In the recent finance landscape, municipal bonds have demonstrated resilience and a subtle upward shift, amid fluctuating economic indicators. The steady performance of this asset class, particularly following the announcement of significant infrastructural investments like the $2.5 billion Brightline West Passenger Rail Project, highlights underlying dynamics in the municipal market. This article will dissect these elements further, considering both the macroeconomic backdrop and specific market movements.

On a typical trading day, we witness a backdrop where U.S. Treasury yields experience a minor decline, and equity markets show signs of fatigue. This is likely advantageous for municipal bonds, providing a fertile environment for their growth. Notably, as reported, the two-year municipal yield compared to U.S. Treasury (UST) bonds held at approximately 62%, with marginal fluctuations noted across different maturity brackets. The stability in these ratios suggests that the market is evaluating the relative value of tax-exempt securities against taxable counterparts.

The tax-exempt market’s recent performance is particularly remarkable, reflecting an optimistic sentiment amid diminished supply levels. The week in focus was framed by $18 billion in reinvestment capital arriving into the market, juxtaposed against a scant $4.3 billion in new issuance—a combination that typically favors existing bondholders by boosting demand and potentially elevating prices.

Inflation remains a significant force in the financial landscape, with recent tariff-driven concerns pushing the 10-year UST yield briefly to notable heights in January. However, as market adjustments occur, yields ultimately remained stable at around 4.54% by month end. Here, market analysts, such as James Pruskowski, attribute ongoing volatility to shifting narratives surrounding macroeconomic policies and emergent technologies, particularly in the AI sector. The interplay of economic indicators, global events, and investment flow showcases an intricate dance that will likely continue to influence the bond market.

The mention of ‘Deepseek’—a player reshaping the AI industry—indicates how technology continues to intertwine with financial forecasting. This relationship is essential, highlighting how advancements in technology can influence decisions surrounding risk and investment in various asset classes, including municipal bonds.

Recent bond issuances, particularly tied to substantial projects such as the Brightline implementation in California and Nevada, point to an increasing focus on infrastructure finance. The pricing for various tranches of these bonds reveals competitive yields appealing to investors seeking sustainable options. For instance, green revenue bonds associated with Brightline present terms that are notably attractive, reflecting the market’s growing appetite for environmentally focused investment opportunities.

Moreover, other notable issuances, such as airport revenue bonds from Miami-Dade County, signal strong institutional demand. These funding mechanisms are critical as they support vital services and drive job creation while contributing to regional economic stability.

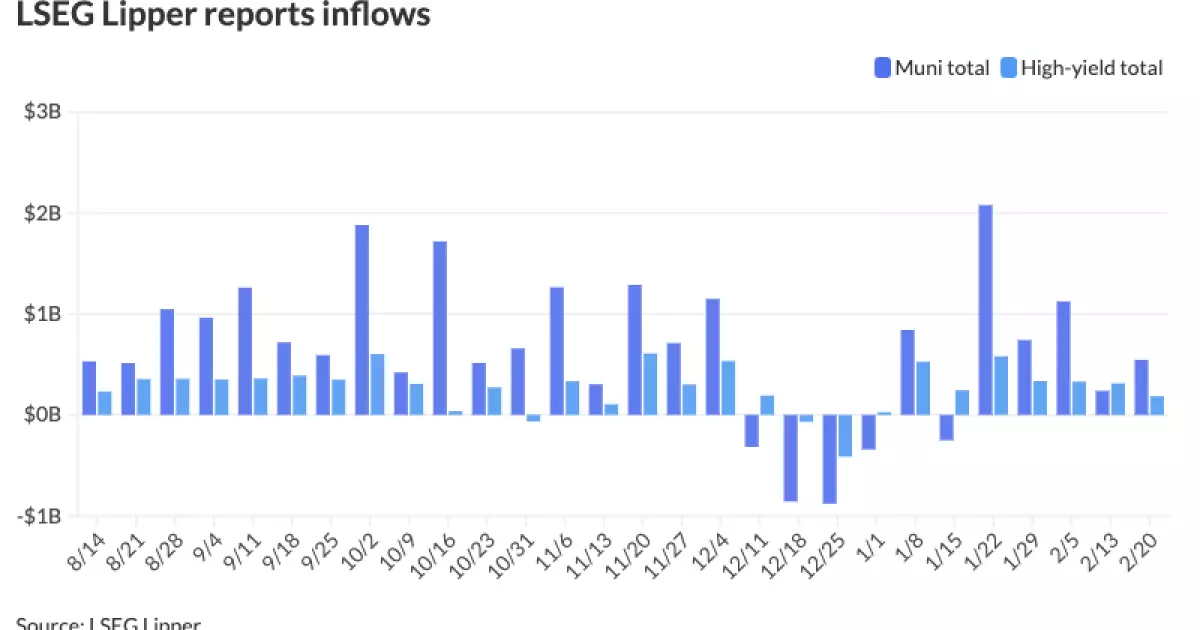

Investor behavior plays a crucial role in the dynamics of municipal bond performance. The latest data shows significant inflows of $546.3 million into municipal bond mutual funds, following substantial inflows the previous week. Such activity indicates a renewed confidence among investors eager to capitalize on the relative safety and tax advantages of municipal bonds. Furthermore, while high-yield fund inflows have moderated, this segment still draws interest—underscoring a nuanced investor approach to risk and return in the current market climate.

Interestingly, the outflow observed in tax-exempt municipal money market funds suggests that while long-term investments are favored, shorter-term holdings may be viewed as less attractive amidst evolving market conditions. The broader impact of these decisions will undoubtedly ripple through the municipal landscape as investors adapt their strategies in response to ongoing economic developments.

As we look beyond the February horizon, market analysts from firms such as J.P. Morgan emphasize potential challenges ahead as reinvestment capital may dwindle. This could lead to sporadic opportunities for investment at potentially lower price levels during the traditionally challenging months of March to May. These technical challenges, however, are balanced by supportive dealer practices, indicating a robust response from market participants to navigate upcoming volatility.

Given the historical context of long-dated high-grade municipal yields nearing one-year highs and UST rates climbing towards three-year peaks, investors are encouraged to evaluate their strategies carefully. Forecasting across various timelines suggests that while immediate volatility may be expected, longer-term trends point to a potential decrease in rates by 2025, making the current yield landscape appealing for astute investors.

As the municipal bond market continues to navigate its path through evolving economic indicators and market sentiment, opportunities continue to abound. The intersection of infrastructure investment and investor confidence sets the stage for a potentially lucrative environment for those attuned to the nuances of municipal finance.