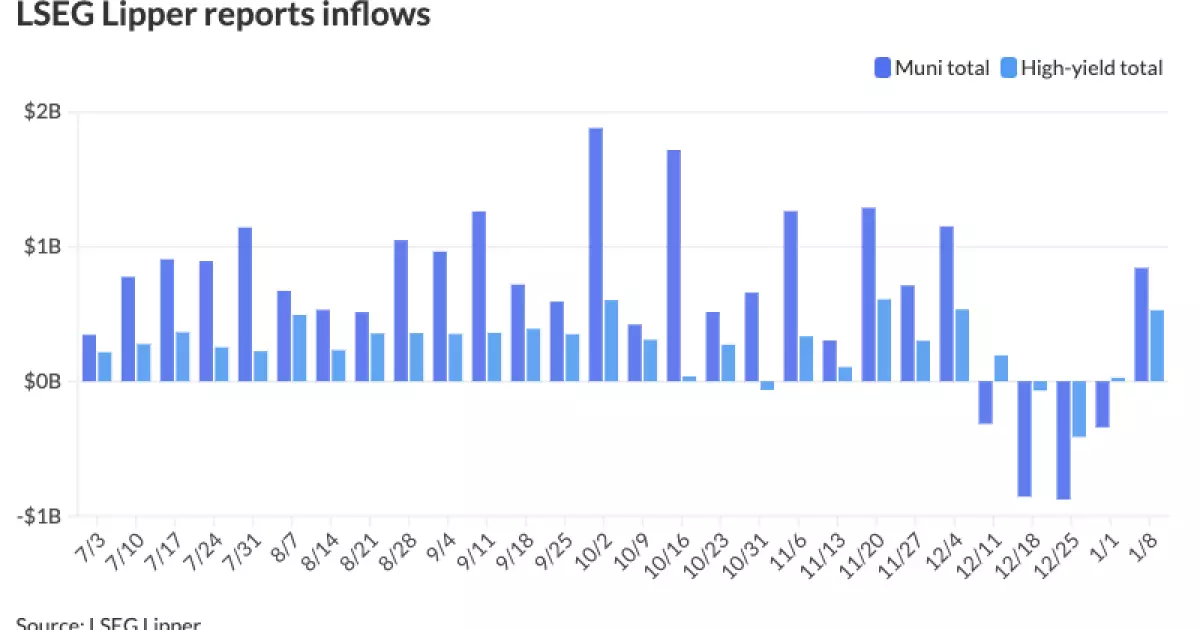

As we delve into the municipal bond landscape for the early part of 2025, the market appears to exhibit a steadfast nature, characterized by minor fluctuations at the shorter end of the curve. After experiencing several weeks of outflows, municipal bond mutual funds are signaling a resurgence with inflows totaling $842.4 million. This recovery comes at a time when U.S. Treasury yields have experienced a slight decline, resulting in a mixed performance across equities. The shift from outflows to inflows could indicate a renewed confidence among investors, suggesting that the municipal bond market may have found its footing once again.

The positive inflow trend follows a notable outflow of $342.2 million the previous week and is underscored by high-yield municipal bond funds, which saw inflows of $527.1 million, a remarkable increase compared to the preceding week’s mere $26.3 million. Analysts, including James Welch from Principal Asset Management, maintain that despite temporary outflows, the municipal market remains resilient, primarily supported by strong demand from separately managed accounts and exchange-traded funds. Welch emphasizes that this period presents one of the best entry points for investors in recent years, given that yields are currently at their highest levels in a year.

The current environment of municipal bonds is marked by attractive taxable equivalent yields ranging from 7% to 8%, depending on various credit and yield curve positions. However, this comes alongside relatively rich ratios, as recent data indicates a 65% ratio for the two-year and five-year maturities to UST bonds, with 66% for the 10-year and 81% for the 30-year. Such ratios provide risk-sensitive investors an opportunity to capitalize on a favorable entry point while navigating the nuances of the yield curve.

As we consider the broader context, the 2025 issuance landscape appears somewhat subdued as market participants appear to be cautiously entering the year post-holidays. This hesitation is further complicated by external factors, such as the national day of mourning dedicated to the late President Jimmy Carter, which has curtailed robust trading activity. Despite these headwinds, significant issuances are on the horizon, including a notable $981.685 million bond issue by the Central Valley Energy Authority, which indicates that the market may soon regain its momentum.

Reflecting on the anticipated issuance trends, experts project that the issuance volume is likely to remain a prominent theme throughout 2025. The observable slowing in initial issuance does not overshadow the more substantial deals projected in the coming weeks. With billions of dollars in deals lined up, including substantial offerings from the University of California and the Oklahoma Turnpike Authority, there is a clear indication that larger transactions will become increasingly common.

However, significant uncertainties loom on the horizon, particularly concerning potential shifts in fiscal policy following the transition to a new presidential administration. Market players are grappling with the specter of potential changes, notably the concern regarding the potential elimination of the tax exemption for municipal bonds, which could incite volatility in this sector. Analysts suggest that this looming uncertainty may result in varying degrees of anxiety within the market, prompting cautious optimism among investors who are keenly watching developments.

Economic indicators suggest that municipal bond markets have significant opportunities moving forward. The first week of January saw tax-exempt municipal money market funds attract $4.085 billion in inflows, elevating total assets to $139.335 billion. However, the average yield for these funds has seen a decline, now resting at 2.04%, indicative of the prevailing dynamics in money markets.

In contrast, the broader economic context, including the Federal Open Market Committee’s (FOMC) discussions on interest rates and inflation, adds another layer of complexity to the situation. With the likelihood of rate cuts becoming more tangible by March, market participants are awaiting the FOMC’s decisions with keen interest. Analysts’ speculations about inflation trends underscore the importance of monitoring macroeconomic shifts that could subsequently influence municipal bond yields.

While the early stages of 2025 present some headwinds for municipal bonds characterized by cautious issuance and uncertainties about federal fiscal policy, the underlying fundamentals remain strong. Factors including rich yield ratios and positive inflows into mutual funds, along with supportive institutional investments, suggest a resilient trajectory for the municipal bond market throughout the year. The evolving landscape necessitates vigilant monitoring of economic indicators, interest rate decisions, and potential market volatility, all of which will significantly shape the opportunities that lie ahead. Investors aiming for advantageous positions in the municipal bond market should prepare for both challenges and potential rewards as this sector evolves in response to external economic stimuli.