The recent performance in the municipal bond market presents a gloomy picture. With yields escalating up to nine basis points in various segments, a significant weakness has emerged, raising alarm bells for investors. This precarious situation is exacerbated by the mixed signals emanating from U.S. Treasury yields, along with the unsettling sell-off in equities. The confluence of poor performance and rising uncertainties is not just a blip on the radar; it reveals a trend that could jeopardize future investments.

Cooper Howard, a fixed-income strategist at Charles Schwab, rightly points out that this volatility transcends short-term fluctuations. With Washington’s policy discussions teetering on the edge, including fraught tariffs and other economic measures, investor confidence is failing. The Big Picture is one of apprehension, where market participants are left trying to decipher which risk will dominate the headlines next. As the narrative continues to shift and evolve, the reality is clear: this isn’t just a temporary downturn but a symptom of deeper-rooted issues that must be addressed.

Liquidity Woes: The Silent Killer

Further compounding the issues in the market is a stark decline in liquidity. As James Pruskowski, chief investment officer at 16Rock Asset Management, aptly observes, the current volatility is not merely a passing phase. The consequences of thin liquidity ripple through markets, making it challenging for buyers to emerge. When the equilibrium of buying and selling is disrupted, price stability is jeopardized. To make matters worse, long-standing market participants may unearth opportunities during this turbulent phase off volatility; however, new entrants are likely to hesitate, and rightfully so. A lack of capital flows can only fuel longer-term insecurities.

Moreover, the timeline for recovery appears uncertain, as key indicators such as employment reports and investment demand offer no clear path forward. This ambiguity dampens prospects for stability, pushing seasoned investors further into a corner. Why would anyone stake their capital in a market fraught with such risk? It seems entirely plausible that we could witness a slowdown affecting the overall municipal landscape in the coming months, driven by rising interest rates and ongoing uncertainty regarding political maneuvers.

Structural Headwinds: Weaker Credits Under Pressure

While the market shows relative strength among AAA and AA-rated bonds, the inherent risks of weaker credits should not be ignored. For investors, the allure of higher yields can quickly fade in the face of substantial rating risks and inherent structural challenges. The notion that weaker credits will remain under pressure is not a mere hypothesis; it is an inevitability grounded in observed market patterns.

This disparity in credit quality offers a cautionary tale for those diving into the market with blind optimism. Sure, munis may still look attractive on the surface, boasting tax-equivalent yields above 7% for those in high-tax brackets, but will that compensate adequately for the risks faced by lower-rated bonds? It seems the collective memory of past defaults hasn’t faded enough to dismiss the real concerns around credit quality. The backdrop of uncertainty rapidly becomes a breeding ground for bond defaults, and astute investors must take heed.

March mayhem: The Historical Context

Each March, investors brace themselves for potential chaos, evidenced by historical data dating back to 1980 indicating a median monthly return of only 0.03%. In a month that has traditionally been unfriendly to total returns, what significant changes could possibly prompt a different narrative this year? The odds seem stacked against any opportunity for growth. It’s almost as if March is an annual trapdoor that investors stumble into, only to find themselves amid dismal returns and regrettable decisions.

As upcoming tax deadlines loom, high-net-worth individuals will inevitably liquidate their muni holdings, threatening to amplify the undercurrents of instability. The habits formed through historical trends seem hard to overcome, suggesting that investors will continue to bring their tax season anxieties into an already strained market—the imminence of selling creates further downward pressure on prices.

Fund Flows: A Fragile Resilience in the Face of Adversity

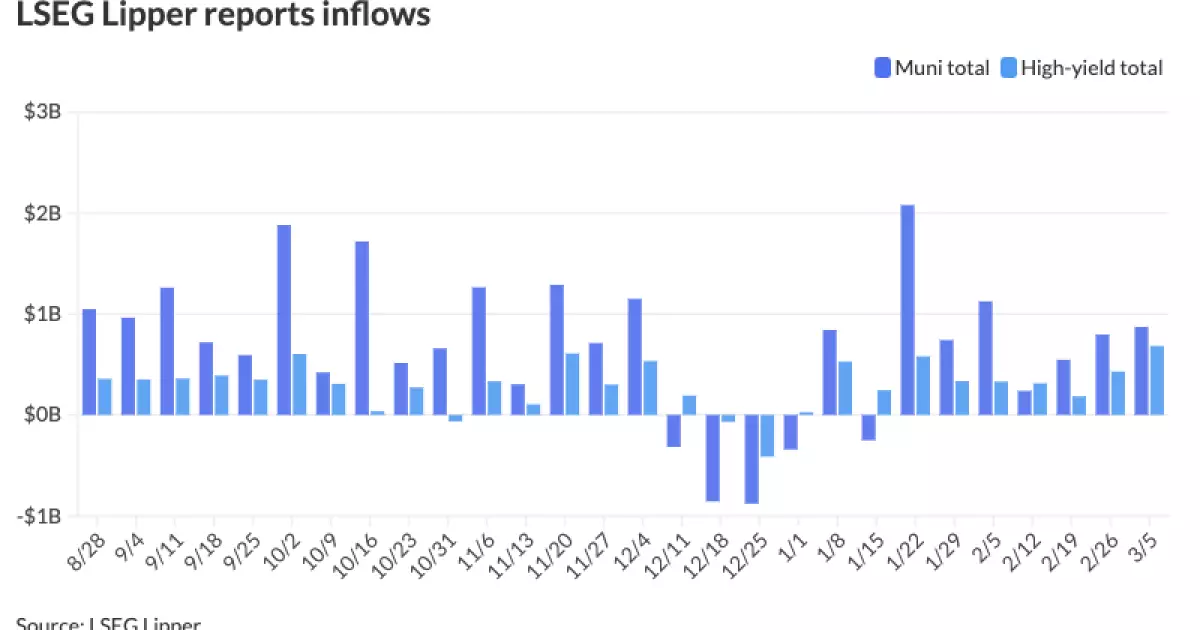

Despite the mounting challenges faced by the municipal bond market, the influx of $872.2 million into municipal bond mutual funds indicates a flicker of resilience. However, is this mere speculation on the part of investors? High-yield fund inflows of $681.8 million provide some evidence of an appetite for risk, but the overall market environment remains fragile. Why does it take a narrowly positive data point to instill any semblance of hope in an otherwise convoluted scenario?

Investors appear motivated by the allure of short-term gains, but this raises pertinent questions about their long-term orientation and the sustainability of such inflows amid volatile conditions. Can safety be found within high-yield bonds in a marketplace resonating with alarm? Perhaps established investors believe that benign conditions will eventually re-emerge; however, it is essential to tread cautiously.

The world of municipal bonds stands at a crossroads, tinged with uncertainty while grappling with structural, liquidity, credit, and historical challenges. The game may be shifting, but whether the players are prepared for the changing dynamics remains to be seen.