As the municipal bond market experiences a notably stable phase, the dynamics between tax-exempt bonds and U.S. Treasury yields warrant examination. On a recent Thursday, the market displayed minimal fluctuations, noting that the inflow of funds into municipal bonds continued steadily. At the same time, U.S. Treasury yields climbed marginally, leading to dips in equity markets. Such contrasting movements prompt an analysis of investor behavior and yield ratios within the sector. For instance, the two-year ratio of municipal bonds to UST stood at 62%, with figures ranging up to 86% for the 30-year benchmarks. This data indicates a broadly consistent pricing mechanism in a time of market volatility.

Kim Olsan, a senior fixed-income portfolio manager at NewSquare, commented on the nature of recent market actions, suggesting that while there is growing interest in long-term maturities, this has not translated into significant yield enhancements for municipal bonds. Particularly, despite a heightened demand for tax-exempt securities, the yield on 30-year AAA-rated bonds needs to adjust upwards to meet annual averages. Such a nuanced perspective illustrates the challenges of aligning supply with investor demand in an environment where external rates are shifting.

In observing the secondary market, the flow of funds appears indicative of broader investor strategies, as recent data showed a pronounced shift toward longer-term maturities. Maturities extending beyond 12 years accounted for 55% of total tax-exempt volume—a notable increase from previous periods. This trend suggests a growing preference among investors to lock in longer-duration securities, particularly as some high-grade issuers, such as state general obligation bonds, remain attractive due to favorable yield spreads. Olsan highlighted trading examples, underscoring that securities like Ohio GOs have provided appreciable yield advantages relative to their shorter counterparts.

The transition of capital flows into the municipal market is noteworthy particularly when considering newly issued securities. Recent offerings from state authorities in South Carolina and New York City, which witnessed upsizing due to strong investor demand, signal a vibrant primary market. Such movements are increasingly essential for balancing out the market’s supply-demand equation, especially as redemptions are anticipated in the upcoming months, potentially offering opportunities amid a volatile backdrop.

As the marketplace braces itself for the upcoming issuance and redemption cycle, analysts are contemplating the negative supply projected for regions like New York and New Jersey. With New York facing an estimated negative balance of $2.21 billion, and New Jersey a shortfall of $1.06 billion, there could be significant implications for local investors. Olsan emphasizes that in-state buyers will face intensified competition for available tax-exempt products, thus enhancing demand for high-quality credits. The in-state exemption continues to play a pivotal role, elevating these securities’ appeal and further complicating the pricing dynamically across various maturity horizons.

Additionally, California presents another area of interest, where negative supply scenarios are tightening yield spreads for buyers, compelling a closer look into the investment landscape. These regional trends beckon investors to pay attention to localized market conditions and the potential for changes in credit risk profiles, as municipalities adapt to shifting fiscal realities under the strain of negative supply.

Looking ahead, it is vital to acknowledge that market conditions are volatile, with unpredictable movements potentially leading to a mixed response from credit spreads in March. Several states, like Pennsylvania, forecast a positive net supply, implying that their general obligations could face widening spreads due to a greater supply relative to demand. In contrast, areas with constrained supply could benefit from strengthened market positions for existing bonds.

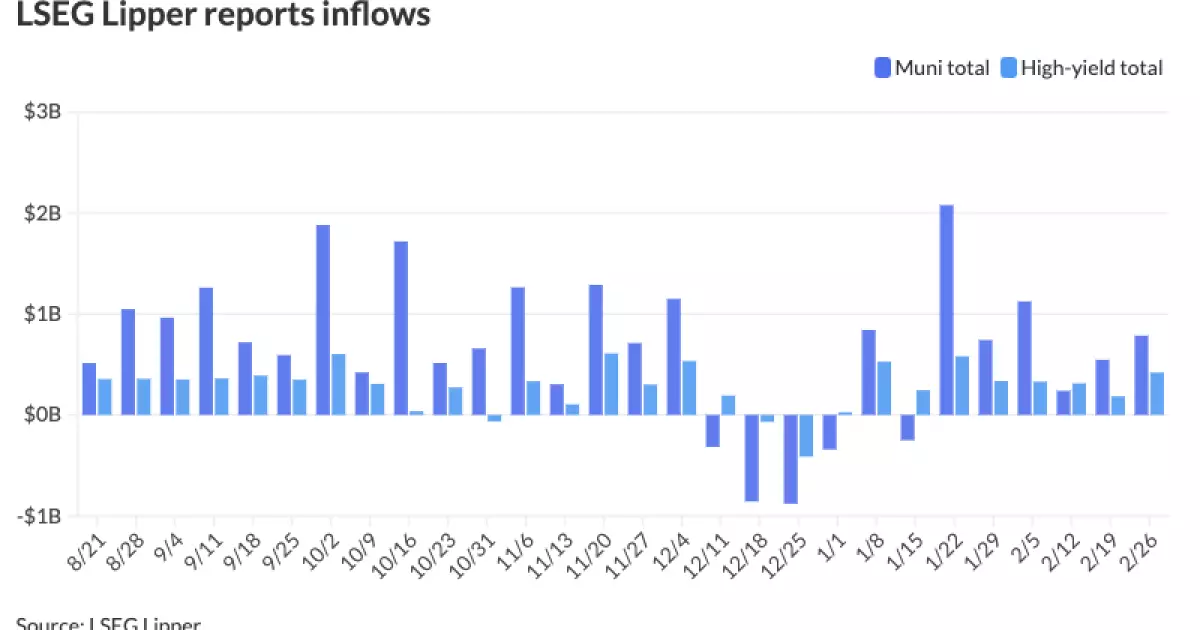

Investor inflows into municipal bond mutual funds reveal significant interest, as evidenced by a week-on-week growth of $785.5 million in a recent tally. This indicates ongoing confidence in the municipal sector despite rising Treasury yields. Additionally, with high-yield funds also attracting substantial inflows, it’s clear that investor sentiment leans towards the tax-exempt market for yield generation.

While challenges persist regarding rising yields and fluctuating spreads, the municipal bond market exhibits resilience marked by sustained demand for tax-exempt securities. The interplay between investor behavior, supply constraints, and market conditions sets the stage for an intriguing landscape in the months to come. As both challenges and opportunities unfold, market participants must remain agile and informed to navigate this complex investing environment effectively.