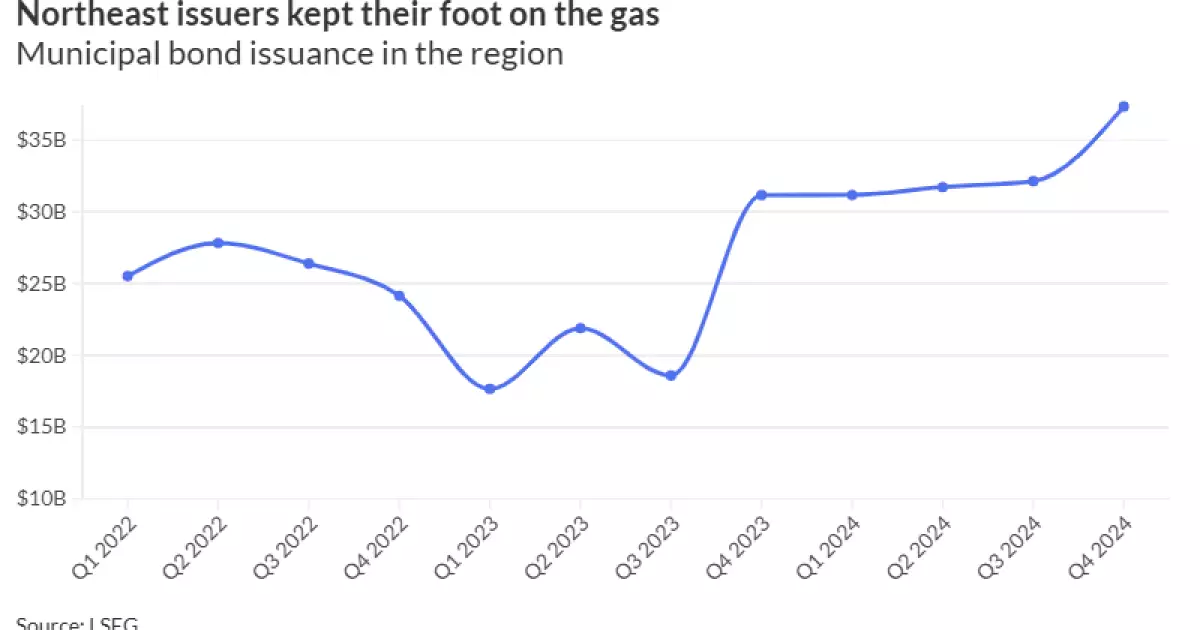

The Northeast region of the United States witnessed unprecedented activity in its municipal bond market throughout 2024. A remarkable surge in issuance, reaching an impressive $132.3 billion, signals not only a renewed confidence in local governments and infrastructure projects but also highlights the overarching trends shaping public financing mechanisms amid varying economic conditions.

The municipal bond market in the Northeast experienced a staggering $43 billion increase in issuance compared to 2023. This 47.9% year-over-year growth not only set a new record—surpassing the previous high of just under $130 billion established in 2020—but also reinforced the Northeast’s position as a significant player in the national municipal bond landscape. Such robust growth indicates a heightened demand for financial instruments that enable state and local governments to fund essential services and infrastructure projects.

The increase in new-money bonds, which rose by an impressive 39%, alongside a dramatic 76% increase in refunding bonds that totaled $17 billion, demonstrates a proactive approach by municipal issuers. It reflects a strategic initiative to enhance funding availability while capitalizing on favorable interest rates. Furthermore, the near doubling of combined new-money and refunding bonds volume to $14.5 billion highlights a trend of adaptability and responsiveness to evolving market conditions.

Among the various sectors that dominated the bond market in the Northeast, transportation emerged as the frontrunner, achieving a 67% increase and amounting to $28.5 billion. This growth mirrors broader trends in urban development and infrastructure maintenance that seek to improve connectivity within the region. The education sector followed closely behind, with a growth of 40%, signifying sustained investment in schools and colleges, despite overarching challenges.

Conversely, the healthcare sector experienced a staggering 198% increase, reaching $10 billion, showcasing the growing acknowledgment of health infrastructure as a critical area for public funding, especially in the wake of the COVID-19 pandemic. Notably, however, higher education institutions witnessed a drastic decline in issuance of 76.8%, amounting to only $279 million, bringing attention to the sector’s ongoing struggles with capital management and enrollment challenges amid shifting demographic demands.

New York continued to assert its dominance as the leading bond issuer in the Northeast, with total sales amounting to $58.8 billion, a 39% increase from the previous year. Pennsylvania and Massachusetts followed suit, each showing significant increases of 36% and 67%, respectively. Notably, states like New Hampshire demonstrated an extraordinary leap of 251% in issuance, indicating emerging financial strategies that could reshuffle the traditional hierarchy of state issuers in the coming years.

The fluid landscape of issuance patterns also saw Maryland making significant gains, breaking into the top five issuers with nearly double the 2023 volume. Meanwhile, Delaware and Puerto Rico also displayed remarkable growth trajectories, contributing to an evolving competitive atmosphere that fosters innovation in public finance.

The competition among the top issuers within the Northeast underwent considerable transformations in 2024. The New York City Transitional Finance Authority retained its top position with sales of $10.6 billion, closely followed by the Dormitory Authority of the State of New York. Interestingly, agencies like the Triborough Bridge and Tunnel Authority, which ranked fifth nationally in 2023, saw a decline in their issuance, related to broader uncertainties surrounding infrastructure funding and regulatory challenges.

Conversely, new players like the New Hampshire National Finance Authority emerged, indicating potential shifts in the geographical dynamics of bond issuance. These changes illuminate the competitive landscape in which established entities must continually adapt to retain their status.

In terms of underwriting prowess, BofA Securities led the way, facilitating $27.9 billion across numerous transactions. This highlights the essential role that financial institutions play in navigating the complexities of municipal fundraising and the broader implications for project execution and capital management.

Moreover, advisory firms like the Public Resources Advisory Group maintained strong presences, epitomizing the importance of expert guidance in ensuring that municipalities leverage available resources effectively while adhering to compliance and regulatory frameworks.

The growth evidenced in the 2024 municipal bond market in the Northeast underscores a vibrant, adaptive financial ecosystem committed to meeting infrastructural and social needs. As issuers navigate uncertainties while leveraging innovative financing strategies, the outlook for future issuance remains bright. This dynamic environment reflects not just a local public finance story but a test case for how municipalities across the country can harness growth even in challenging economic climates. The insights gleaned from 2024 will likely reshape bond issuance strategies moving forward, fostering an era characterized by resilience and forward-thinking.