The recent turbulence in the municipal bond market illustrates the precarious balance between government policies and market stability. Following President Donald Trump’s announcement of a 90-day pause on retaliatory tariff plans, municipal bonds had a notable reaction. Yield curves saw significant reductions, particularly in triple-A bonds—falling 30 to 50 basis points. At a glance, the bond market seemed to recover from a downward spiral characterized by unprecedented volatility, including historically steep single-session losses. Nevertheless, digging deeper, we see that this relief could merely be a band-aid over a more profound underlying issue.

The comment from Alex Chilton, Head of Municipal Securities at Morgan Stanley, underlines the gravity of what we’re witnessing. Some of the largest one-day adjustments in municipal yields occurred not just in times of economic crisis, like March 2020, but also during this recent spell. When money managers reference a “negative liquidity environment,” it is not merely jargon; it’s a reflection of investor anxiety. The recent back-and-forth in the bond market, driven by policy decisions, should raise alarms about the volatility stemming from unpredictability in trade relations.

The Quantity Behind the Quality: Trade Volume Insights

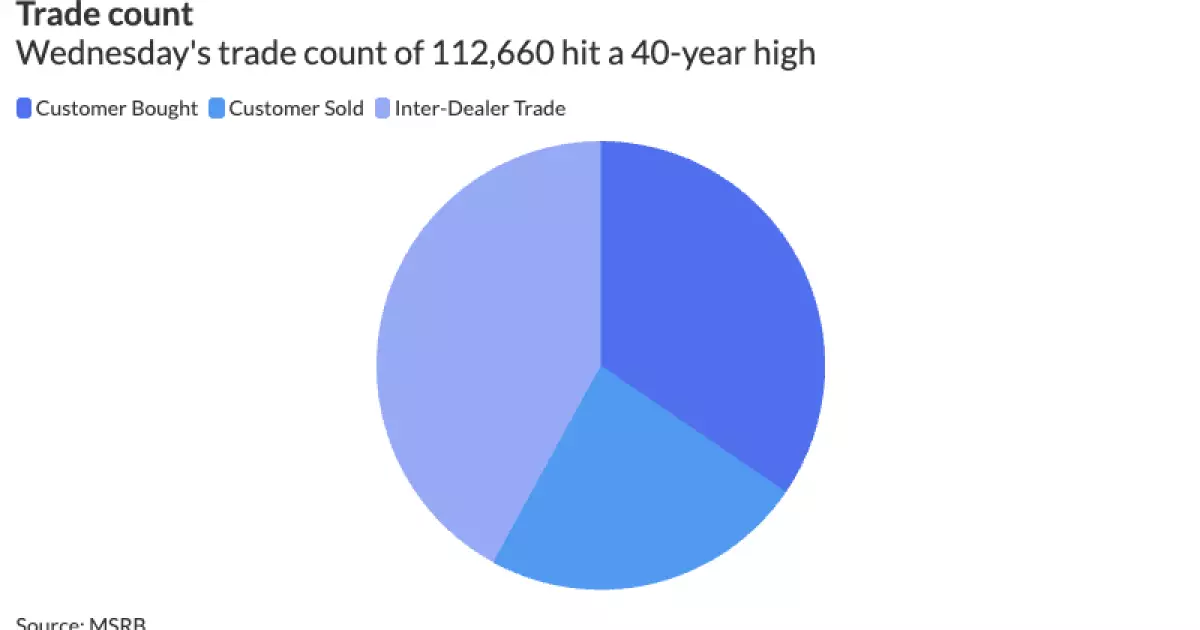

Looking at trading volumes offers another layer of revelation. On Wednesday, the municipal market logged a staggering 112,600 trades—the highest number since 1995. The sheer volume of trades, amounting to $32.5 billion, indicates a market grappling with both anxiety and an urgent need to reposition portfolios. What becomes clear is that even a glimmer of optimism from the White House can trigger a trading frenzy, yet the question remains: Is that trading backed by confidence or merely a reaction to short-term news?

Sean Carney, the Chief Investment Officer at BlackRock, captured this contradictory sentiment well; the underlying tone of the market was still heavily tainted by liquidity concerns. It’s almost ironic that as trading volumes rise, trust in the market diminishes. Investors faced a situation where selling and buying became nearly impossible in just a few days, sparking worries about accessibility to quality assets. The trading statistics expose a labyrinth of sentiment driven by perceived fear rather than rational planning, highlighting a weak fabric stitching the municipal bond market together.

Yield Curves and Investor Sentiment: Navigating Uncertainties

The immediate reaction to yield adjustments following Trump’s tariff announcement serves as a litmus test for investor sentiment. The yield movements paint an image of a market caught off-guard, grappling with what could be seen as misleading optimism during volatile periods. As yields adjusted—some are even speculated to have plummeted significantly during just one session—it highlights how easily investors can shift their outlook on the state of municipal bonds.

Sure, yields appear to bounce back after positive news; however, the lasting effects of prior downturns cannot be overstated. What about the mixed signals from the treasury market? Bond investors often find themselves in a bind, balancing between fear of losses and the allure of gains. The fluctuations, viewed through the prism of this recent tariff pause, bring to light a dismal reality: the municipal market still leads a perilously low-risk narrative that may not resonate with fiscal prudence.

In dissecting the implications of these recent developments, one cannot ignore the broader repercussions of maintaining the equilibrium between domestic policies and investor confidence. Hedge cases in trading may lead us to think we’re on the cusp of recovery, but one must remember: any misstep could send the market back into turmoil.

The situation remains delicate as we navigate these challenges; the market could be a reflection of political decisions made far removed from the day-to-day complexities of municipal finance. For all who invest, the awareness that they are entangled in a labyrinthine web of politics and fiscal policies becomes vital for maintaining portfolio integrity amidst the chaos. Only time will reveal whether this pause will usher in a sustained recovery or unmask deeper vulnerabilities that threaten the very foundation of municipal finance.