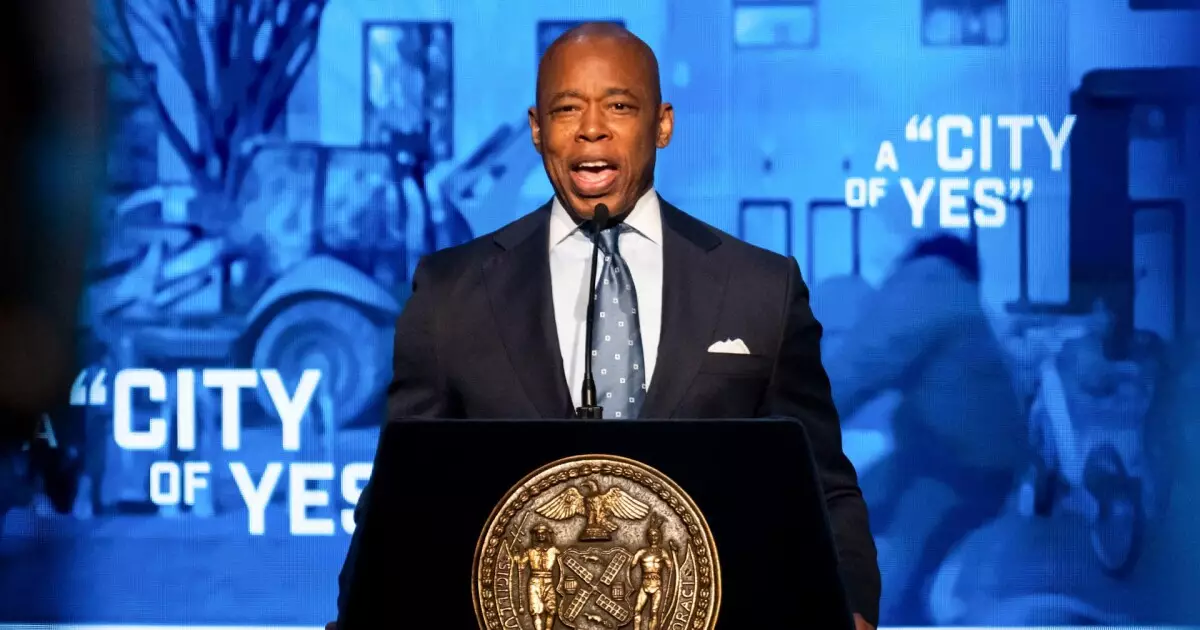

As the fiscal landscape of New York City evolves, Mayor Eric Adams has put forth a bold $114.5 billion budget proposal for the upcoming fiscal year beginning July 1. On the surface, this budget reflects a significant increase—more than $2.5 billion—over the current year’s expenditures. It suggests a newfound confidence in the city’s fiscal health, a stark contrast to the constraints faced in previous budgets. However, a deeper analysis raises questions about the sustainability of such financial optimism and the underlying factors driving this budgetary shift.

Unlike prior budgets under Adams, which revolved around austerity measures and attempts to squeeze savings from various city agencies, this proposal marks a clear departure. The absence of proposed cuts indicates not only a change in fiscal strategy but also an acknowledgment of a robust economy post-pandemic. Critics argue, however, that this optimism may stem from years of overly cautious budgeting practices rather than genuine fiscal robustness. The significant influx of tax revenues, particularly stronger-than-anticipated business tax receipts, is allowing Adams to forego the stringent measures that characterized earlier budgets.

Furthermore, a notable element of this year’s budget is its focus on bolstering social services, with hundreds of millions earmarked for these initiatives. The intention here is twofold: to address the pressing needs of the city’s residents and to gradually recuperate from the financial constraints imposed during the previous years. Yet this approach requires careful monitoring to ensure these expenditures do not lead to future deficits, particularly as the city faces projected budget shortfalls in the coming years.

One of the central topics of discussion surrounding the budget is the financial impact of the ongoing migrant crisis. With over 230,000 migrants arriving in New York City since April 2022, the administration initially estimated exorbitant costs, predicting a staggering expenditure of $12 billion by this month. However, actual spending has been around $6.91 billion—a substantial reduction that has allowed for greater fiscal flexibility.

This adjustment reflects the city’s successful implementation of strategies aimed at controlling costs, such as renegotiating service contracts and imposing time limits on shelter stays. As a result, the number of migrants residing in city-funded shelters has fallen from about 69,000 to fewer than 50,000. Nevertheless, some city officials caution that while these strategies have yielded short-term budgetary relief, they do not wholly address the complexities of the migrant situation. Sustainable solutions will hinge on both immediate aid and long-term integration policies.

While the current budget paints a picture of optimism, the proposed financial plan does not fully address looming fiscal challenges. Projected deficits of $4.2 billion in fiscal 2027, $5.4 billion in 2028, and $5.1 billion in 2029 cloud the city’s financial forecast. In an economic environment characterized by uncertainty, particularly with potential shifts in federal politics, these numbers warrant scrutiny and caution.

Furthermore, the ongoing commercial property vacancy rates, though forecast to decline, still contribute to a slower-than-expected growth in property tax revenues. Although tourism is anticipated to rebound to pre-pandemic levels by 2025, reliance on this rate of recovery may be overly optimistic. Without prudent management of the finances alongside strategic economic planning, New York may find itself grappling with a substantial budget shortfall exacerbated by external pressures.

In an effort to alleviate financial burdens on low-income families, Adams is advocating for his “Axe the Tax” initiative, which proposes the elimination of city income taxes for families earning at or below 150% of the federal poverty level. Although this policy could uplift many underprivileged residents, it also presents fiscal implications that must be thoroughly vetted. The cost of this initiative, estimated at $63 million annually, could impact the city’s ability to invest in other essential services if not balanced by alternative revenue sources.

Moreover, how the city navigates potential shifts in federal aid under a changing administration will play a pivotal role in shaping its financial future. As city officials engage in scenario planning, they are reminded of the challenges posed by interpersonal political dynamics, which may influence federal support and complicate funding efforts.

While Mayor Adams’ budget reflects new opportunities and strategic spending changes, it is underscored by an intricate balancing act between optimism and caution. As New York City emerges from the burdens of the pandemic, leadership must remain vigilant in addressing pressing fiscal realities and external uncertainties. The responsiveness to current challenges, paired with strategic policy innovations, will ultimately dictate whether this ambitious budget paves the way for sustainable economic recovery or leads to future fiscal constraints that could undermine the city’s resilience.