Recent weeks have exposed the municipal bond market to significant uncertainty as President Trump’s tariff pronouncements rippled throughout various sectors. However, the true narrative reveals a resilient bond market that, despite the chaos, has shown unexpected strength and adaptability. Jamie Doffermyre of Truist Securities underscored this recovery at the Southeast Public Finance conference, indicating that while the yields exhibited fluctuations, the municipal landscape is more stable than many may perceive.

The “Liberation Day” benchmark, marked by a five-year MMD yield ranging from 2.81% to 2.96%, is a testament to this resilience. While daily variances appear daunting, a closer examination suggests an underlying stability. As traders and investors grapple with macroeconomic signals, the lasting potential of municipal bonds emerges brighter than superficial readings would imply.

Understanding Yield Trends

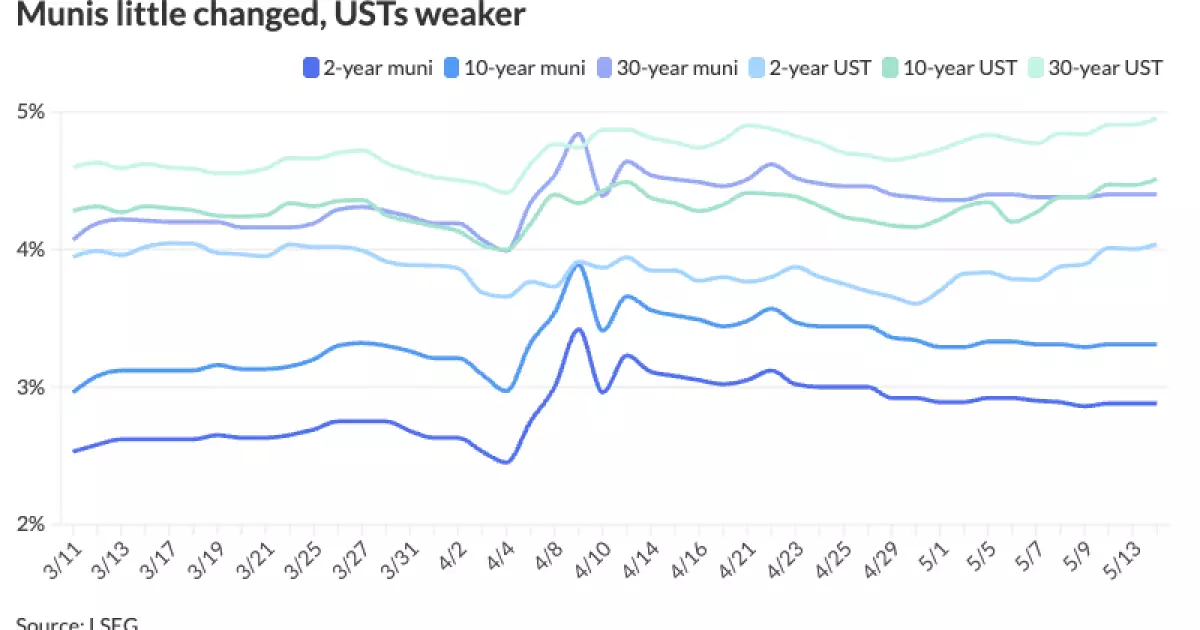

When analyzing the MMD yield movements over recent weeks, a critical observation is the momentum of ten-year yields. From 3.21% to 3.31%, the recovery trajectory has been mostly positive, unaffected by short-term reports. Comparing these trends to the performance of U.S. Treasury securities shows an interesting dynamic; the wider spreads in USTs signal that investors are still wrestling with uncertainties directly tied to fiscal policies. The ten-year UST yields being 30 basis points wider than MMDs indicates a tilt towards municipal securities in the search for security and predictability.

The thirty-year MMD yield story echoes this sentiment, climbing from 4.19% to 4.40%. These numbers are indicative of an investor base that is moderated yet optimistic about long-term prospects, recognizing the embedded value within the municipal framework despite headwinds. This resilience reflects a broader acceptance of the evolving credit landscape.

The Role of Credit Risk in the Municipal Sphere

The critical analysis of credit risk presented by Ronald Banaszek and Gary Hall reveals a more intricate layer to the municipal bond story. While certain sectors like healthcare and higher education may endure credit strains, the overall municipal bond market stands firm – a paradox in the face of tariff-induced volatility. The discussion surrounding potential long-term degradation of credit, fueled by tariffs and their subsequent adjustments, introduces a much-needed cautionary note.

Hall’s assertion about the potential onset of true credit dislocations serves as a reminder to investors: vigilance is paramount. With geopolitical uncertainties casting a shadow, the need to assess credit ratings continually is more critical than ever. The hint at forthcoming pressures on access to capital provides a sobering thought for investors who often stand in the face of systemic risks without adequate safeguards in place.

Recovery amidst Fluctuations

Derdenger’s comments encapsulate a crucial dynamic in the bond market: credit spreads are realigning, moving toward a normalized state even after the turbulence induced by international trade uncertainties. This stabilization, especially within the investment-grade bracket, paints a picture of an adaptive market capable of learning from disruptions.

It stands to reason that the municipal bond market remains a bastion of stability in an age where unpredictability is commonplace. As the bond market navigates the intricate web of tariffs, trade negotiations, and potential federal budgetary changes, a discerning investor should remain poised to capitalize on the opportunities these shifts will undoubtedly create.

Final Thoughts on the Economic Impact

The current conditions dictate that investors must act strategically. With potential tariff reintroductions looming and a fast-approaching 90-day window, how stakeholders respond could shift the bond landscape once more. The realities of municipal finance do not operate in a vacuum; they are intricately tied to the broader economic narrative.

Ultimately, the market’s ability to absorb shocks and recover speaks to a deep-seated resilience, even while warning of lurking risks in the background. The outlook may be cautious, but for the discerning investor, the municipal bond market remains a fertile ground for opportunities amid evolving economic landscapes.