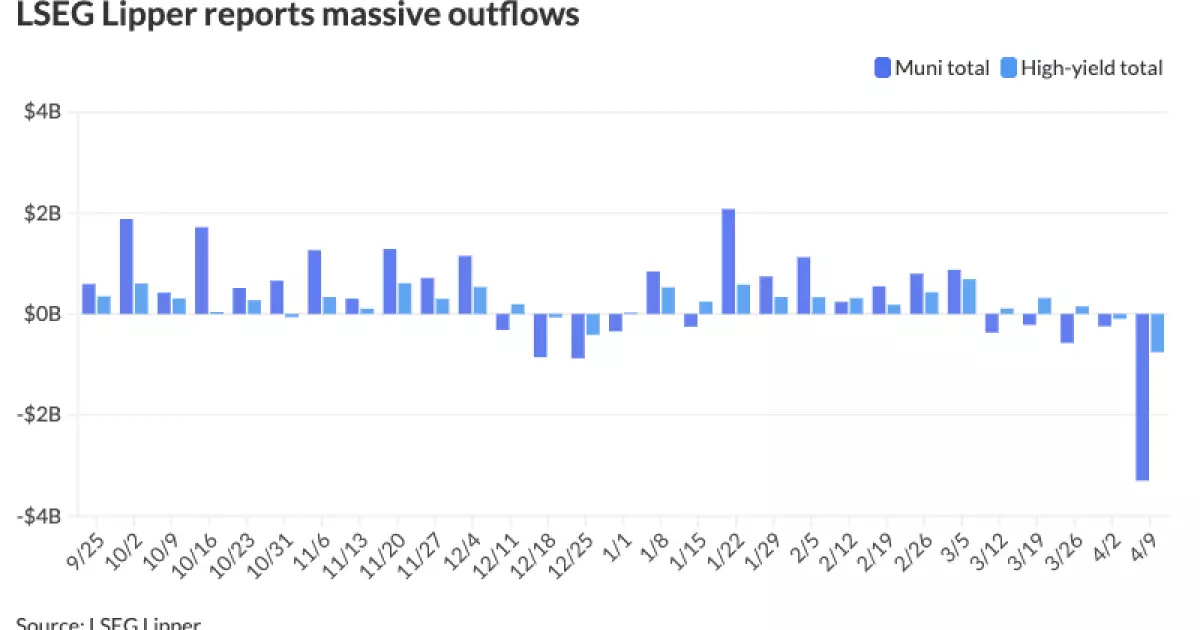

In recent days, the municipal bond market has experienced dramatic swings, culminating in a staggering outflow of $3.3 billion from municipal bond mutual funds, marking the most severe drop since June 2022. This volatility brings to light several underlying issues affecting not just municipal bonds, but the broader economic landscape that influences investor sentiment. As municipal bonds appear to walk a tightrope between recovery and decline, it’s crucial to delve deeper into the factors propelling this crisis and what they signify for investors going forward.

Inflation Reports: A Double-Edged Sword

On the one hand, the release of a lower-than-expected Consumer Price Index (CPI) report has provided a glimmer of hope, indicating that inflation may be easing—rising only 2.4% year-over-year against an anticipated 2.6%. However, this positive news may not have the stabilizing power that Investors hope for. Many market experts, including Mark Paris from Invesco, argue that unless the CPI’s next report is a dramatic shock, the market was likely poised to absorb its benefits. Yet the immediate fallout has created an air of trepidation, igniting a cycle of volatility rather than certitude.

Indeed, the optimism surrounding inflation may simply mask deeper concerns about long-term sustainability. Economic indicators can tempt investors, yet the knee-jerk reaction of the bond market illustrates just how fragile confidence is. The “good news” surrounding declining inflation could easily lead to complacency, reinforcing the belief that volatility in the financial markets, specifically in the realm of munis, is not over yet.

The Tariff Threesome: A Recipe for Market Mayhem

The uncertainty surrounding tariffs has exacerbated this turmoil, providing a turbulent backdrop against which municipal bonds must operate. The announcement of a 90-day tariff extension was meant to soothe tensions, but despite transient relief, it left the market grappling with larger existential questions regarding U.S.-China relations. As Michael Pietronico, CEO of Miller Tabak Asset Management, aptly pointed out, the ongoing tariff discourse will continue to be a significant driver of volatility, complicating any attempt to stabilize the bond market in the near term.

The threat of tariffs can chill investment, with potential repercussions not just for municipal bonds, but for the broader equity markets as well. This situation highlights a fundamental fracture in our economic philosophy: investors are eagerly searching for stability yet are consistently met with uncertainty. While the notion of a temporary settlement may offer some confidence, we simply cannot ignore the broader implications it carries—an environment defined by fear and hesitation.

The Dire Impact of Withdrawal Trends

Amidst the turbulence, it’s essential to recognize the seriousness of the ongoing withdrawal trend from municipal bond mutual funds. Over five consecutive weeks, these funds have seen massive outflows, with the latest figures signaling that investors are losing faith in their municipal allocations. This trend raises unsettling questions: Are investors overly pessimistic, or are they simply responding to undeniable risks positioned against municipal bonds?

Tom Murphy, a senior analyst at Morningstar, pointed out that the tapering demand began even before the recent tariff-induced volatility. This suggests a deeper malaise within the municipal bond market that is not merely a reaction to external shocks but rather signals an underlying issue related to excess supply and persistent uncertainty regarding tax policies. In the wake of oncoming financial pressures, it is vital to address how the municipal bond market can adapt to changing investor sentiments—especially when trends suggest that the supply-demand balance may tilt unfavorably.

Market Participant Sentiment: A Reflective Low Point

As market participants navigate this precarious environment, their fluctuating confidence illustrates a broader truth about financial markets: stability is an illusion. As Paris noted, traders felt a temporary sense of confidence on Thursday, but the upcoming days loom ominously. If “yield shocks” manifest, the market could plummet back into its prior chaos, albeit not necessarily at the extremes experienced at the beginning of the week.

Investors looking for stability amid the uncertainty of the Tariff Ages are stuck in a precarious position, forced to balance their innate risk aversion with the necessity of navigating a volatile landscape. What remains clear is that the intersection of municipal bonds with ongoing economic policies will likely define market performance for months to come. Hence, careful consideration of individual investment strategies, especially within this unpredictably shifting landscape, is of utmost necessity.

In this inflation-inflected era, the municipal bond market is more than just a series of numbers; it’s a reflection of broader economic tensions, investor anxieties, and the ongoing saga of policy interplay. The challenges are daunting; nevertheless, an informed approach and greater responsiveness to market shifts could prove instrumental in navigating this turbulent climate.