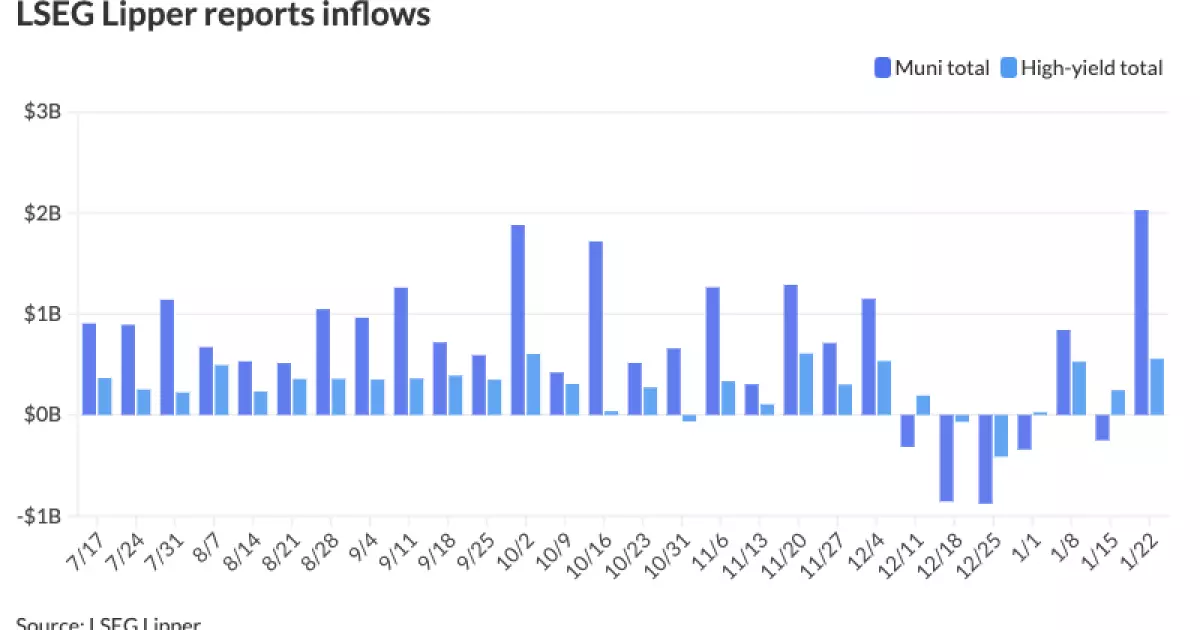

In the ever-evolving world of municipal finance, the recent developments provide a telling snapshot of market dynamics and investor behavior. As of Thursday, the municipal bond sector showed signs of instability, evidenced by a slower primary market juxtaposed against a tide of inflows to muni mutual funds exceeding $2 billion. Simultaneously, U.S. Treasuries faced rising yields over extended durations, painting a complex picture of economic sentiment.

Municipal bonds have often been heralded as resilient instruments despite prevailing uncertainties. However, recent trends indicate vulnerabilities. The notable outperformance of munis in the face of fundamental supply and demand challenges is noteworthy. Daily statistics reflect a two-year municipal to UST ratio of 64%, suggesting tighter competition for assets. Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital, underscores this anomaly, suggesting that while there is increased issuance and fewer redemptions, yields have not escalated as one might expect. This inconsistency calls into question the overarching health of the muni sector.

Olsan notes that many high-grade credits entered the market simultaneously, creating an avenue for investors who are keen on securing sound yield opportunities. For example, robust sales from Washington state and Nevada GOs achieved narrow spreads, indicating a healthy interest in these securities. This sentiment was echoed by comparable sales from AAA-rated entities like Fairfax County, Virginia, driving spreads that were comparably tighter. Such occurrences suggest that investors are willing to overlook inherent risks in preference for the yields available, even as the market experiences volatility.

The secondary market’s activity mirrors the cautious yet firm attitude taken by investors. Despite an alarming 30% drop in daily secondary trade volumes compared to the previous year, January’s inflows indicate a vibrant appetite for munis. Interestingly, AAA and AA-rated bonds exhibited modest outperformance, capturing a significant lion’s share of recent trades. This suggests a preference for higher-quality securities among risk-averse investors amid prevailing economic uncertainties.

Olsan’s analysis paints a picture of selective optimism. Municipal bonds, particularly in high-grade categories, now account for a more significant percentage of transaction volumes, outpacing expectations. This trend impacts market behaviors, encouraging participants to focus on actionable yields rather than being solely driven by fluctuating interest levels.

The performance metrics for different ratings reveal a clear differentiation in investor appetite. While the Bloomberg Barclays AAA index showed a gain of just 0.12%, the AA-rated index’s increase of 0.04% highlights a selective confidence in higher-rated securities. Conversely, single-A and Baa-rated indices report more substantial positive returns, revealing a diversification of investor strategy.

In the current climate, the Massachusetts Development Finance Agency’s recent pricing of revenue refunding bonds reflects attractive yield offers which, combined with substantial investor interest, indicate a continued commitment to municipal bonds despite the market’s inherent risks. This dynamic was further bolstered by the competitive pricing of various bond series, which showcased robust demand and evident investor confidence.

The broader economic backdrop also factors into the shifting dynamics facing municipal issuances. The SIFMA Swap Index has seen an uptick in yield, raising questions about underlying market sentiments. As yields in the municipal bond space decline, investor strategy appears to lean toward accumulating diversified exposure in higher-rated credits rather than solely focusing on traditional high-grade assets. This shift indicates an evolving risk assessment as investors seek to navigate the complexities of the current landscape.

Overall, the interplay between primary issuances and secondary market activity is emblematic of a broader search for yield, even amidst weaker supply-demand fundamentals. Investors appear increasingly selective, drawn not just by lower yields but also by the potential for growth in emerging financial products.

As we reflect on this multifaceted scenario within the municipal bond market, it becomes clear that we are witnessing a transformative phase. While yielding positive sentiments in some respects, there remains an overarching caution as investors strive to tread carefully through the intricacies of fluctuating yields and complex market dynamics. The juxtaposition of inflows against subdued market performance underscores the need for adaptive strategies in finance, articulating the importance of understanding nuanced trends in municipal finance as the landscape continues to evolve.