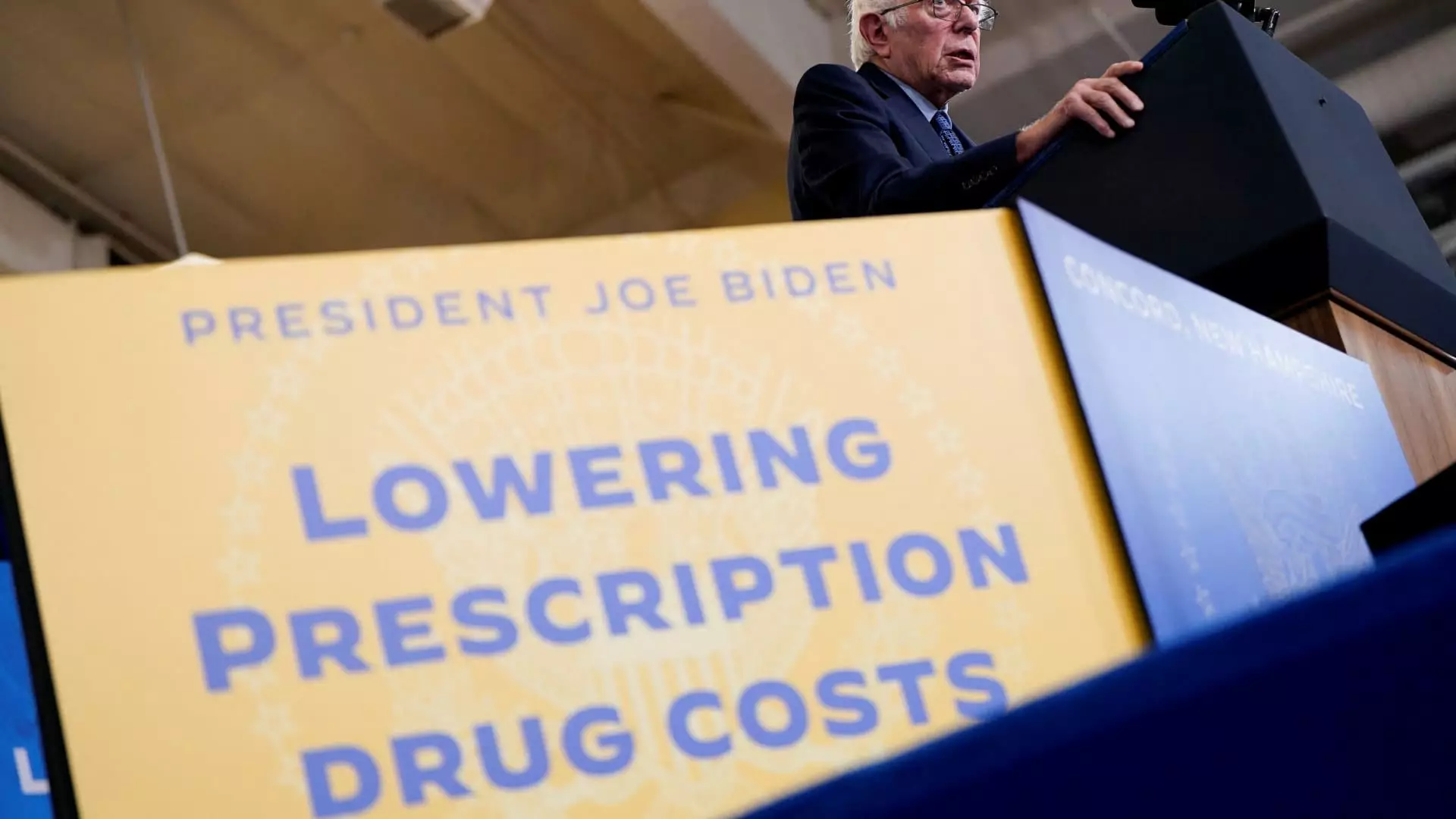

As the healthcare landscape evolves, one key change has emerged from President Joe Biden’s 2022 Inflation Reduction Act: a cap on out-of-pocket spending for Medicare beneficiaries. Specifically, a $2,000 limit on prescription drug costs went into effect this year, promising substantial savings for many older adults during a time of rising drug prices. A recent report by AARP has provided insights into how this new cap could drastically alleviate financial burdens for millions of enrollees, particularly those facing high-cost medications for severe conditions like cancer and rheumatoid arthritis.

The AARP report highlights a striking statistic: 94% of the 1 million Medicare Part D enrollees projected to hit the new spending cap by 2025 are expected to experience lower overall costs, averaging a noteworthy reduction of $2,474 in their out-of-pocket expenses. This constitutes a substantial 48% decrease, underscoring the potential of the cap to ease the financial strain often associated with receiving necessary medications. The Medicare population has historically faced exorbitant expenses, frequently paying two to three times more for prescriptions than their peers in other developed countries.

With a median income of just $36,000 annually for Medicare beneficiaries, many seniors find themselves making tough choices between essential expenditures. Leigh Purvis, AARP’s prescription drug policy principal, emphasized the transformative potential of these savings. For seniors, the relief from high drug costs could allow them to redirect resources to other critical needs, such as food and housing, thus enhancing their overall quality of life.

Of the projected 1 million enrollees reaching the limit, approximately 62% are projected to save over $1,000 in 2025, and 12% are expected to benefit by saving more than $5,000. Such significant reductions would likely make a measurable difference in a demographic that is particularly vulnerable to financial instability. However, it is important to note that about 6% of enrollees who reach the cap may face increased out-of-pocket costs, averaging an additional $268.

The distribution of savings isn’t uniform across the country. A staggering estimated 95% of Part D enrollees in 33 states and Washington, D.C., will enjoy lower total costs associated with reaching the cap. This information unearths the variability in financial relief among Medicare beneficiaries, highlighting the regional disparities that can affect access to affordable care.

The implications of this cap extend beyond just individual savings. The legislation not only introduces the $2,000 cap but also includes a $35 per month limit on insulin costs and provisions for Medicare to negotiate drug prices with manufacturers. Although many participants expect their premiums to rise in 2025, primarily due to price adjustments related to negotiations that will not take effect until 2026, the overall decrease in out-of-pocket expenses is projected to more than make up for these increases.

Critics may argue that rising premiums are a flaw in this policy, but the AARP report posits that the long-term effects of these savings will provide greater financial relief than the temporary spike in premium costs. The anticipation of reduced drug prices from the negotiated first round of medications set to begin in 2026 supports the forecast of additional savings for beneficiaries in the future.

Looking ahead, AARP’s analysis forecasts that roughly 3.2 million Medicare recipients will benefit from the out-of-pocket cap in 2025. By 2029, this number is expected to climb to 4.1 million enrollees, thereby significantly enhancing the financial wellbeing of an increasing proportion of Medicare beneficiaries. Given that Medicare envelops around 66 million individuals in the United States and that more than 50 million are enrolled in Part D plans, this policy has the potential for widespread impact.

The $2,000 out-of-pocket cap on prescription drugs emerges as a landmark provision aimed at alleviating one of the most pressing challenges faced by Medicare recipients. While the policy does not come without complexities, its potential to generate meaningful savings and facilitate access to necessary medications highlights a significant step towards improving the financial landscape for seniors dependent on Medicare. The ongoing analysis of the impact of this policy will be crucial in understanding its efficacy and identifying areas for future enhancement in drug pricing strategies.