Seaport Research Partners has raised eyebrows in the investment community by issuing a sell rating on Nvidia, a move that speaks volumes in light of the company’s recent stock performance. With a price target set at $100 per share—implying more than 8% downside from its recent close—this bold stance contrasts sharply with the prevailing optimism surrounding AI investments. Investors should take heed: financial exuberance often leads to inflated valuations, and Nvidia’s meteoric rise may already be baked into its stock price.

The Erosion of Investor Confidence

Despite the euphoric gains of 239% in 2023 and 171% in 2024, Nvidia’s stock has taken a more than 21% dive this year, a stark reminder that the market’s highs can quickly transform into lows. A concerning trend is emerging: when investor confidence wanes, it can catalyze rapid sell-offs. A critical examination reveals that the AI sector isn’t immune to economic fluctuations; recession fears exacerbated by rising tariffs under the Trump administration compound the instability. Given these circumstances, can Nvidia maintain its previous growth trajectory?

Is AI Overhyped? Examining Real-World Impact

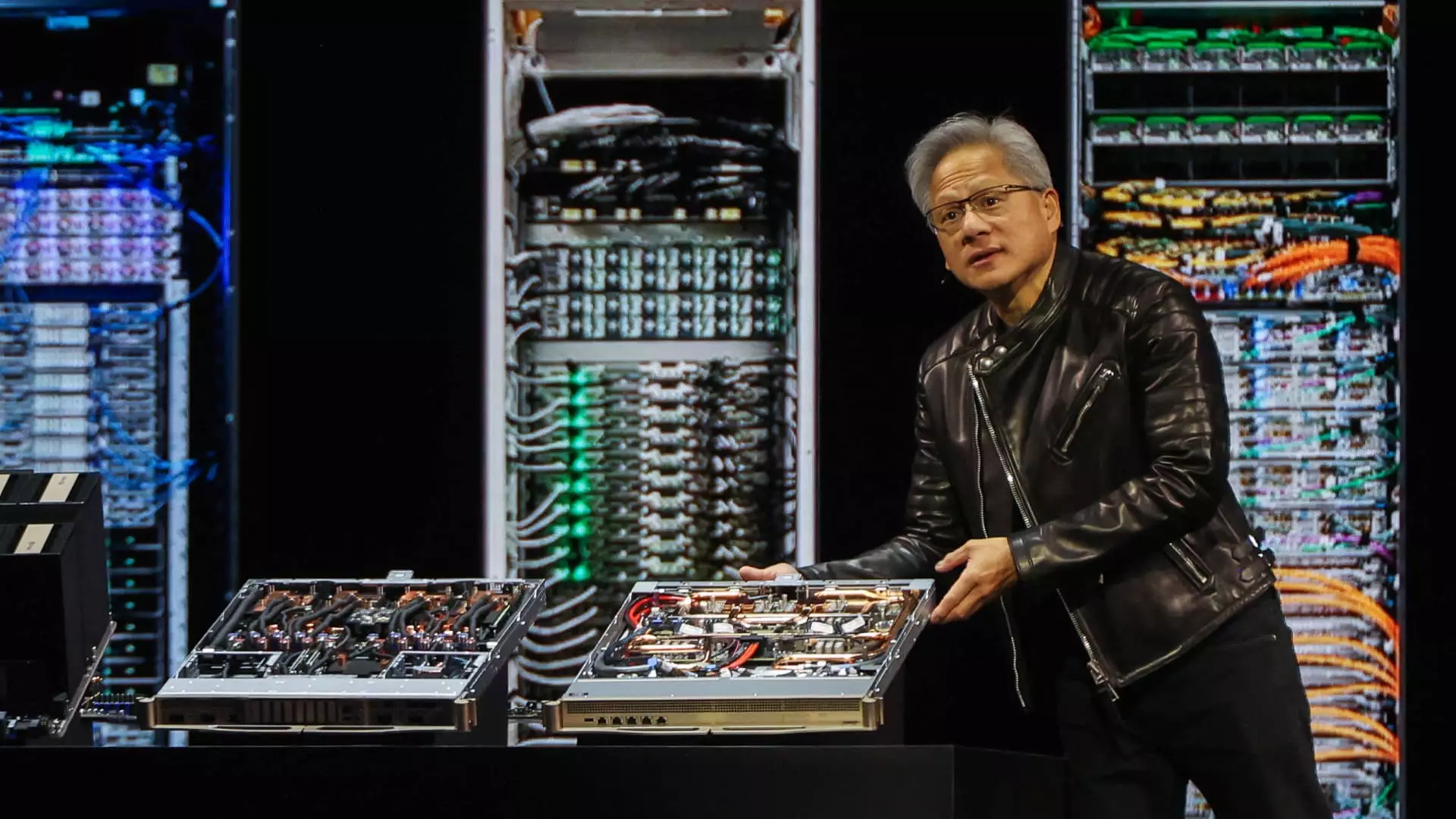

As Jay Goldberg notes, the anticipation for robust profits driven by significant AI investments has yet to materialize. Companies ranging from tech titans like Microsoft and Alphabet to emerging competitors are investing heavily in AI, yet the tangible outcomes remain ambiguous. In a landscape where the utility of AI is in question, one must wonder if the industry’s initial promise is overstated. Compounding this skepticism is the arrival of cheaper alternatives to Nvidia’s offerings, such as China’s innovative DeepSeek language models.

Competition Breeds Resourcefulness

The design strategies of major hyperscalers signify a worrying trend for Nvidia. As tech giants begin to develop their own chip alternatives, Nvidia’s customer base may erode as companies pivot to in-house solutions. This escalating competition pushes the boundaries of innovation but narrows Nvidia’s previously substantial market share. Thus, the question remains: can Nvidia adapt swiftly enough to retain its status as an industry leader?

Analyst Discrepancies: A Cautionary Tale

Seaport’s cautionary perspective starkly contrasts the majority opinion on Wall Street, where approximately 87% of analysts recommend buying Nvidia stocks. The disparity in forecasts indicates a disconnect in understanding the narrative at play. However, reliance on overwhelming bullish sentiment can obscure underlying vulnerabilities, hinting that the consensus may be dangerously complacent.

As the AI bubble continues to swell, investors would be wise to parse the nuances of growth potential against market realities. The question isn’t just about Nvidia’s current standing but rather its capacity to navigate an increasingly tumultuous landscape. Only time will tell if this AI powerhouse can withstand the pressures that could well deflate its once-soaring stock price.